Ryan Cohen's Meme Stock Love Affair

The SEC Hates the Dog Food Billionaire

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

In case you missed it, last Thursday, the Securities and Exchange Commission (SEC) announced that it was investigating Ryan Cohen, the founder of pet supply e-commerce company Chewy, for some “timely” stock trades on the now-bankrupt retailer, Bed Bath & Beyond, that netted him a ~$60M profit in 2022.

This investigation comes just weeks after US District Judge Trevor N. McFadden declined to dismiss a shareholder lawsuit against Cohen surrounding this same trade, with McFadden calling the timing of Cohen’s sales “sketchy.”

What was so “sketchy” about the trade, you ask? Well, on August 16, 2022, Cohen announced that he owned 11.8% of the company, and the stock price jumped as a result. Then, a few days later, Cohen announced that he had liquidated his entire stake (for a $60M profit.).

On the surface, sure, it’s sketchy. But here’s the catch: Cohen didn’t announce that he had purchased any additional shares. He just re-announced that he owned the same shares he had previously purchased in March, but he was obligated to again disclose this stake because his percentage ownership had increased after the company bought back shares.

Of course, no one actually read the filing, investors poured into the stock assuming that Cohen had purchased new shares, he made bank, and now Cohen is dealing with a lawsuit and a federal investigation.

Today, I want to talk about how exactly a dog food billionaire got here in the first place, and what I think about this SEC investigation.

After selling his pet supply e-commerce startup, Chewy, for billions in 2017 and stepping down as CEO, Ryan Cohen launched an investment firm: RC Ventures. His earliest investments included massive bets on Apple and Wells Fargo (the former which turned out to be quite lucrative), but in 2020, he took interest in an unlikely target: GameStop.

If GameStop were an animal, it would be a cockroach. Ugly, practically useless in its local ecosystem, but seemingly impossible to kill.

In the era of digital downloads, the market for a brick-and-mortar video game retailer wasn’t exactly booming, and GameStop was hemorrhaging cash as the lockdowns drug on.

But, much like a 25-year-old girl with a deadbeat boyfriend, Cohen thought that he could fix GameStop, so in September 2020, he purchased and disclosed a 9% stake in the company.

Cohen was young, charismatic, addicted to Twitter, and, most importantly, a proven e-commerce success, and his purchase put investors on notice. The stock jumped 24% on the news of his investment.

Two months later, he published an open letter to GameStop’s board outlining a plan to grow their e-commerce business, and in January 2021, Cohen shocked the world by increasing his stake to 12.9%, joining the company’s board of directors, and, most importantly, firing off meme after meme supporting his new investment.

At this point, GameStop had already garnered a cult following on social media sites like Reddit, with many investors betting on a short squeeze that would send its stock price skyrocketing.

Cohen’s vote of confidence proved to be the spark that sent GameStop nuclear, and its stock price climbed more than 1,000% in the aftermath, making GameStop’s newest board member and his most loyal followers rich.

With GameStop (fairly or not) becoming a pseudo-battle ground between Wall Street and Main Street, Ryan Cohen was lauded as a hero of the little guy who helped them stick it to the man.

At this point, I would like to note that despite all of the social media shenanigans and conspiracy theories surrounding GameStop, there was a legitimate short squeeze thesis in play: more than 100% of GameStop’s shares were being sold short at the time, and the buying frenzy that Cohen sparked did, in all likelihood, also cause several hedge funds to repurchase their shares at substantial losses, which further propagated the “squeeze.”

However, several other companies on life support also saw their stock prices jump by 100%+ despite their lack of short interest. Names like AMC, Blackberry, and Bed Bath & Beyond that were on their way to zero now showed some signs of life as the FOMO spilled over from GameStop to the broader market.

However, this FOMO slowly dissipated, and these “meme stocks” continued their slow descent to 0 until March 2022, when, more than a year after being named to GameStop’s board, Cohen re-ran the same playbook with a new company.

Bed Bath and Beyond could have done well during Covid, had they better managed their e-commerce brand. But management was sloppy, and, unlike GameStop and AMC, had failed to capitalize on the timely stock pump by issuing new shares to raise cash. At this point, Bed Bath & Beyond was a dumpster fire headed for bankruptcy.

