Rich in Experiences, Sufficient in Finances

Some thoughts on money this fine Monday morning.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

A few weeks back, I was mindlessly scrolling through Twitter when I came across this article by Lawrence Yeo. They say a picture is worth a thousand words, and his graphic is pretty damning.

You don’t think about money much as a kid. But as you get older, the narrative shifts. You are taught to make good grades in high school to gain acceptance to a great college. Once you enroll at your university, you need to maintain good grades, choose the right degree path, and complete a solid internship so you can land a competitive job.

Why do you want a competitive job? Because you want to make a lot of money, obviously. Every university career center has some rubric that shows starting salaries for various majors and different career paths. Every single aspect of your education is geared towards finding the path that will make you the most money.

What jobs pay the best for finance students (my personal degree path)? Consulting and investment banking. So you bust your ass to land a job at McKinsey & Company. You are in the top 1% of applicants, and you secure the bag.

You’re now making $150k as a new hire at McKinsey & Company, the most prestigious consulting group in the world. Congratulations, winner. Well after a few weeks, that initial euphoria wears off. You’re not particularly happy in this role, because you are pushing 70-80 hours a week writing reports, building presentation decks, and traveling Monday to Thursday. But you are learning a ton, and a promotion next year would bump your pay to $250k. You bust your ass to get that promotion, take on more responsibilities, and make $250k. And then you get there. Well after a few weeks, that initial euphoria wears off. You’re still not satisfied. But if you can just make it to the associate partner level, you’ll make $500k! You bust your ass to get that promotion, take on more responsibilities, and make $500k. And the cycle continues. There goes the first 10 years of your career.

Pretty somber, eh?

