Hello friends, and welcome to Young Money! If you want to join hundreds of other readers in learning about finances, career navigation, and figuring this life thing out, subscribe below:

You can check out my other articles and follow me on Twitter too!

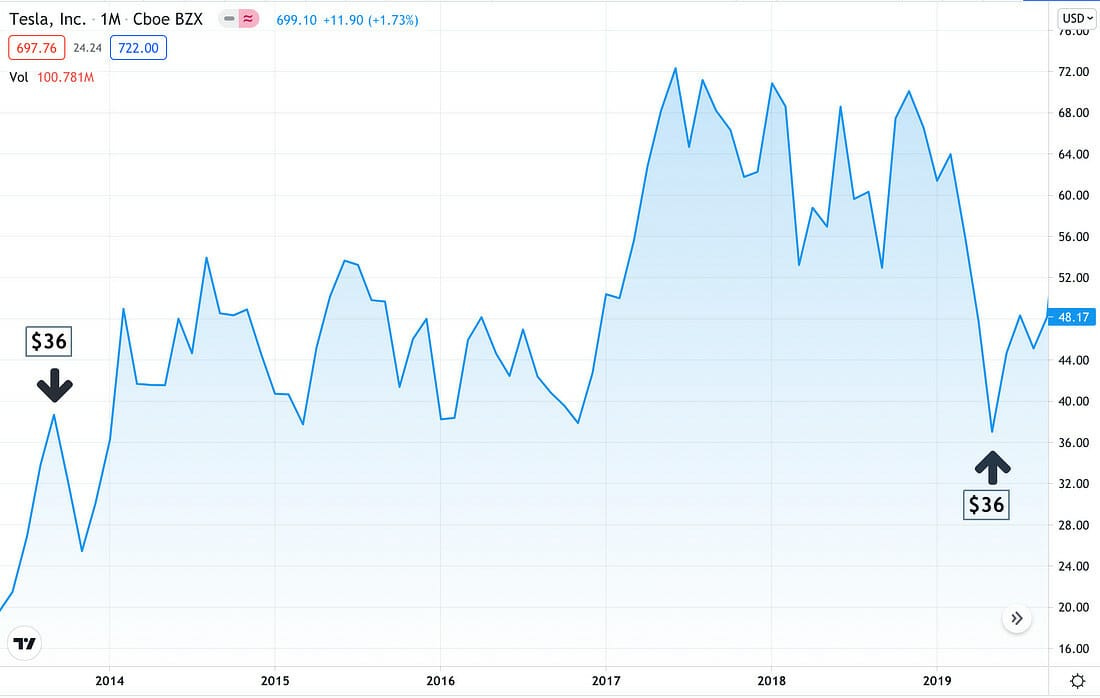

If you bought stock in Tesla in late 2013, you would have made $0 on your investment through the end of 2019. Six years. No returns. Meanwhile, the S&P 500 was up more than 80% over that period. The greatest bull market in 20 years, and you would have missed the whole thing by betting on a controversial electric car manufacturer.

