Time to start blogging again.

Done writing a book, back to writing a blog, among other things.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Hello there, dear reader! Long time no inbox. I owe you a brief explanation for where I disappeared to over the past few months, so let’s get to that. If you recall, I’ve been working on a book for the ~past year, and, in July, I turned in my first draft to my editor. The moment I hit send, I thought to myself, “Thank God we’re done with that.”

Then I spent the next month not thinking one bit about my book, as I had rented an Airbnb in East Hampton with six of my buds. Over the next three and a half weeks, I spent a lot of time by the pool, drinking mud slides, listening to 27 renditions of “Mr. Brightside” by the Killers at The Stephen Talkhouse, etc. All in all, a pretty good summer. Better than most, for sure.

And then in mid-August I met a Bulgarian man in Queens to ship my jeep to San Francisco, and I flew back to California (my jeep made it in one piece), and I took another look at my book draft after stepping away from a month.

Thematically, it was what I wanted. But structurally, I had so much more work to do. I realized to actually get this book where I wanted it I was really just going to have to block out pretty much everything that wasn’t either 1) work, 2) book, or 3) the occasional 45-minute pump at the Marina Equinox. So I put blogging (and 90% of my social life, frankly) on the back burner, and pretty much all of my weekend time (besides hanging out with Will O’Brien on his birthday and Halloween), went to this book.

So, that’s basically what I’ve been doing over the last three months. Work and write and work and write and work and write.

This whole book process has really been an act of self-delusion and continual gaslighting as I convinced myself that there’s only “a little bit left,” at least 12 times, but after some aggressive restructuring and rewriting, I’m finally happy with what I’ve got, and I’m looking forward to sharing more with you all in 2026. I do think instead of a formal book tour, I’m just going to rent out my favorite dive bars in NYC / SF / Atlanta this summer where we can crush Guinnesses while I give out books vs. doing something at a book store because that feels so played out.

Stay tuned.

For now though, it’s nice to be pretty much done with that, and, for the first time in a year, have just “one job” and more bandwidth in my personal life again. And I can get back to blogging. Email interactions with internet strangers are one of life’s greatest joys.

That being said, it was nice to step away from this blog for a bit and think about what, exactly, it is that I want to get from this thing. “Young Money” has changed shape a few times since I started it. This was initially supposed to be a personal finance blog. But just writing about personal finance all day is boring. There’s only so many ways to tell people to invest in a Roth IRA and spend less than they make. So then I started writing a travel blog. And then I started writing about financial markets. And then random life musings. And then… you get the idea. I realized pretty early that I didn’t want “Young Money” to be any particular “type” of newsletter. I just wanted it to be me. It’s been more fun that way. When your content is “you” vs. being a particular thing you produce, you give yourself a lot more flexibility on what you write and how often you hit publish.

I used to churn out, I don’t know, like three articles a week. Which was a lot. I don’t have time to write three articles a week any more. And then I published one essay per week. But there’s nothing worse than trying to force some profound “long-form” blog post every week if you don’t have anything to say.

Now that I’m “back,” I’ll be resuming a weekly newsletter cadence. But the weekly newsletter won’t necessarily be long-form. Every Monday, I’ll share anything interesting I’m working on / thinking about, and, sporadically, I’ll pen the occasional long-form essay as the ideas hit me. Maybe that’s twice a month. Maybe it’s once a month. Maybe it’s once a week. I don’t know. But I do think a much more effective conduit for writing is keeping the “what I’m up to” structured, and letting the brain blasts hit your inbox as they hit my brain.

I say all that to say, it’s good to see you in your inbox again. Catch you next week (and the week after that, and the week after that).

What I’m Working On:

Etiquette School: Earlier this fall, I went to Y Combinator’s “Demo Day” to market our Slow Ventures Etiquette Finishing School to different founders. This initial idea was light humor around the “wear hoodies and dress like shit” meme that describes typical SF dress code today, but after 70+ people expressed interest in coming to Etiquette School, we decided to do it live, bringing 50+ people together at the Four Seasons in downtown San Francisco a month later for a 3 hour, 5-panel-long mini-conference on improving one’s social etiquette. That event was a hit (see below for caviar bumps and vodka shots), and we’re now hosting several around the world in 2026, but, in the meantime, we also published a ~100 page Etiquette Handbook for anyone who just can’t wait for the IRL event. Grab your copy here.

