Perverse Incentives

How poor incentives create irrational outcomes.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

The Cobra Effect

Years ago when India was still under British rule, the British government grew concerned about the number of venomous cobras in Delhi. Hoping to reduce the number of snakes in the city, Britain offered citizens a bounty for every dead cobra.

Initially, this was a successful strategy; large numbers of snakes were killed for the reward. Eventually, however, enterprising people began to breed cobras for the income.

Breed 100 cobras, kill half, repeat.

When the government became aware of this, the reward program was scrapped. Suddenly, these cobra breeders had thousands of now-worthless snakes. No longer serving any purpose, they were released back into the wild.

The result? The wild cobra population increased.

The "cobra effect" is one example of a perverse incentive: an incentive that has an unintended and undesirable result that is contrary to the intentions of its designers.

History is full of perverse incentives:

Congress agreed to pay builders per mile of track laid when building the transcontinental railroad in the 1860s. As a result, Union Pacific Railroad unnecessarily lengthened a section of the route by forming a bow shape.

Bangkok police used tartan armbands as a badge of shame for minor infractions. However, the badges were treated as collectibles by those offending officers forced to wear them. Since 2007, to avoid the perverse incentive, the police department has been using armbands with the Hello Kitty cartoon character.

Intending to increase the number of accounts sold, Wells Fargo in 2016 introduced and imposed overly ambitious sales goals for their employees. Facing the threat of losing their careers if these quotas were not met, some employees began to open large numbers of unauthorized accounts.

In 2002, British officials in Afghanistan offered Afghan poppy farmers $700 an acre in return for destroying their poppy crops. This ignited a poppy-growing frenzy among Afghan farmers who sought to plant as many poppies as they could collect payouts from the cash-for-poppies program. Some farmers harvested the sap before destroying the plants, getting paid twice for the same crop. (Classic Brits)

Charlie Munger once said, "Never, ever, think about something else when you should be thinking about the power of incentives."

The most powerful incentive in the world? Money.

Finance is full of seemingly irrational events that are actually quite rational when you understand the incentives at play. Let's dive in.

Crypto

Crypto has been a fascinating case study on the power of incentives, especially for founders. Traditionally, companies that needed outside funding would raise money through venture capital firms.