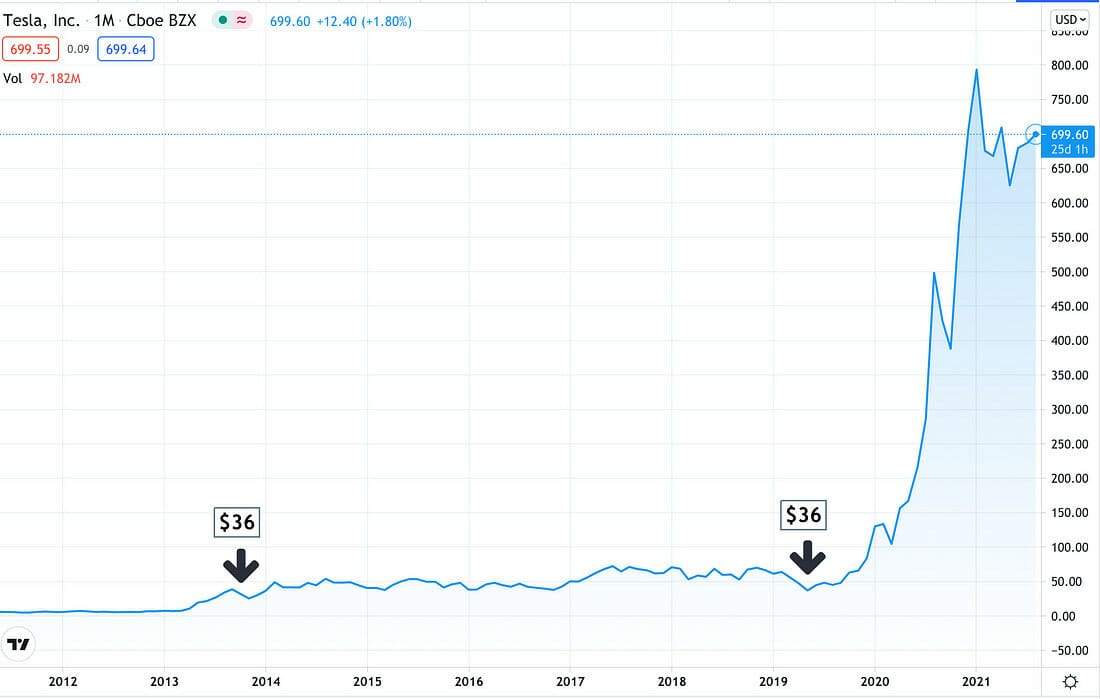

His company was on the verge of bankruptcy. Tesla ran into production headwinds during its ramp up of the Model 3, and the automaker almost went bust. Critics loudly proclaimed that the stock would go to zero, and Musk even called Tim Cook to discuss the possibility of Apple buying the auto company. But then something strange happened: Tesla didn’t go bankrupt. In fact, the automaker turned a surprise profit. And another one. And another one. And in Q2 2021, Tesla blew analyst predictions out of the water by growing sales by 98% and net income by an astonishing 988%. Remember that six year period of no returns? Zoom out on Tesla’s chart now.

Tesla’s stock is up ~2000% since 2019. Meanwhile, the S&P 500 is up 58%. Going back to 2013, Tesla has now outperformed the S&P 500 by 10-fold. Six stagnant years, then one year of explosive gains.

Slowly.

Slowly.

Then all at once.

Most of the world saw Tesla as a struggling feel-good story with no path to profitability. The electric vehicle movement sounded good, but US infrastructure was designed to support gas and diesel automobiles. The Roadster was an exciting model, but Tesla never stood a chance to take any real market share from the established brands. Even if consumer demand was there, Tesla would never be able to profitably scale its production. The critics weren’t far off. Musk himself said, “Prototypes are easy, production is hard, and being cash flow positive is excruciating.”

Where the outside world saw failure, Tesla was busy innovating, experimenting, and building. One battery technology failed, and engineers tried something new. Electric vehicle customers had range anxiety, so Tesla built its own charging network. Marketing was expensive, so Musk meme’d himself into the world’s greatest free advertisement. Tesla factories were constructed to maximize efficiency. Supply costs declined over time, and the average American became Tesla’s target customer. In 2013, Tesla’s grand plan seemed like a pipe dream. By 2020, Tesla’s ambitions seemed all but inevitable. Other auto makers were too slow to develop their electric models, and Tesla now dominated the market. Those six years of “nothing” were actually full of countless “somethings.” All of these “somethings” compounded, and they resulted in Tesla’s 2020 explosion. It just wasn’t obvious to the rest of the world until after the fact.

Slowly, then all at once.

