National Treasure 3: The Rug Pull

Everything you need to know about Ken Griffin's Constitution bid.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

If Elon Musk is the real world Iron Man, Ken Griffin is trying his hardest to be Thanos. Last week, I wrote about Constitution DAO, an ambitious effort to crowdfund the purchase of the US Constitution at the Sotheby’s auction in New York City.

For those wondering what a DAO is, here are a few definitions:

Word of the Constitution DAO spread across Twitter like wildfire, and everyone wanted a piece of the action. As I write this, the Constitution DAO Twitter account has 45k followers, the Discord server has 21,600 members, and every media outlet in America has talked about this “chat room with a bank account.”

In just five days, a few semi-serious text exchanges between friends transformed into the largest crowdfunded auction bid ever.

Before the auction, Sotheby’s anticipated that the historic document would sell for $20 million. The DAO raised more than double this estimate, building a war chest of $46 million. A hell of an accomplishment for a ragtag group of retail investors.

That being said, there was one problem with crowdfunding an auction bid in public:

Everyone can see exactly how much money is raised. And when the fundraise is over, someone with “f*ck you money” can say “f*ck you” by placing a higher bid.

*Ken Griffin enters the chat.*

Kenny G

Ken Griffin is the founder, CEO, and majority owner of Citadel LLC. Citadel is both a $38 billion hedge fund and the largest market maker in the country, handling 40% of stock trades in the US. Citadel is what Dave Portnoy would call, “The suits.”

Griffin was thrust into the national spotlight in February of this year, as he was called to testify at the GameStop Congressional hearing alongside Robinhood CEO Vlad Tenev, Reddit folk hero/newly minted millionaire Keith Gill, Reddit CEO Steve Huffman, and destitute short-seller Gabe Plotkin. Hell of a line up.

Why was Griffin called to testify?

Citadel is Robinhood’s largest customer (more on that in the next section), paying the brokerage hundreds of millions each quarter

Citadel processed 7.4 billion shares for retail investors on January 27th, 2021

Citadel invested $2.5 billion in Melvin Capital, the hedge fund that nearly imploded thanks to its short position on GME

Citadel was more involved in the GameStop fiasco than anyone.

During the GameStop short squeeze, several brokerages (including Robinhood) suspended trading of $GME due to extreme volatility. Most investors couldn’t buy new shares of GME, and the price dropped by almost 90% over the next two weeks.

The likely explanation was the outdated T+2 process (click here and here if you want to get technical).

Tl;dr: stocks don’t actually “change hands” instantly. It takes two days for trades to settle, and the brokerage has to have the funds to account for those shares until they settle. When a stock goes ballistic and the same shares trade 10x per day (like GME in January), the cash requirements spike as well. Most brokerages had to reduce trading volume to meet the cash requirements.

However, when Robinhood restricted trading of GME while its biggest customer (Citadel) bailed out a hedge fund that had a billion dollar GME short position, some eyebrows were raised.

A good narrative always spreads faster than the truth. When everyone from Dave Portnoy to AOC spoke about retail investors getting screwed by trading restrictions, Ken Griffin became public enemy number one.

You either die a hero, or live long enough to see yourself become a villain. The Congressional hearing was Ken Griffin’s villain origin story.

(Rob)b(in)g the (Hood)