Unrealistic Expectations

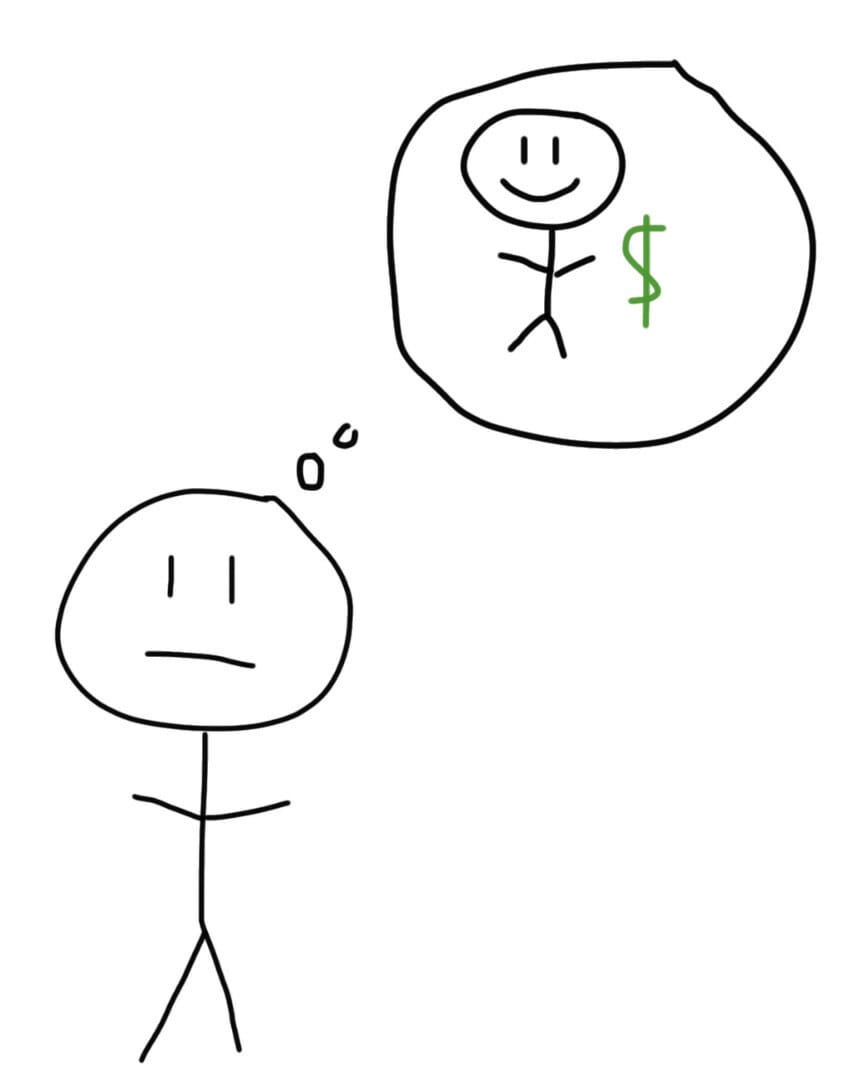

Here is how we think we will feel with more money.

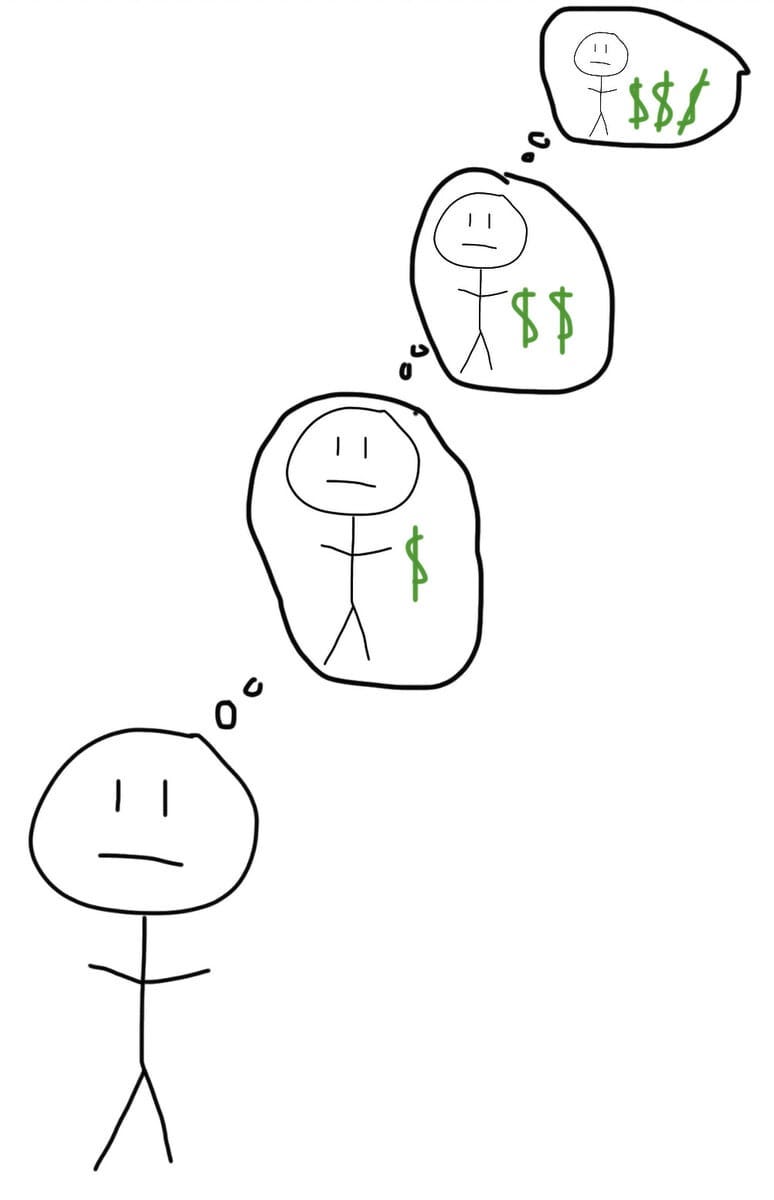

Here is how we actually feel.