Nothing Is Linear

We think progress should be linear. If I work out five times per week, I should get 2% stronger each month. If I publish a newsletter every Monday and Thursday, I should gain 50+ subscribers each week. If I practice Spanish for an hour every day, I should see noticeable improvement each month. As you know from your own life, this just isn’t the case.

When you work on a new skill, your competence rapidly improves at first. The basics are easy to pick up, and your progress is easy to track. You study poker for a few hours, and you now know the mechanics of the game. You had never skied, and now you can make it down a beginner slope. You had your first conversation in a foreign language. You bench pressed 225 for the first time. You get the idea. When your starting point is zero, early breakthroughs will be frequent, powerful, and obvious.

At some point, your progress will appear to plateau. You were making impressive strides for weeks, and then you hit a wall. You can’t hit that new max in the weight room. You struggle to grasp certain tenses in a foreign language. You are stuck as a backup on the depth chart. You keep grinding, but you don’t see yourself improving.

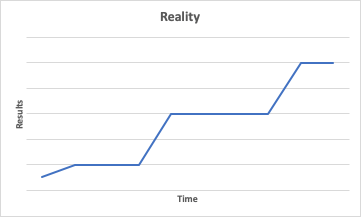

It looks like everyone around you is continuing to move forward while you are treading water, but everyone experiences this sensation. We expect progress to look like this:

but reality goes more like this:

Extended plateaus are the cost of admission if you desire success.

Staying in the Game Is Your Edge

No matter the discipline, most people quit. 92% of New Year’s resolutions don’t make it a full year. The winners aren’t necessarily the most creative or talented individuals. They are often just the players who stuck around. You can’t win the game if you’re not in the game, but most people tap out when they feel like their progress slows. You want an edge on the competition? You want a chance at really doing something special? You have to stay in the game long enough to see the results.

Say you want to start a podcast. There are two million podcasts online. Seems like a saturated market, no? How are you supposed to stand out? How are you supposed to grow your subscriber base?

Stay in the game.

If you publish 21 episodes, you will be in the top 1% of all podcasts globally. Why? Because 90% of podcasts don’t make it past three episodes. Now you are left with 200,000 shows. Of those 200,000, another 90% will quit by episode 20. Two million to 20,000 in 21 episodes. If you can make it to episode 21, you stand in elite company.

(If you want a detailed breakdown of this podcast study, click here. Fascinating information on survivorship.)

Success looks like a series of sprints, but it’s really a marathon. The inputs are a constant grind, but the outputs come in explosive bursts. Staying in the game improves your odds of success because the competition pool grows smaller and smaller. Endurance has an another benefit as well: over time, your experiences can compound.

Everything Compounds

While Tesla’s stock was stagnant for years, the business itself was transforming. The countless failures, setbacks, and obstacles provided opportunities for the company to iterate, improvise, and learn. All of these individual events were like pieces of a puzzle scattered on the floor. Slowly, a thousand individual pieces begin coming together. The borders are formed, but the final image is indiscernible. Different sections of the puzzle take shape, but they still aren’t connected. Finally the last missing pieces are solved, and a thousand parts combine to make a beautiful image.

Everything compounds. During plateaus, you won’t feel like you are making any progress. At the same time, your behavior during these plateaus will determine how far you can go. You may feel stuck for weeks or even months, but staying the course gives your work time to compound. Eventually these collective efforts will click, and you can reach that next level.

Closing Thoughts

We want success to be a straight line, but that’s not how life works. Progress is a constant cycle of immense growth and prolonged plateaus. How we handle these plateaus determines how far we can eventually go. Most people will quit along the way, so staying in the game is the best edge that we have. Thousands of minuscule improvements are made during these flat periods, continuously compounding. Eventually, these improvements will assimilate to create a massive breakthrough.

Grow —> flatline —> compound —> grow —> flatline —> compound.

If success is the end goal, plateaus are the cost of admission. Embrace it.

Go build something cool this week.

Jack

If you liked this piece, make sure to subscribe by adding your email below!