And then, in March 2022, Cohen announced that he had purchased a 9.8% stake in the company. Similar to his GameStop letter a year earlier, Cohen addressed Bed Bath & Beyond’s board in an open letter, saying that they should narrow the focus of their rebuild to correct the inventory mix and meet demand, and they could consider spinning-off their Buybuy Baby brand.

What happened after Cohen’s announcement? Bed Bath & Beyond’s stock price soared by 60%.

Now is the time for us to take a step back and ask why exactly Cohen’s announcement should have caused Bed Bath & Beyond’s stock price to jump in the first place.

1) The most plausible line of thinking is that given Cohen’s pedigree and history with Chewy and GameStop, it’s reasonable to think he could actually make a material impact on the business that would help the company return to profitability.

It is important to note, however, that the investors who think Cohen saved GameStop probably weren’t paying much attention to the company’s actual financials, which had since regressed, but were only paying attention to the stock price, which was still above Cohen’s purchase price two years later.

There are also other lines of thinking that are both more fun and, in my opinion, more likely.

2) Some retail investors who rode Cohen’s coattails to the peak of the GameStop pump salivated at the chance to double dip, assuming that the same thing might happen again.

3) Other retail investors, who experienced an existential sense of FOMO from missing the previous GameStop pump, salivated at their second chance to ride the Cohen pump for the first time.

4) Hedge funds who witnessed (and may very well have made or lost millions on) Cohen’s GameStop shenanigans didn’t want to miss the encore, and they likely piled into the failing home retailer as well.

We should also consider why Ryan Cohen decided to take a ~$100M stake in the near-defunct retailer.

1) Much like the first group of investors, Cohen may have thought that given his e-commerce chops, he could force some much-needed changes in the business.

2) Cohen realized, after the GameStop short squeeze, that he was a cult hero among retail investors, and he wanted to see if investors would once again blindly follow him into the abyss (defined here as BBBY common shares).

So everyone with some interest in the stock, from retail investors to hedge funds to Cohen himself, probably thought that Bed Bath & Beyond shares would continue to climb.

But they didn’t.

Despite jumping by as much as 60% on the day of Cohen’s announcement, the shares had fallen well below Cohen’s purchase by August 2022.

And then Cohen made his now-controversial second announcement, where he simply restated his ownership stake 4 months late.

Neither GameStop nor Bed Bath & Beyond improved all that much as a business between 2020 and 2023, but GameStop did do one thing right: they sold billions of new shares to raise cash when their stock price was inflated.

In an incredible illustration of poor execution, Bed Bath & Beyond actually did the opposite: they burned precious cash buying back shares from the market,

No, it is typically not good practice for unprofitable companies that are running low on cash to spend what little cash they have on their own stock in a vain attempt to pump the price.

Even though this was an atrocious business decision, buybacks shouldn’t affect any individual shareholder all that much, but this particular buyback did affect Ryan Cohen, because it pushed his stake in the company over 10%.

In math terms, the numerator, or number of shares he owned, remained the same, but the denominator shrunk, so the percentage increased. Cohen now owned 11.8% of the company, and he was legally required to disclose that he owned >10% of the company.

This amended filing was due on April 21, 2022, but Cohen conveniently didn’t file until August 16th. Of course, no one actually read the filing. Instead, screenshots showing that Ryan Cohen owns 11.8% of Bed Bath & Beyond flooded the web, and the stock price exploded once again.

Then, three days later, Cohen announced that he had liquidated his stake, turning a $60M profit on the trade in the process.

Which brings us full circle to the SEC probe and lawsuit.

So why exactly is Cohen being sued and probed? Well, one reason was his usage of a “moon emoji.”

I’m serious.

On August 12, 2022, just a few days before Cohen sold all his shares, CNBC tweeted an article discussing how a semi-prominent short seller called for BBBY’s stock to head to $1 (it eventually did), and the thumbnail attached to the image included a female Bed Bath and Beyond shopper with a cart full of goods.