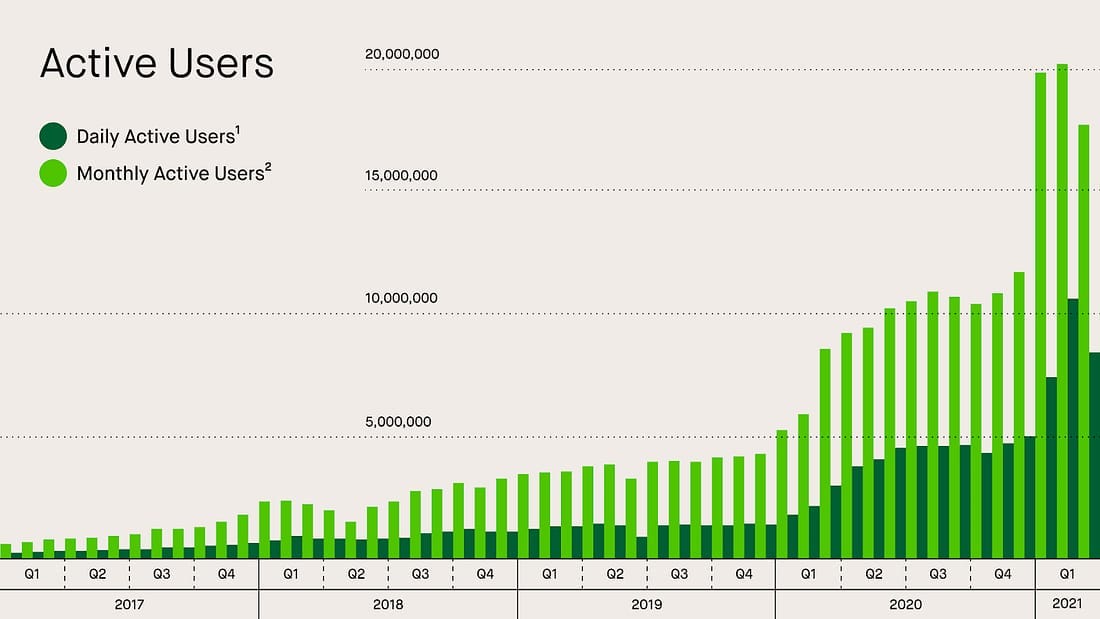

Back to Citadel’s payment for order flow. COVID-19 was bad for a lot of companies. COVID-19 was good for Robinhood. The graph below shows Robinhood’s user growth over the last four years.

Unprecedented market volatility, global lockdowns, and free trading meant one thing: a lot of bored people had a lot of free time to invest (read: gamble) on the stock market.

You know who else benefited from Robinhood’s growth? Its number 1 customer, Citadel Securities. 43% of Robinhood’s revenue comes from Citadel. Why is Citadel paying Robinhood hundreds of millions? The market maker wants your trade data.

Commission-free trading isn’t free. You just pay with your data instead of your wallet. Investors become the product, and funds like Citadel become the clients.

For my Robinhood degens out there, have you ever placed an order for a Tesla call option expiring in three hours, just to see the ask immediately jump $0.05? That wasn’t a coincidence. That was Citadel doing its thing. Citadel pays for Robinhood’s order flow, meaning it receives your order a microsecond before the trade actually places. Because 40% of trading volume is routed through Citadel, it can front run your trade by increasing the ask. While this only costs you $5, Citadel front runs retail trades millions of times per day. Those dollars add up quickly. No wonder Griffin pays Vlad so much for the data.

Robbing th3 H00D

After months of public backlash, Ken Griffin had become the enemy of retail investors. So he embraced his role as resident bad guy. For years, his company has made millions by front running retail order flow.

What is the ultimate retail order flow rug pull?

Watching an internet community raise $40 million, then phoning in to the auction and out-bidding them in real time.

Kenny G pulled the most meta move of all time by bumping up the ask on the US Constitution.

A week ago, I thought there were three outcomes of Constitution DAO:

It doesn’t raise enough money

A rich collector wins the auction

Constitution secured

But I’m an idiot! I forgot the Second Law of TherMuskdynamics:

When you take Musk’s tweet into account, it was actually quite obvious that the CEO of a $35 billion hedge fund that profits from scalping retail investor order flow would rug pull these same retail investors that crowdfunded a Constitution bid.

Nothing more American that rich institutional buyers pricing the little guy out of the market.

Everyone Needs an Enemy

Ironically, this was the best possible outcome for Constitution DAO, Web 3, and the decentralization movement. Why? Because Ken Griffin represents everything that the new generation of investors despises about traditional finance.

And he just rug pulled thousands of retail investors who wanted to own part of the US Constitution. You can’t make this stuff up.

You know why Avengers Endgame was a box office success? Because its prequel, Infinity War, left viewers with a burning hatred for Thanos. We didn’t know the final outcome, and we were begging to see what comes next. Do the dead Avengers come back to life? Does Thanos win in the end? What comes after the snap?

If Constitution DAO wins the bid, the movie ends. The credits roll, and we walk out of the theater thinking, “Wow that was a cool movie!”

If a random collector wins the bid, the movie ends. The credits roll, and we walk out of the theater thinking, “What a lame ending. Anyone could have seen that coming.”

But Ken Griffin snapped his fingers and won the auction. Now we anxiously hope for a post-credits scene that hints at a sequel. And we get that post-credits scene. We see the gang regrouping to plan another DAO purchase. Except this time, a mutual hatred for Ken Griffin leads Constitution DAO to join forces with the masses of Wallstreetbets.

What is the next project? Will the DAO pursue a $100M purchase? Will it launch an attack against Griffin/Citadel? Does Nicholas Cage break into Griffin’s mansion to steal the document himself?

I have no idea. This was the cliff hanger that we didn’t know we needed. Kenny G’s last minute bid turned a one act play into a multi-episode drama, and I’m all for it.

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!