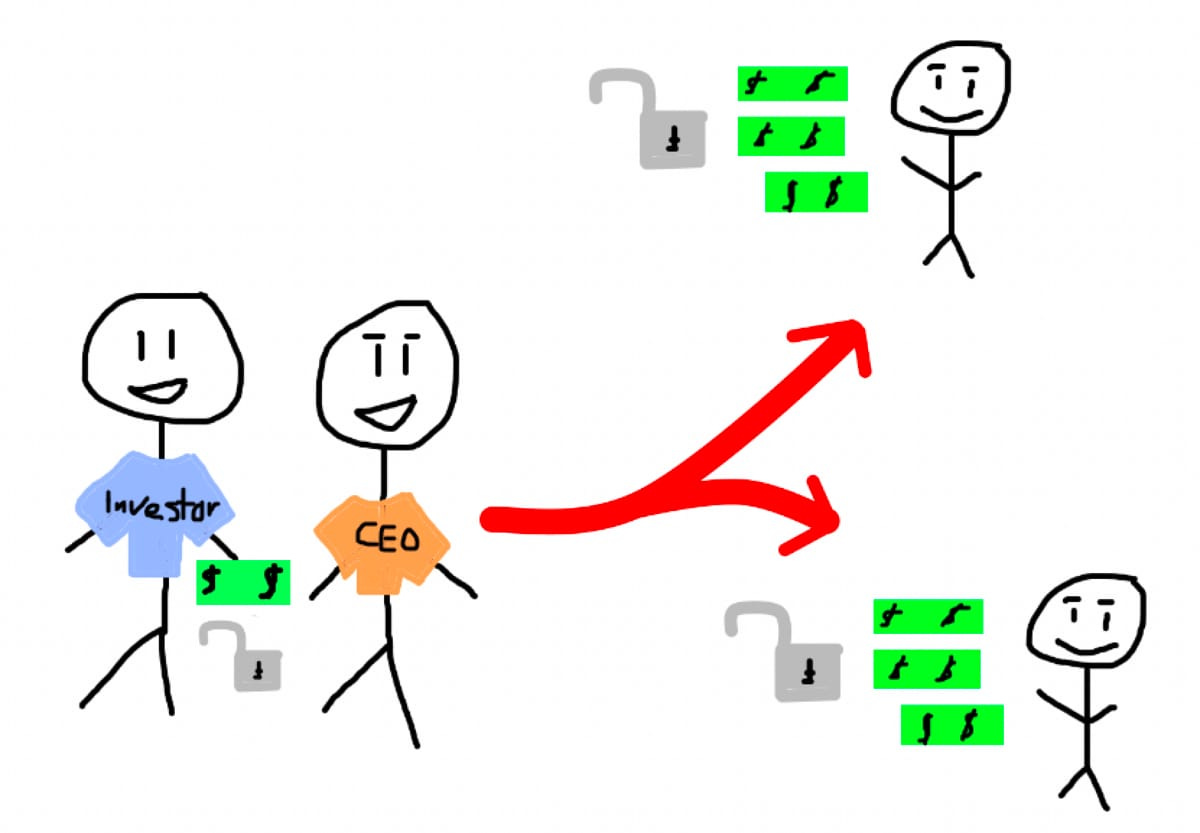

Imagine that I wanted to raise capital to expand Young Money. I raise ~$4M in VC funding in exchange for equity. However, both mine and the investors' equity is illiquid, or locked up, for the time being. For me and my investors to realize our gains, we would need to reach one of two exit opportunities: acquisition by a larger firm or IPO.

If Young Money is successful, I will cash out with life changing money. If Young Money fails, my illiquid equity was now worthless. Get rich or go broke, a binary outcome.

Crypto flipped the funding cycle around. While equity shares in private startups are illiquid for years, tokens are immediately liquid. Now, founders can issue tokens to raise funding.

Instead of raising venture capital, let's say that I raise $4M by issuing YM ownership tokens. These tokens are now tradable on crypto exchanges, so my equity is liquid from day 1. With venture capital, I can raise funding now, but only profit from my equity later. With tokens, the fundraise itself allows me to profit immediately. The financial reward is no longer dependent on the business outcome. It is dependent on your ability to sell the story of your future business outcome.

Don't get me wrong, there are ways to better align my incentives with those of other token holders. Lockup clauses would ensure that I couldn't just dump my holdings the moment that I raise capital, for example. Still, the tokenization of startups has created an easier* opportunity to profit from products before they are built.

*I say easier because SPACs are the OG pre-product grift. More on that later.*

Delayed liquidity incentivizes founders to build sustainable businesses; if they can't make it to the finish line, their equity is worthless. Immediate liquidity incentivizes founders to promote heavily to increase short-term price.

Profit now, build later. The incentive structure has been flipped.

You don't even have to build a project or start a company. You could just create a cryptocurrency with no utility, offer celebrities like Paul Pierce, Kim Kardashian, and Floyd Mayweather tokens in exchange for pumping it to their millions of followers, and dump on their audiences for exit liquidity.

Shot:

Chaser:

Instead of dedicating 90% of your efforts to building and 10% to selling, the key to getting rich is building just enough to convince someone else that your project shows real promise.

Then sell.

Incentives.

While instant liquidity in crypto incentivizes grifting, the crypto ecosystem is still really, really small. Large VC firms aren't investing tens of millions into half-baked ideas, and they certainly aren't touching projects without airtight lock up clauses.

The truly perverse incentives with billion-dollar impacts appear in traditional finance.

Asset Management

Professional investors tend to outperform the market, right?

Wrong. In a year that the S&P 500 was up 29%, only three hedge funds on the above list outperformed. Yet these companies manage billions and billions of dollars. What gives?

The 2&20 fee structure, baby. Hedge funds don't get paid for outperforming the market. They get paid for managing as much money as possible.

Generally, hedge funds charge a 2% management fee on assets under management, + 20% of profits over a certain benchmark. But the benchmark doesn't have to be the S&P 500, NASDAQ Composite, or the Dow Jones. It can be whatever they want. Oftentimes, it is just 20% of all positive returns.