This isn’t some fluke. It’s actually normal. What gives? Social scientists use the term “hedonic treadmill” to describe the human tendency to return to the same level of relative happiness after something good happens. Interestingly, we also return to the same level of happiness after something bad happens.

This is why lottery winners experience a brief wave of increased satisfaction before returning to their baseline level. It’s also why amputee victims experience a brief wave of despair before returning to their baseline as well.

That salary increase I mentioned above? That’s your winning lottery ticket. And no matter how much you want to hold on to that dopamine hit, it always disappears.

The craziest part about this whole thing? There are countless people stuck in this cycle of chasing promotion after promotion. Raise after raise. Many don’t even enjoy what they do, it’s just all they know. And every time they reach another milestone, that hedonic treadmill pulls them right back down.

Chasing the Wrong Scoreboard

When you start chasing money for money’s sake, it becomes your scoreboard. Money is tangible, easy to track, and a common measuring stick in our society today.

Say I previously made $50k. After a promotion and new job, I make $100k. Objectively I’m making twice as much money. My “score” is twice as high. Setting a new score feels good, so we keep trying to set new scores.

It’s easy to get caught in this cycle of “setting a new high score” with your salary. So you keep chasing it and chasing it. But you will never win a game that has no score limit. Yet like a hamster running on a wheel, we keep trying to score more points.

You tell yourself that once you hit $X target, you’ll let off the gas.

“Once I make $5 million, I’ll slow down at work.”

But that’s not going to happen. A nicotine addict will keep smoking. An alcoholic will keep drinking. An adulterer will keep cheating. When money has been the scoreboard for your entire career, money is all you know. It’s ingrained in your head at this point. Maybe you do stop for a while. But one day, you glance at the scoreboard again. And you feel the itch to chase a higher score once more.

Like the hamster, you’ll hop back on the wheel. Because it’s all you know.

The Finite vs. the Infinite

Everyone wants to be rich. But ask yourself this, would you trade places with Warren Buffett right now? $100 billion net worth, but you have to be 91 years old? I doubt it. What about a different trade off: Jeff Bezos. If you are a 20-something, would you switch places to be a 57 year old with $200 billion?

How about we flip the question around. How much money would Bezos sacrifice to switch places with me, a 24 year old guy out here backpacking Europe? Probably a lot. Hell, maybe all of it. He’s already shown that he wants to invest billions in life extension technology.

So many people spend their 20s and 30s grinding to make as much money as possible, while the richest people in the world would trade their fortunes for more time. Talk about irony.