Cohen replied to the tweet with “At least her cart is full 🌝”

A snippet from a Wall Street Journal piece covering the lawsuit:

Some investors took it as a bullish signal, indicating that Bed Bath & Beyond stock would go “to the moon,” according to the lawsuit. The stock rose 12% that day, according to FactSet data.

In his response to the investors’ lawsuit, Cohen denied misleading the market about his trading plans. He decided to sell, he said in a court filing, because the stock price had “unexpectedly increased to a value that exceeded what he believed it was worth.”

Cohen also said that one of his earlier disclosures told investors that he could sell some or all of his shares. He didn’t change that statement, so investors were on notice that Cohen could dump his stake at any time, his court filing said.

In declining to dismiss the case, Judge McFadden wrote that investors “plausibly alleged that the moon tweet relayed that Cohen was telling his hundreds of thousands of followers that Bed Bath’s stock was going up and that they should buy or hold.”

When the lawsuit news first broke, Matt Levine shared his thoughts on the relevance of the emoji:

That is a lot of weight to put on that little emoji. I wonder if some portfolio manager at a big hedge fund loaded up on Bed Bath stock after this tweet, and then the stock tanked and she got called into her boss’s office to explain herself, and she was like “no I had an expert insider direction to buy this stock” and the boss was like “you did?” and she was like “well there’s this moon emoji tweet.” A moon emoji is not really “an expert insider’s direction to buy or hold.” It is just sometimes, “in the meme stock ‘subculture,’” perceived that way.

My first inclination is to agree with Levine: the idea that an obscure moon emoji tweet could constitute securities fraud is ridiculous… but there is precedent!

In February 2023, former SEC Branch Chief Lisa Braganca tweeted that “A federal court judge ruled these emojis 🚀📈💰 objectively mean “one thing: a financial return on investment.” Users of these emojis are hereby warned of the legal consequence of their use.”

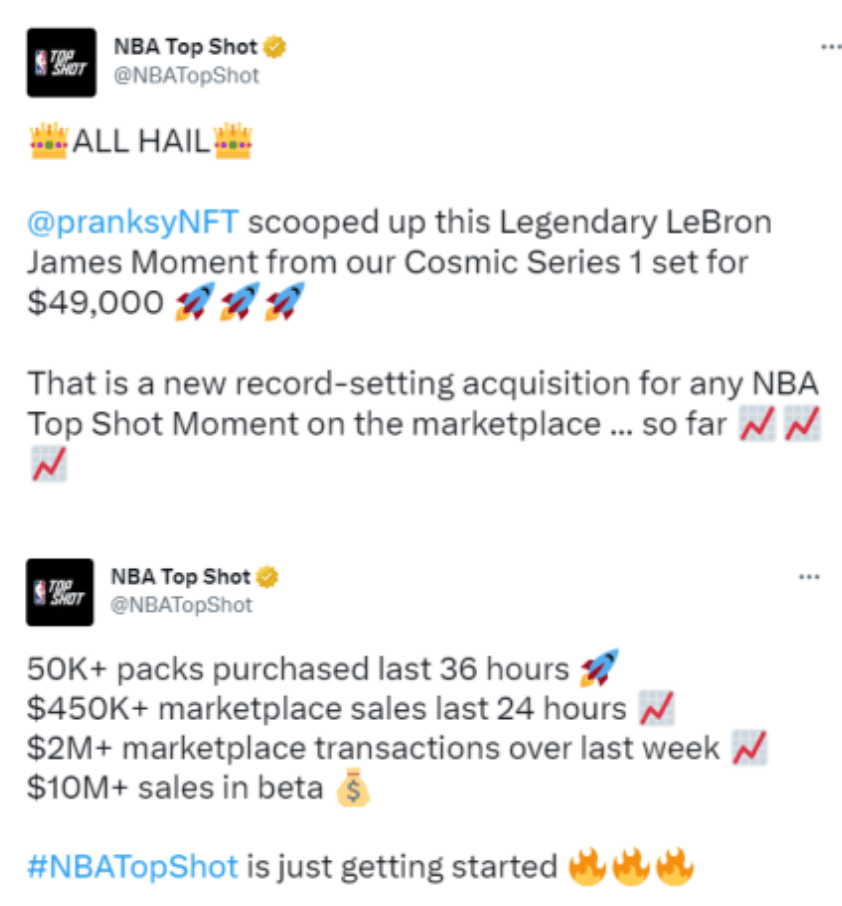

This tweet was in reference to federal court judge Victor Marrero’s denial of Dapper Labs’ motion to dismiss the amended complaint alleging that its NBA Top Shots Moments violated securities laws.

