What Does "Upper-Middle Class" Actually Mean?

A look into everyone's favorite socio-economic group.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

I would like to propose an experiment.

This Saturday, head down to Chelsea in New York City, Buckhead in Atlanta, the Marina District in San Francisco, or whatever similarly affluent neighborhood exists in your city of choice.

If the weather is nice, take a seat at an outdoor cafe, order an overpriced latte, and as customers file into the restaurant, ask ten well-dressed patrons if they consider themselves to be rich.

Nine times out of ten, they will chuckle nervously as they wait to see if you’re joking before saying something like:

“Um, I mean, I wouldn’t say that I’m rich. Like, I don’t own a mansion or anything. I’d say I’m probably upper-middle class.”

“Upper-middle class.”

It’s the perfect term, isn’t it? After all, no one wants to be seen as the snobbish upper class. The only thing worse than being poor is being perceived as too rich. Rich is elitist, antagonizing.

But you know that you can’t just say that you’re “middle class” either, especially when your outfit costs as much as the median rent in East Village.

But “upper-middle class?” Well, that just might work.

It has a touch of blue-collar to it. It says that you earned your lifestyle. “Yeah, I live a comfortable life, but it’s not too comfortable.” “I might vacation in Europe, but I’m not flying first class.” “My parents paid for my college tuition, but they didn’t donate a building to get me in.”

“Upper-middle class.”

As someone who grew up in a big house, got a truck at 16, and never really needed to worry about money as a kid, I’ve played the upper-middle class card myself over the years.

But as Eminem said in the critically acclaimed song Love the Way You Lie, “I can’t tell you what it really is, I can only tell you what it feels like.”

So what does “upper-middle class” actually mean?

The Pew Research Center defines the “middle class” as individuals earning between two-thirds and twice the median household American income, which was $70,784 in 2021.

This means that American households earning between $47,189 and $141,568 are, technically, “middle class.” Of course, these numbers will vary as you focus on specific geographies. The middle class of the San Francisco-Oakland-Berkeley area is $77,000 - $232,000, for example.

However, those measures are for all household incomes. The median income for single-person households in the US and the San Francisco Bay area are $46,000 and $70,000, respectively, meaning that individuals earning between $30,670 - $92,000 and $46,700 - $140,000 are, by definition, middle class.

DQYDJ has a cool tool where you can calculate your income percentile based on your location and household size, and the results are pretty wild.

If you earn $115,000 in the greater New York area, you fall in the 80th percentile:

The same is true if you earn $142,000 in the San Francisco Bay area:

Obviously, this tool doesn’t tell the full picture. The costs of living in Newark and downtown Manhattan are vastly different, for example. But you get the idea. The income needed to land in the “upper class” is far lower than you think.

Now back to “upper-middle class.”

There is no real definition for upper-middle class, but if Pew defines middle class as 2/3 - 2x the median income, I’m going to say that upper-middle class should be 1.5-2.5x the median income.

How did I select those parameters? Vibes, primarily.

So if the median incomes for single households in the US, San Francisco, and New York are $46,000, $70,000, and $52,000, the “upper-middle class” for each geography is $69,000 (nice) - $115,000, $105,000 - $175,000, and $78,000 - $130,000.

Above that range, you’re rich, baby.

Of course, if you ask someone who earns $180,000 in San Francisco or $150,000 in New York if they’re rich, they’ll laugh in your face. Or at least chuckle nervously as they wait to see if you’re joking before saying something like:

“Um, I mean, I wouldn’t say that I’m rich. Like, I don’t own a mansion or anything. I’d say I’m probably upper-middle class.”

So what’s up with the disconnect between perception and reality? Why do people who are objectively rich not feel that way?

For starters, I’m not the only person who has noticed this disconnect. In fact, my inspiration for this post was Nick Maggiulli’s latest piece, Is $200k a Year a Good Income? And Nick wrote that piece in response to a reader who asked the article’s title as a question.

Personally, I think this gap between perception and reality boils down to two things.

First, we believe that being perceived as rich is bad. You want to be successful, but you don’t want to look like you’ve already won.

Humans are tribalistic, we desire to be a part of the in-group. The second that you’re “rich,” you’re in the out-group. The enemy. The “1%.” Your net worth must have come at someone else’s expense, right? It’s your fault that wealth inequality in the US is increasing! As society’s primary antagonist, there is a target on your back.

To make a ridiculous Nintendo analogy, no one cares about the person in second place on Mario Kart. But as soon as you jump to first, everyone is gunning for you. Blue shells, red shells, whatever. Everyone wants to knock you back.

If you want to avoid being ostracized, it is quite literally in your best interest to not be “rich.” Or at least, not appear to be rich.

Second, we have a skewed perception of wealth and status because we compare ourselves to our closest peers, not to broader society.

If you make $75,000, you probably live around other people making $75,000. You go to restaurants and bars that fit your $75,000 per year lifestyle, you go on $75,000 per year vacations, and drive a $75,000 per year car.

Then you make $150,000. Your house, your dining preferences, your vacation destinations, your hobbies, and your social group all join the $150,000 circle as well.

And it doesn’t stop.

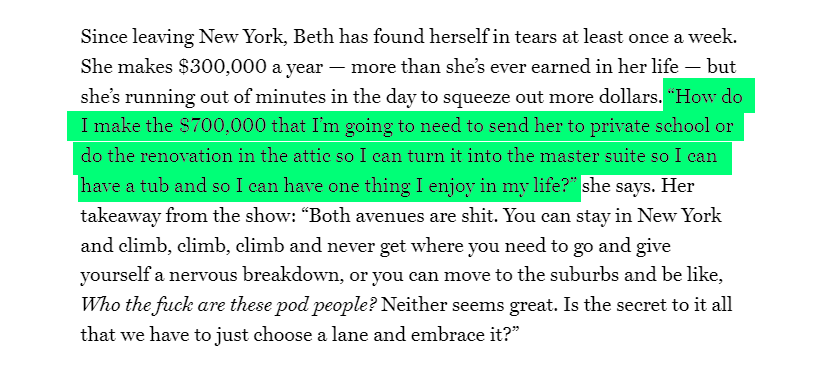

Eventually, you end up in the situation highlighted below (shout out Paul Millerd for sharing this) where you are on the verge of a nervous breakdown because you have no idea how you’ll make the $700,000 you “need” to cover the base expenses of your lifestyle.

When it’s in your best interest to not appear to be “rich,” and when you continue to upgrade social groups as you climb the socio-economic ladder, and when your spending increases at a 1:1 rate with your income, it’s no wonder that everyone believes they are in the “upper-middle class.”

After all, when there is always someone richer, you can’t possibly be the rich one, right?

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

Everyone knows that a diverse portfolio is a healthy portfolio, but have you ever considered fine art as an alternative asset? And no, you don’t need $100M to invest in a Van Gogh. Through Masterworks, you can invest in fractional shares of blue-chip art, an asset class that has outperformed the S&P 500 over the last 26 years. Purchase your share of a Picasso here.*

Ben Carlson wrote a fantastic blog post covering lessons learned from his 10 years of writing A Wealth of Common Sense.

Apparently, Elon Musk made the Twitter engineers tweak the algorithm to make his tweets show up on everyone’s feed.