Stocks Only Go Up

Dave Portnoy was right.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Dave Portnoy is the outspoken founder and president of Barstool Sports. Portnoy is a sports bettor at heart, but the pandemic shut down sporting events for months. Where did Portnoy turn to satisfy the gambling itch? The world’s greatest casino: the stock market.

Portnoy started live streaming his trading activity under the “Davey Day Trader Global” brand, and he would throw millions of dollars at different stocks every day. His “due diligence” was groundbreaking: Portnoy once pulled letters out of a scrabble bag to pick a stock before throwing $500k in it. Dave turned the stock market into a live streaming reality show, and his audience loved it. Hundreds of thousands of viewers watched him trade everyday, and Portnoy got air time on CNBC. A few months into his trading career, Dave coined the phrase “stocks only go up”. It was catchy, funny, and rang true in the sharpest bull market in history.

“Stocks only go up” may sound ignorant, short-sided, and dumb, but I’m here to tell you that Dave Portnoy was right. Stocks only go up, and that is a good thing.

Time Frame Matters

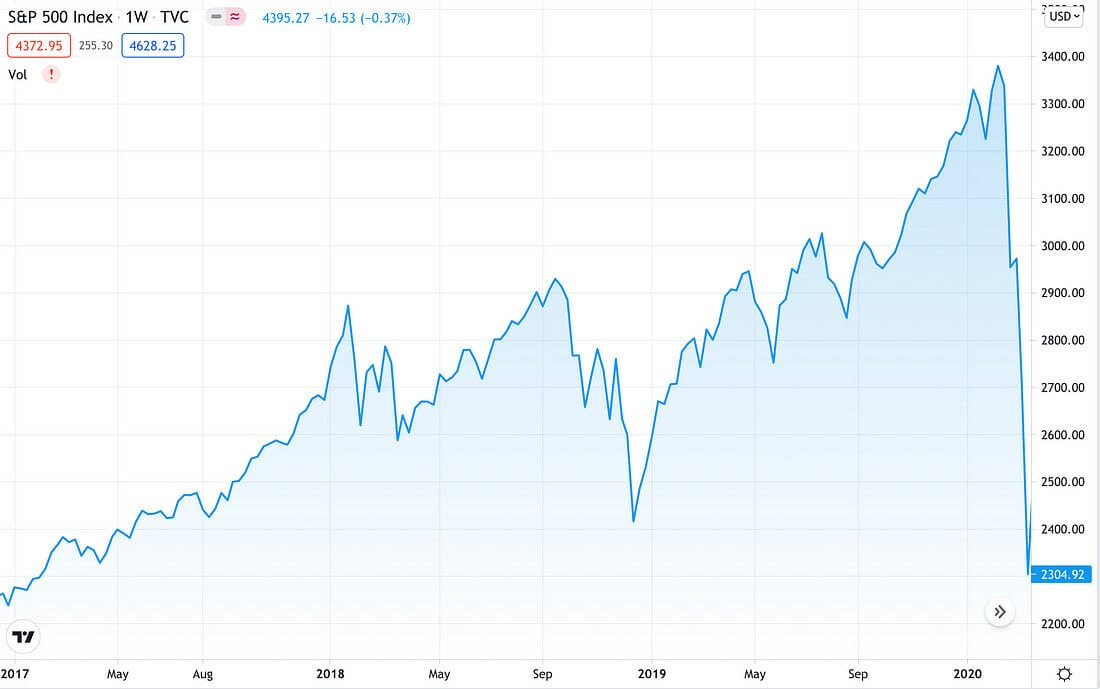

Imagine that you invested $1000 a month in the S&P 500 starting on January 1st, 2017. Three years later in March 2020, every contribution would be underwater.

Losing money over three years sucks, right? Now zoom out through July 2021.

LOL what dip? In 15 months, the market went up by 100%. Assuming that you stayed invested, your money has now doubled since the pandemic lows. While the speed of 2020’s crash and rebound was rare, the end result was par for the course. Look at the S&P 500 from 1900 to now.

The Great Depression looks like a flat line, the 1987 flash crash looks like a tiny pullback, and the Great Financial Crisis looks like a generational buying opportunity. We are up 10x from the peak before the 1987 crash and 3x the Dot Com and Housing bubble peaks. If your time frame is long enough, stocks really do only go up. You wouldn’t know that from the financial media though.