Imagine that a $10B fund using a 2&20 fee structure generated 10% returns last year, and performance fees were applied to total positive returns. The fund managers would have taken home $200M in management fees (2% of $10B) and another $200M in performance fees (20% of $1B).

Professional asset management is shrouded in a cloak of mystery that leaves investors wondering what they are missing out on. Ironically, most investors would be better off sticking with index funds.

Hedge funds get paid for 1) managing a lot of money and 2) not losing much of it. They get rich by growing their capital base, not chasing alpha. Underperformance is a feature, not a bug.

Incentives.

IPOs

After hitting $85 on its first day of trading, Robinhood is now $10 per share.

It's incredible just how poor this brokerage has done in the public markets, but Robinhood is no outlier. It is actually the norm for recent "tech" IPOs.

These aren't fringe cryptocurrencies. These are multibillion dollar publicly traded companies.

Crypto rug pulls make for popular headlines. What idiot would lose money on Squid Game Coin??

Trading volume on the day that Squid Game coin dumped? A measly $4M.

Meanwhile, 442M shares of Robinhood stock traded on the day that it hit $85. At a midpoint price of ~$50 per share, that is over $20B exchanging hands in a single day. The stock has lost more than $30B in market cap since then.

Robinhood, DoorDash, and Affirm are three of several hot tech companies that IPO'd in the last year or so. in 2020 and 2021, tech stocks were trading at nosebleed prices. Late-stage private companies were raising capital at outrageous valuations, and many knew that their growth rates were unsustainable and pandemic tailwinds were due to disappear.

For example, $144M of Robinhood's $565M total revenue in Q2 2021 came from DOGE coin trades 🤨 Is that really a sustainable business model?

You know what’s better than pump-and-dumping a $2M crypto? Pump-and-dumping a multi-billion-dollar tech company on your users. How would you do that?

File an IPO to take your retail-focused trading platform public at peak valuation

Let traders on your platform invest in the IPO, promoting it as a method for leveling the playing field for retail investors; IPO allocations are typically reserved for institutions

Warn investors not to "flip" IPO shares, or they may be banned from future IPOs

Dump millions of shares in your own company after threatening retail investors not to do the exact same thing

Thanks Vlad Tenev, very cool. Obviously Robinhood's founders and investors knew that growth was going to slow down, but who cares? When your company made hundreds of millions selling order flow on GameStop and DOGE, might as well cash in by dumping your stock on retail (and Cathie Wood).

Once again, incentives drive everything. Secure the bag now, and deal with the fallout later.

SPACs

Special Purpose Acquisition Companies, or SPACs, were all the rage in 2020 and early 2021. I would know, I traded them like a madman for a year. SPACs appealed to many early-stage companies because they were quicker and more flexible than traditional IPOs. Instead of hiring a bank to help price your IPO, private companies could find a SPAC, which was basically a publicly traded bank account, and "reverse merge" to go public.

SPACs give private companies money in exchange for shares. A $100M SPAC merging with company XYZ at a $1B valuation would receive 10% of the shares in the new company, for example.