Vibe-coding project: I’ve been increasingly vibe-coding my own personal software suite using Claude Code, and my most recent tool is rolodex/personal CRM that I now host in a Google Sheet. I’ve been iterating on this for a few months now, first pulling in all of my contacts from Twitter / Email / Linkedin / Text, running my DM history with each through an LLM to give context on how I know them, and then consolidating repeats, and I’ve now added an automated weekly email that pings me with any to-do’s / outstanding followups with anyone on the list. I cannot stress enough how much a centralized personal rolodex helps, particularly in the job I have now, and Gemini is getting so good now that I can ask it “help me find 10 founders to invite to a dinner in San Francisco next week,” and it does most of the sorting/searching for me.

“ChatGPT Wrappers": One of the more interesting things about investing at the seed stage right now is that it’s incredibly easy to make a “decent-looking” v1 product to pitch to investors, and the biggest two questions I always have are “how durable is a moat here if this works?” and “what’s actually going on on the back-end, besides OpenAI API calls with a pretty UX?” A couple of weeks ago, I read this Medium post where the author claimed to have reverse-engineered 200 AI startups, and ~3/4 of them were just repackaged ChatGPT / Claude with a new UI, selling prompts are markups. It’s one of those things that everyone kind of knew was happening, but then you see the phenomenon quantified and think, “Damn, I don’t want to get tricked.” So I’ve started working through Andrej Karpathy’s videos / essays on how LLMs work structurally + playing around a lot in Python to improve my ability to quickly discern the right questions to ask diligencing these companies to better determine what’s real, and, more importantly, what’s actually hard / impressive rather than what “looks good” during a pitch. I’m open to any and all recs from anyone on best practices for refining my bullshit detector on some of this stuff.

What I’m Thinking About:

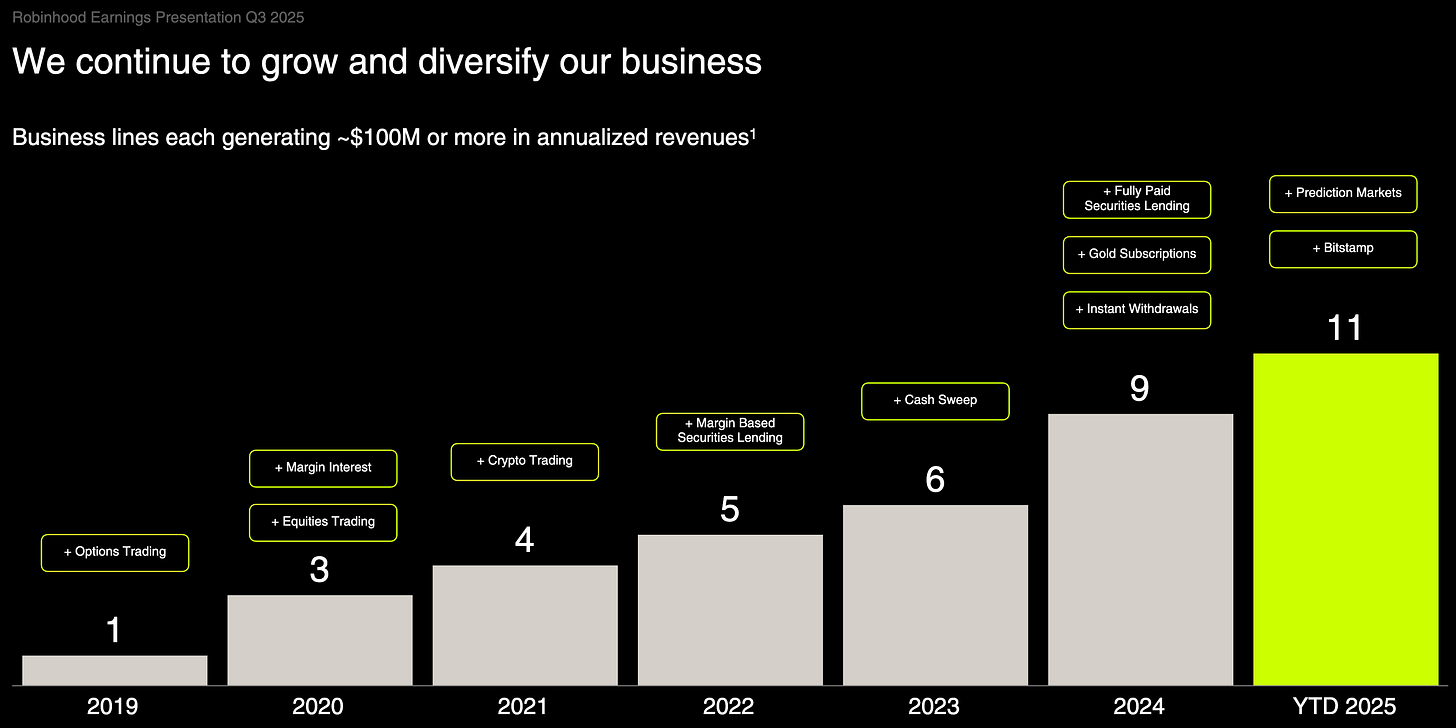

Robinhood positioned to dominate prediction markets. The big story of the week was Robinhood’s and SIG’s acquisition of 90% of LedgerX, a CFTC-regulated Designated Contract Market and Derivatives Clearing Organization. In their last earnings report, Robinhood noted that prediction markets were now a $100m+ ARR business with 9 billion contracts traded on its platform since launching a year ago, so it’s not a shocker that they’re doubling down on this business line. What’s interesting is how this move might reshape the prediction market “market.”

Robinhood had previously partnered with Kalshi to launch its prediction markets because Robinhood needed a licensed DCM, and Bloomberg reported that ~half of Kalshi’s volume was coming through its Robinhood partnership. The irony here is that Kalshi did most of the work to legalize prediction markets in the US in the first place, winning a multi-year legal battle last fall allowing them to launch election markets before the presidential election, but now all evidence suggests that Robinhood is looking to deprioritize their current partnership and run their prediction markets in-house. It’s also worth noting that SIG, who now co-owns LedgerX with Robinhood, was the first institutional market maker on Kalshi.

I’m going to write a longer piece on this next week after I do more research, but my bet, which I’ve been saying since before the Robinhood/LedgerX news, was that if prediction markets stick, Robinhood is going to win because distribution is the only thing that matters. With enough money, you can either buy the infrastructure stack needed or lobby your way to getting licensed yourself, at which point it’s a customer acquisition game. Robinhood has ~28 million users buying stocks, options, and cryptocurrencies in both taxable and retirement accounts. They have a credit card. They’re launching banking. It’s much lower friction re-allocating a few hundred dollars from stocks to a prediction market bet on the same platform than it is to transfer money to another site to place those same bets, giving them a massive entrenched advantage. The result: more than a million Robinhood users traded at least one prediction market contract since they launched.

Part of me thinks I have to be missing something and it can’t be this simple, considering that Kalshi and Polymarket both just raised at ~$10 billion valuations (Robinhood, now worth > $100b, was worth less than $10b itself just two years ago). Part of me thinks those deals would have looked different if the investments were closed after the Robinhood news, and some investors are probably sweating right now. More to come here.

What I’m Reading / Watching:

I hadn’t read a new book in the last eight months, which is frankly a bit disgusting as someone who enjoys reading, and I have a whole backlog of books that friends have sent me or recommended + dozens that I’ve downloaded sporadically as I saw them rec’d on X. Now that I’m done with my book, I’m reading again, which means I’m also back to recommending books I’ve enjoyed. I just finished Private Equity: A Memoir, by Carrie Sun, and I highly, highly recommend it for anyone interested in an inside look at the high-stress, hyper-competitive New York hedge fund world. Carrie worked as an assistant for Chase Coleman, founder and managing partner of Tiger Global, in the mid-2010s. I found myself growing anxious reading her internal monologues as she struggled with the all-consuming nature of being the right hand person for one of the most successful fund managers of the 2010s. This isn’t an investing book, it’s a psychological story that shows the tradeoffs that come with “success.” It’s a really, really good read for the hyper ambitious-but-uncertain young professional.

David Senra remains the best of the best among podcast interviewers, and his recent interview with Michael Ovitz is excellent.

I’m a total sucker for “year in review” types of content around holiday season. Here’s a good list of questions as you reflect on the last year and prepare for the next one.

See you next week,

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

My first book thingy I did for the pathless path was hanging out 50 free books at a dive bar in Austin. Highly recommended.

I read Private Equity this year as well! I recommend to all my friends living/working in New York