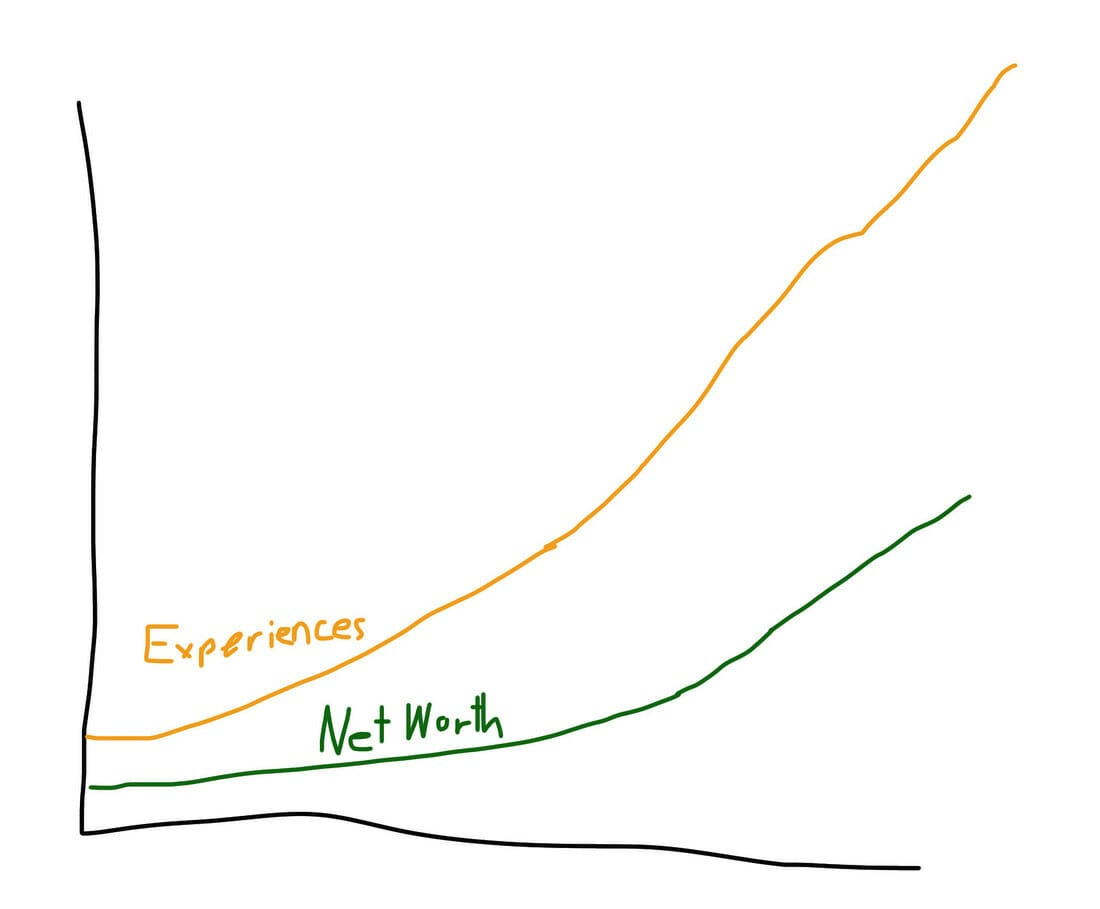

Money is an infinite asset with unlimited upside. Time is a a finite asset slowly ticking down to 0. Yet we focus more on accumulating as much money as possible, time be damned.

How much of the finite are you willing to sacrifice for the infinite?

What Are You Optimizing for?

No amount of money will satisfy you if you are chasing money for money’s sake.

The individual making $60k is envious of his friend who makes $100k. But that guy is envious of his boss who makes $250k and owns a nice house. Who is envious of his neighbor who makes $600k and owns a boat and mountain cabin. Who is envious of…

… you get the idea. It’s a perpetual game of keeping up with the Joneses.

Our society has made money the goal, but that’s backwards. Money is tool that helps you achieve your goals. Don’t confuse the tool for the goal itself.

It’s important to take a step back and say, “What are my goals?” or more importantly, “What am I optimizing for, and how much money do I need to get there?”

I have gone through this myself over the last year. I made hundreds of thousands trading stocks, and lost six figures in a day. I was just playing the game. Chasing the next dollar. There was no end goal. I said that I wanted to make a million, but I know I never would have stopped. How could I?

Like a hamster on a wheel, it was all I knew.

Luckily, taking a fat loss snapped me out of the cycle. My wheel broke, and I had to figure out where to go from there. Making $400k in 9 months didn’t make me happy, and losing half of that didn’t break me.

So what now? What am I optimizing for?

The title of this article: A life rich in experiences, and sufficient in finances.

So that’s what I’m pursuing right now, a life full of experiences. Because I think in 60 years, I would rather have a journal with thousands of stories than a bank account with millions of dollars?

Do I still want to make a lot of money? Of course. I have every intention of doing so. But money is a tool to help me optimize an experience-rich life. You can either use money, or it is going to use you. Money is infinite, but your time isn’t.

What are you optimizing for?

A life rich in experiences, and sufficient in finances.

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!