Not Fungible

Everything you need to know about the most ridiculous asset market today

Hello friends, and welcome to Young Money! This is the most ridiculous thing I’ve ever written about. If you want to join hundreds of other readers in learning about finances, career navigation, and figuring this life thing out, subscribe below:

You can check out my other articles and follow me on Twitter too!

How much would you pay for this picture of a rock? $1? $10? “Bro, you’re an idiot. I can literally screenshot the picture right now and have it for free.” Maybe I am an idiot, because you’re right. You can screenshot the picture and keep it for yourself. That being said, an even bigger idiot paid $1.2 million. MILLION. for this JPG of a rock. Our boy Ozzy bought this picture for ~$5,000 19 days ago, and he just sold it for a $1.2M profit.

What’s so special about this rock? It’s an “NFT”. We’re really out here working 50 hours a week, when we should have been selling crayon drawings online all along. Seven figures of cash thrown at a picture that I could draw in Microsoft paint in ten minutes. It’s not just small-time speculators gambling on NFT prices. Visa, you know one of the largest financial services companies in the world, paid $150,000 for this image:

Welcome to the NFT market. Everyone is getting hysterically rich, and you’re not.

NF What?

NFT stands for non-fungible token. This is fancy jargon for a piece of digital data that can’t be replicated or counterfeited. NFTs can be anything. Pictures. Videos. Audio files. Legal contracts. Tom Brady’s autographs. Literally anything. I could sell the rights to this very newsletter as an NFT.

Why can’t NFTs be counterfeited? Because transactions are tracked on the blockchain. I know, I know. Another crypto buzzword. Blockchain sounds intimidating, but it is literally just an online ledger that tracks ownership of a digital asset. If I buy the EtherRock photo from someone, I take ownership of that piece of data. This ownership exchange is recorded via blockchain technology, thus I can prove that I actually own the asset in question.

“Why would I pay thousands for a JPG image when I could just screenshot it?” Great question. Functionally, there can only be one true version of any NFT. Ownership of the actual asset is tracked via blockchain. Sure, anyone “can” screenshot the picture, but it still isn’t the original. You could counterfeit Brady’s autograph perfectly, but it would still be fake. A great artist could recreates an identical copy of the Mona Lisa, but it would never be worth the same as the Mona Lisa. That same dynamic is at play here. You would think the ability to screenshot an NFT would make it less valuable, but the opposite is true. My friend Austin explained it well, “NFTs actually become more valuable as more counterfeit versions are produced, as it draws more attention to the original item.”

So NFTs provide a way to attach infallible ownership to a digital asset. That doesn’t explain why they’re worth anything, right? Sure, there is no “intrinsic” value to NFTs. They aren’t cash flow positive businesses or tangible assets like houses. But you could say the same thing about art or fine wine. Market participants assign value to everything in any market.

The Mona Lisa was hidden in a closet for hundreds of years. An art afterthought. It only became famous after it was stolen and subsequently found. The mystique that built around this stolen painting helped drum up the interest of art fanatics, and it’s now the most famous painting in the world. I wouldn’t pay $1 billion for the Mona Lisa, just like I wouldn’t pay $10,000 for a picture of a penguin.

But enough people are paying massive premiums for different online images that the prices are holding up. Who am I to say what the fair price is for something that I don’t care all that much about?

Clout Chasing

For the entirety of human history, mankind has wanted to flex on its neighbors. Ancient kings adorned themselves in gold and held lavish festivals. Billionaires have massive yachts and private jets. Top Fortnite players wear ridiculously expensive skins. Why? Because they want to assert their dominance. As absurd as it sounds, there is a legitimate, massive online community that achieves this same sense of dominance through owning expensive NFTs. A couple of weeks ago, Packy McCormick had a great piece about this phenomenon. Humans will always use their money as a flex when applicable. Somehow, pictures of penguins, rocks, and apes have become a status symbol in online circles.

Creator Economy

The real winners in this new market are the creators. Why? Permanent royalty structures. NFTs can be coded to generate royalties for the creator each time the NFT changes hands. Say I draw a picture of a potato, and it sells for $20,000 (lol). I also code a 10% royalty fee into the data. If someone sells my potato for $1 million next year, I will make $100,000 in royalties. If it changes hands again the next year, I’ll get another royalty. Creators who can build loyal audiences in this market have a venue for generating massive income. NFTs turned art into dividend investments for the creators.

OpenSea = Ebay for NFTs

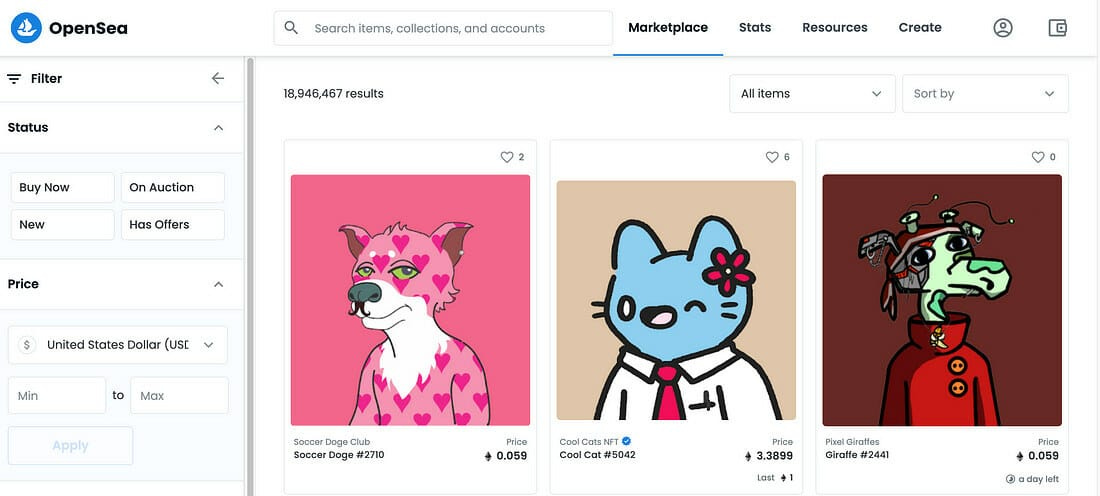

So where do you buy NFTs? OpenSea is the primary market. Austin Cain wrote a detailed explanation of this platform here, but OpenSea is essentially Ebay for NFTs.

All sorts of projects trade hands on this site each day, and volume has exploded over the last few months. This online market place has seen $1.3 billion change hands in August so far, up 287% from July.

One important caveat for OpenSea is that investors can only purchase NFTs with Ether (the crypto currency supported by the Ethereum network). All assets are priced in ETH instead of USD. The live bid-ask as well as all prior transaction prices are listed on the site as well.

Bubbly

Is this a bubble? Without a doubt. 100%. Someone flipped a $5,000 purchase to a $1.2 million sale in less than three weeks. Everyone is trying to flip these images to the next buyer, and some people will 100% get burned in the process. In all likelihood, 90% of these NFTs will go to zero. That being said, the technology and potential applications are legit. Artists can make permanent royalties on their work. Musicians could license their songs. Athletes can sell digital highlights and autographs. NFTs could change how digital contracts are written. The possibilities are endless, and it’s likely that the final use cases haven’t even appeared yet. I think this is a fascinating sector. While I haven’t invested in it, I am attentively watching it.

Have a great rest of the week. I’ll be back with more content on Friday.

Jack

If you liked this piece, make sure to subscribe by adding your email below!