It's Okay to Spend Money

This sounds like anti-financial advice, but hear me out.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Background

I used to obsess about money. Looking back, it never really made sense. I grew up as an upper middle class kid, and I never had to worry about finances. Sure, I worked during the summer, but my parents gave me money for gas and food during the school year. Academic and football scholarships paid for college, and I didn’t have to work my way through school. Since I was playing football in college, my parents said they would help with my extra living expenses. Even so, I always hesitated to ask for money. Maybe I felt like a burden, or maybe I just hated running low on money. I would let my checking account get near zero before sheepishly saying that I needed more. I tried to save every penny that I could for the sake of saving money. I never had any real reason to feel insecure about my finances, but I still hated spending money.

When I started working a year and a half ago, I carried these beliefs with me. Save, don’t spend. If it’s not essential, don’t buy it. Maybe that’s how you feel right now. You hold on to every extra cent that you make. You never eat out because it costs too much. You stay in on weekends because Ubers are pricy. You avoid trips unless you can find dirt-cheap accommodations. You put every last dollar away because you never want to feel like you need money.

After a few months in the real world, I realized that was a shitty way to live. Saving and investing for the future are important, but don’t let your obsession with saving prevent you from enjoying the present. It’s okay to spend money.

Saving for Saving’s Sake

Don’t get me wrong, frugality is a good thing. You don’t want to live paycheck to paycheck. Blowing all of your money on frivolous activities can become a vicious cycle if you’re not careful. It’s easy to point out the downside of poor personal finance habits:

61% of Americans can’t afford a $1000 emergency expense.

Only 33% of Americans pay off their total credit card balance each month.

We have $1.4 trillion in auto debt.

You don’t want to have these problems, and consistent saving and investing habits are the keys to a strong financial foundation. Thankfully, there are a ton of resources available to help people build healthy savings habits. What we don’t talk about enough is the other side of the equation. Saving too much. The concept of over saving sounds odd, maybe even outright wrong. But it is still an issue.

FIRE

FIRE, or Financial Independence Retire Early, has become a popular trend in recent years. What does the FIRE movement consist of? Aggressively investing your excess income so that you can retire as quickly as possible. Maybe if you invest 50% of your income every year, you can retire in 15 years. For someone entering the workforce at 22, you would hit retirement at 37. Not too shabby.

It’s not a surprise that FIRE appeals to many people. After all, only 36% of Americans feel actively engaged at work. We build this idea that if we can just slog through X number of years at work, we can retire and live happily ever after. It’s a long-term exercise of delayed gratification.

So we save. And save. And save. And when we finally hit that arbitrary target, BAM! Retirement. There is nothing wrong with early retirement, as it provides the freedom to do what we want. The issue is when you constantly sacrifice for your future at the expense of your present. Saving money shouldn’t be the end goal. Early retirement shouldn’t be the end goal. Doing what you want should be the end goal, and your saving/investing habits should help you achieve that.

Imagine saving 70% of every paycheck for 12 years so you can leave the workforce early. Sure, you retired before your peers, but what was the cost? What trips did you skip? What concerts did you miss? What spontaneous nights out never happened because you didn’t want to spend $50? Somehow we decided that the ideal life plan was saving every dollar from ages 22 - 60 so that you might be able to enjoy spending it when you’re old. Seems a little backwards, no? I doubt your grandparents look back and wish they had saved an extra $500 in their 20s. Life is about experiencing things for which you will later experience nostalgia. Don’t let your thriftiness prevent you from having a good time along the way.

“Just Make More Money”

Saving only goes so far. If you are worried about money, you may cut back on eating out, going on vacation, or taking Ubers. You will never get your expenses down to $0 though. Rent, food, electricity, wifi, gas. There are some expenses that just can’t be cut.

I went on a ten day road trip with one of my roommates earlier this month. I asked if he was worried about spending too much money on the trip, and his response was pretty simple, “Not really, you can just make more money.”

Just make more money.