For those who don’t know, NBA Top Shot was an NFT marketplace for purchasing and trading various “digital assets” of professional basketball players. Like every other accounts vaguely associated with NFTs, the Top Shot Twitter account regularly fired off “pumpy” tweets. The judge used some tweets published by the NBA Top Shot Twitter account as evidence.

In my humble opinion, any reasonable person would conclude that “$450K+ marketplace sales last 24 hours 📈” is a FOMO-inducing tactic inferring financial gains for folks who buy NFTs.

Any reasonable person would also conclude that purchasing a JPEG on the internet because the Twitter account of the marketplace for trading said JPEGs tweeted “🚀” is a stupid decision.

But federal court judge Victor Marrero appears to disagree! So now the question is whether or not 🌝 is on the same level as 🚀, 📈, and, last but not least, 💰.

Should the moon emoji be a relevant part of any lawsuit? Probably not! Is there precedent for the moon emoji to be a relevant part of this lawsuit? There could be! “Legality” aside, here are my thoughts on the whole thing:

We’ve seen this same phenomenon of an asset price skyrocketing before crashing across several market segments over the last few years: meme stocks, NFTs, SPACs, crypto, and even large-cap stocks like Tesla, at times.

Yes, it is likely that in every instance, there was probably at least one investor who thought that asset actually had some sort of value (except for maybe in the case of “cum rocket coin.”)

However, in almost all of these instances, pretty much everyone knows it’s a game of musical chairs, Greater Fool Theory. No one is planning to hold any of this stuff in their kid’s 529 college fund, but they will buy it if they think someone will pay more for it later.

It’s a momentum game.

You buy an NFT at $10, and sell to a sucker at $100. That sucker buys at $100, and they sell at $1,000. That sucker buys at $1,000 and plans to sell at $4,000, but it peaks at $1,200 before crashing to $50, and that sucker loses $950.

Of course it was going to crash! It was an NFT!

But the crash wouldn’t have mattered if you had sold (let’s be real, you knew it was coming sooner or later), but it did matter because you got caught on the wrong side of the trade.

But wait! Someone was pumping that NFT that crashed. Of course, you didn’t actually believe the anonymous Twitter account with an animated monkey profile picture when it said that JPEGs of rocks were going to replace the US Dollar as the world reserve currency, but you were willing to buy those rocks and sell them to someone else

But that Twitter account was “promoting” the NFT, and they probably made some money from the NFT, so what if you could sue them for “intentionally misleading” you?

Ultimately, I think that’s what’s going on with the Bed Bath & Beyond case.

In these particularly volatile market segments where FOMO is name of the game, non-events can easily become real events.

Ryan Cohen knows that he is a catalyst for making non-events real events. He played a large role in the GameStop short squeeze two years ago, and he realized that an announcement that he took a stake in Bed Bath & Beyond would send the stock flying.

That stock would fly because tons of investors would pile in, hoping to flip the stock on someone else.

So Ryan took a $100M stake in Bed Bath & Beyond, and, as he suspected, the stock took off. But the momentum didn’t last long. Maybe he thought that he could improve the business, maybe he didn’t. That’s irrelevant at this point. But management did him a favor by buying back stock, because it forced Cohen to file another 13D disclosing he owned more than 10% of the company.

Was the timing of his second announcement questionable? Probably. It was due in April, and he didn’t announce until August. Is it securities fraud if other investors 1) can’t read and 2) are just trying to chase his trades? I don’t think so.

If you buy a stock just because someone else bought it, and that stock proceeds to decline in value, that’s on you. If you buy a stock just because someone else announced that they still owned the same number of shares they owned 5 months ago, but you fail to read the announcement, and then you want to sue that person for securities fraud because they… sold?

Have fun staying poor, I guess.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!