Ignore the Headlines

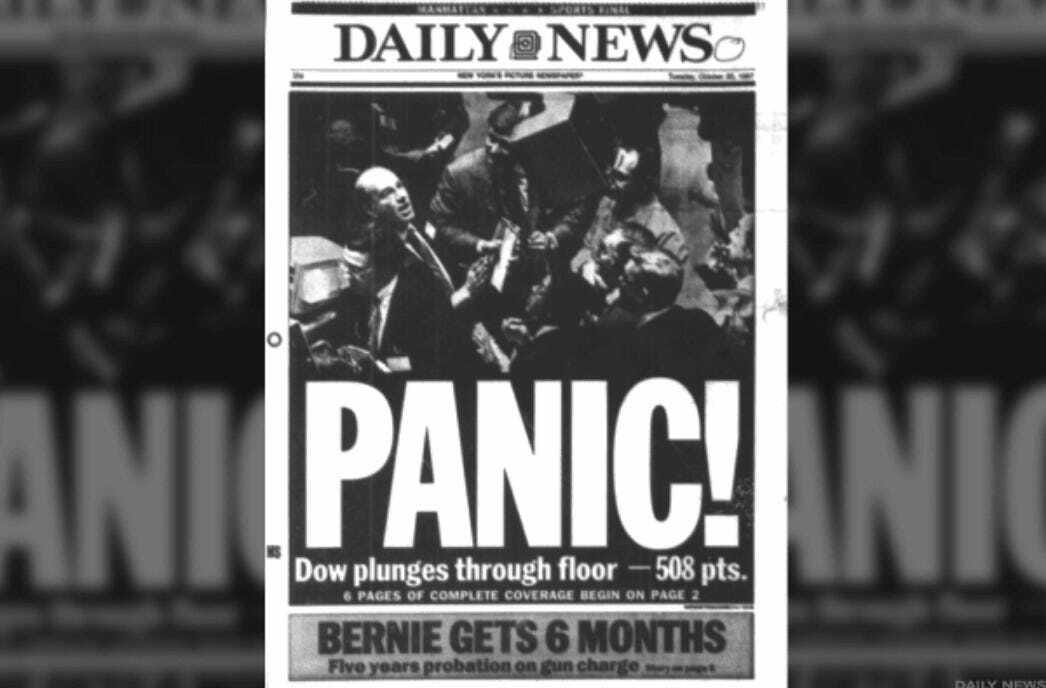

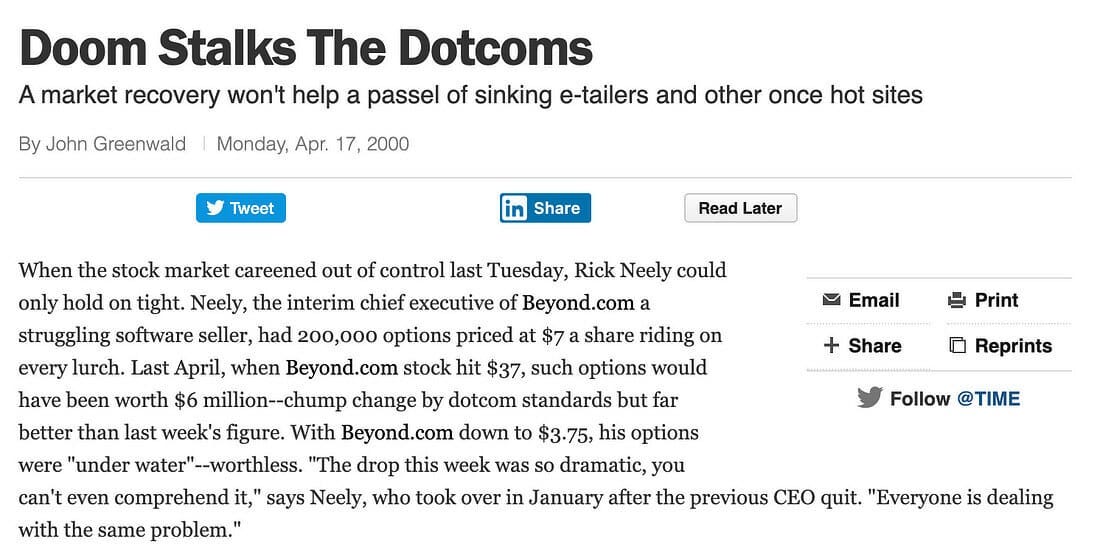

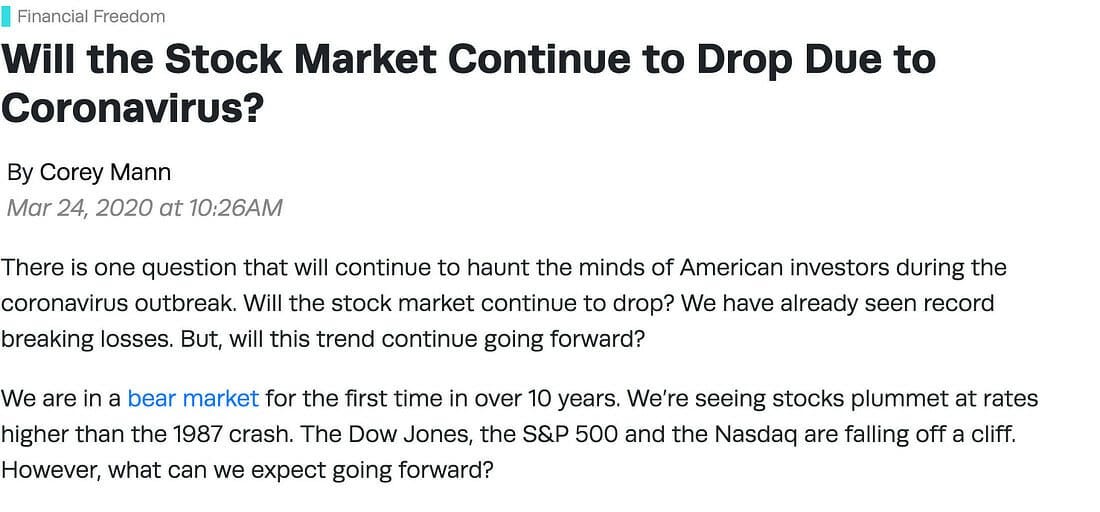

Every market decline is caused by a new catalyst, but our reactions are largely the same. Check out some headlines from the last century.

October 1929

October 1987

April 2000

September 2008

March 2020

After all of these doomsday headlines, the stock market is still chugging along at all-time highs.

There is an excerpt from the March 2020 article that I love: “Forbes believes the stock market is set to drop another 20 - 40%. It may go even further as coronavirus lingers on.” This article was published on March 24th, the day after the market bottomed. The S&P is actually up 100% from there, a far-cry from the projected 20-40% decline. If you waited for that decline, you missed out on a generational opportunity to double your money.

Because markets have crashed in the past, investors and economists try to predict future drops. There is always a great reason for stocks to fall:

Inflation

China Trade War

Quantitative Easing

Biden

Trump

Valuations

Market crash predictions sound smart. No one wants to turn on Mad Money and have Jim Cramer tell them to buy index funds and build wealth over time. We want to figure out when and why the market will crash. The thought of losing money is terrifying for most people, and we want to avoid that reality. So we tune in to CNBC and watch experts tell us 25 reasons why stocks are bound to fall in the next six months. Goldman Sachs said the market could fall another 30% last March. Now they’re saying that the S&P could hit 5000 next year. The truth is many of these experts are good at talking but terrible at predicting. There will always be a reason for the market to crash. Good luck picking the right catalyst at the right time. You know what no one predicted?

A novel virus strain from Western China would bring the global economy to a halt, yielding the quickest bear market in history. One year later, the market would be soaring to all-time highs thanks to incredible performances by tech companies.

Don’t listen to the headlines. Bears make money writing newsletters. Bulls make money buying stocks.

Volatility Is a Good Thing