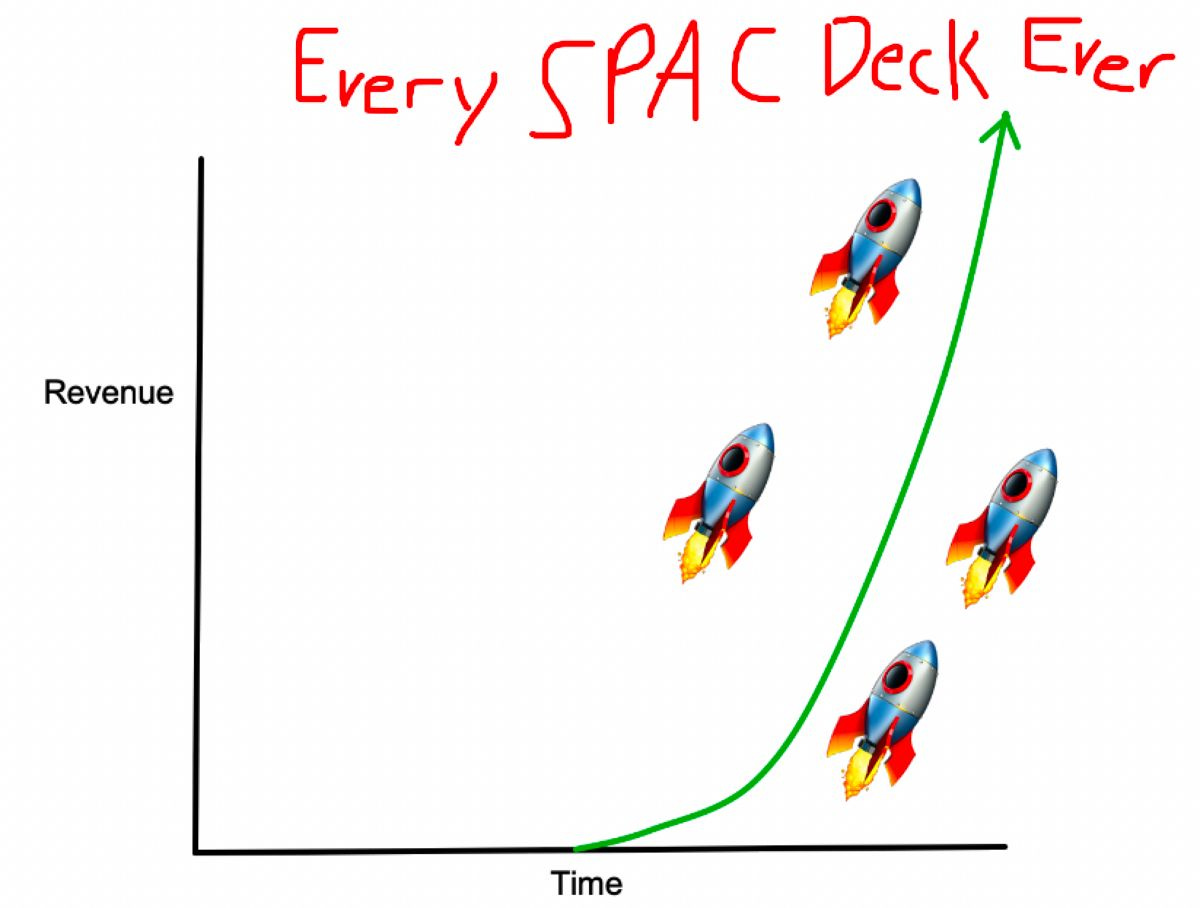

Unlike traditional IPOs, SPACs are allowed to give future financial projections. In July 2020, Fisker, an electric vehicle startup that has yet to produce a single vehicle, projected $600M in sales in 2022, $3.3B in 2023, and $10.6B in 2024. The company also believed that it would hit $1B in FCF by 2024.

Fisker went public at a $3B valuation. While this may seem expensive, it's actually quite cheap by the company's own incredibly realistic financial projections. That's only 3x 2024 free cash flow!

Electric vehicles, 3D printers, sports betting, space tourism, iBuying. All sorts of companies with hockey stick revenue projections went public through SPACs!

Chamath Palihapitiya, the CEO of Social Capital, was the Sultan of SPAC. After taking space tourism company Virgin Galactic public in 2019, he closed deals with OpenDoor, Clover Health, and Sofi. He was also an active investor in other SPACs as well, participating in PIPE investments for companies like Proterra, Desktop Metal, and Metromile. By February 2021, the self-proclaimed next Warren Buffett was on top of the world.

Every single SPAC he was involved in was killing it.

Last February, the billionaire investor published this now infamous tweet.