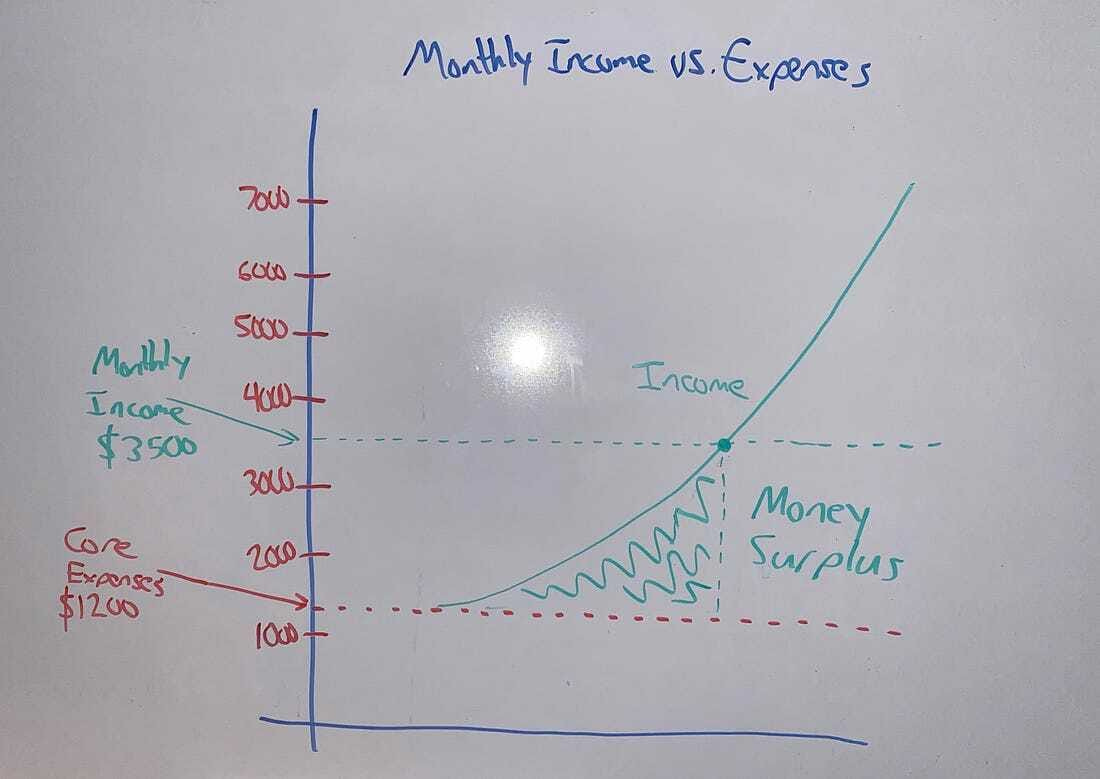

It sounded too simple. Almost condescending. But he’s right. We tend to focus on the savings side of the money equation, but the income side is actually important. Why? Cutting expenses has its limits, because you can’t cut everything. Income has unlimited upside. You can make as much money as you want. That gap between your income and your core expenses creates your money surplus. To illustrate this, I drew a really bad graph on my white board:

Crude, but effective. You can cut every extra expense, but you will still pay $1200 a month in rent, utilities, food, and gas. If you’re down to your core expenses, increasing your income is the only way to increase your money surplus.

Say your monthly income is $3500 a month. You have a $2700 monthly surplus to do as you wish. Throw $500 in a Roth IRA, spend $500 on weekend activities (baseball games, nice dinners, golf, etc.), and you still have $1700 leftover. Cutting expenses has limited benefits for increasing your extra cash, but increasing your income doesn’t.

If you find yourself worrying about money like I did in college, you don’t have to cut every possible cost. Just make more money. Pick up a part-time job, get paid to write online (I currently do this for Seeking Alpha), train younger athletes, babysit. Increasing your income is more effective than lowering expenses.

Balance is Everything

Saving and investing are important. You need your income to outweigh your expenses, and you need to have money set back for retirement. That being said, you don’t need to miss out on experiences right now because you are obsessing over every penny. How do you find the sweet spot between saving and spending? Build a plan that works for you. Have both nonnegotiable investment targets and flexible rules that leave you room to have some fun. The following could be an example plan:

Mandatory Monthly Goals

Put $1200 aside for all fixed expenses (rent, utilities, gas, etc.)

Contribute 6% to your 401k.

Deposit $500 in your Roth IRA.

Save $1000 each month for a house downpayment.

Flexible Spending

Set aside $600 each month for miscellaneous fun activities.

Leftover “fun money” rolls over to the next month.

Additional cash generated outside of your main income stream can be split between mandatory and flexible spending.

The dollars and percentages will vary from person to person. If you want to invest more aggressively for retirement, do it. If your bases are covered and you want to spend more now, that’s okay too. No matter your preferences, setting a disciplined financial plan ensures that you will be prepared for retirement without having to stress over every last dollar.

If you like live music, go see that concert. If you want to go to the beach, rent a house with some friends for the weekend. Want to go skiing out west? Book a flight to Denver. Saving for the future is important, but don’t neglect the present along the way.

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!