Imagine you invest $1000 in an S&P 500 index fund every month for 40 years. The market averages ~10% returns every year, but there are going to be some massive declines. The S&P 500 drops by 10% every 1.84 years and 20% every 7.78 years. That means there are going to be several periods when you lose a lot of money. These declines are how you build wealth over time.

Some of your $1000 investments will come near market bottoms, and some will come near market peaks. Pullbacks suck, but they provide fantastic entry points for your cash. Your February 2020 investment would have declined by 30% in a month, but your April 2020 contribution would have doubled in a year. The overall trend of the market is up and to the right. As long as stocks continue moving this way over time, today’s pullbacks are tomorrow’s profits.

The irony of investing is that the safest time to buy is after the market declines. It was far riskier to invest in January 2020 than April 2020. It was far riskier to invest in 2007 than 2010. It was far riskier to invest in 1999 than 2001. COVID-19 hit, and the market declined. The financial system imploded, and the market declined. Internet companies went bust, and the market declined. The “risk” is that some catalyst will make the market crash. Once this situation occurs, that risk is reduced. However, investors panic when prices drop. They wonder how much lower the market can fall. They don’t want to catch a falling knife. The market dropped 30% from COVID, why can’t it fall 30% more? No one was worried about COVID-19 in January with stocks at all-time highs. Everyone was terrified to invest in March with stocks trading for ridiculous discounts. The biggest profits are generated when you buy these drops.

Closing Thoughts

While the financial media would have you think otherwise, stocks really do only go up. They might not go up every day, but the chart doesn’t lie. If you want to make money in this game, invest regularly and tune out the noise. Markets dropping? Invest. Markets climbing? Invest. Goldman Sachs predicts a bear market? Invest. JP Morgan predicts a bull market? Invest. By investing regularly, you will automatically catch market declines, and that is where you will generate the best returns.

Happy Monday. Go do something cool this week.

Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!