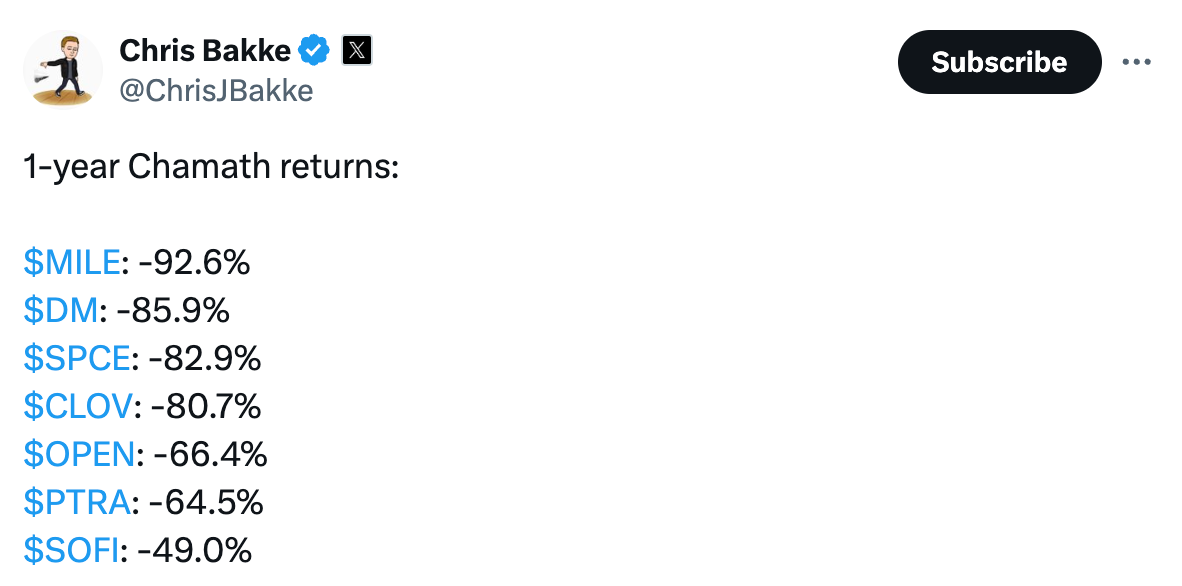

What happened since then?

(Berkshire Hathaway is up 27% over the last year, by the way)

Life comes at you fast. Many of these companies, especially those that were "pre-revenue" had no business being publicly traded. (However, if I'm ever unemployed in the future, I will self-identify as "pre-revenue". That's an incredible line.)

Why take so many of these high-risk companies public? Incentives, obviously. And the incentives to launch a SPAC are quite lucrative.

Closing a SPAC deal is really hard work, and SPAC sponsors need to be compensated for creating so much shareholder value! According to the company's prospectus, IPOA's sponsors received 17.25M shares of stock for a one-time, $25k contribution.

SPACs price deals at $10 per share, so IPOA's sponsors would receive $172.5M worth of stock assuming that any deal was closed. So they take space tourism company Virgin Galactic public. While the company briefly underperformed post-IPO, hype surrounding the space sector eventually propelled the stock to $60 per share.

But Virgin Galactic has missed deadline after deadline, and its stock is trading at $8 as a result. Luckily, Chamath sold 3.8M shares at $25 per share to manage some liquidity last year before stepping down from the board of directors last week.

Virgin Galactic's lackluster execution isn't an outlier. Pretty much every SPAC from 2020 has already missed its 2022 projections and scratched forward guidance altogether. Not that this is a surprise. After all, the combined 2025 projected revenues from every 0 revenue EV start up that went public through a SPAC was something like $100B. Certainly seems, realistic, no?

For the sponsor, it doesn't matter if the company is a dumpster fire. For the small price of $25k, you get tens of millions of shares! SPACs are asymmetrical bets for these sponsors. Your company crushes it and hits $20? You make a cool $200M. Your company sucks and hits $2? You still made $20M.

Sure, due diligence for good deals would be cool. But you know what's really cool?

Tweeting a one-page word document about a shady health insurance company to your millions of followers, and let retail investors pump the price.

This certainly created millions of dollars in shareholder value, right?

Well, maybe not for the investors who paid $10+ per share. But for the sponsor who cashed in on their millions of free shares? Hell yes. Much value creation, very cool.

Wrapping Up

Irrational events in financial markets seem much more rational when you consider the incentives that drive decisions. Easy money is a powerful temptation, and most public market "train wrecks" are actually quite lucrative for their conductors, just not the passengers. Be wary of opportunities that put you at odds with your conductor.

If a company is raising insane amounts of money before every actually doing anything, run far, far away. If a prominent investor takes a company public at a several billion-dollar valuation, dumps his shares, and resigns from the board all before they take a single customer to space, the stock is probably going to zero.

Anyways, I think I'm going to take this newsletter public through a SPAC. Is $IPOD still looking for a target, Chamath?

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!