Media Isn't Dead, It's Evolving.

Changing market conditions don't = dead markets.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

A few days ago on the site formerly known as Twitter, a post caught my eye:

This post echoes a broader opinion regarding media that I’ve been hearing more and more of lately: Media is dead. Journalism is dead. Print is dead. Advertising is dead.

At first glance, this opinion holds some weight. 21,400 media jobs were lost in 2023, the most (ignoring temporary pandemic layoffs) since the Great Recession. Social media algorithms deprioritize outbound links, limiting the reach of media organizations. Social media ad targeting is more effective than media ad placements, and many sponsors have diverted their marketing spend accordingly. The TikTokification of everything has shortened our attention spans to the point that we struggle to digest bite-sized chunks of spoon-fed, watered-down content before immediately scrolling to the next video.

So, sure, maybe media’s only chance of survival is government-funded life support. Maybe it’s impossible for a profitable media endeavor to exist in 2024. But I don’t personally subscribe to this view.

Media, or at least the “media” that we know, is a fairly modern phenomenon. For years, newspapers, plus a few radio and television stations, were the only forms of media in towns around the United States, and advertisers had to go through these local channels to reach the residents of different cities and towns. This dynamic applied to the country-wide level as well: massive media organizations, such as The New York Times and national television networks, were the only platforms with millions of eyes and ears.

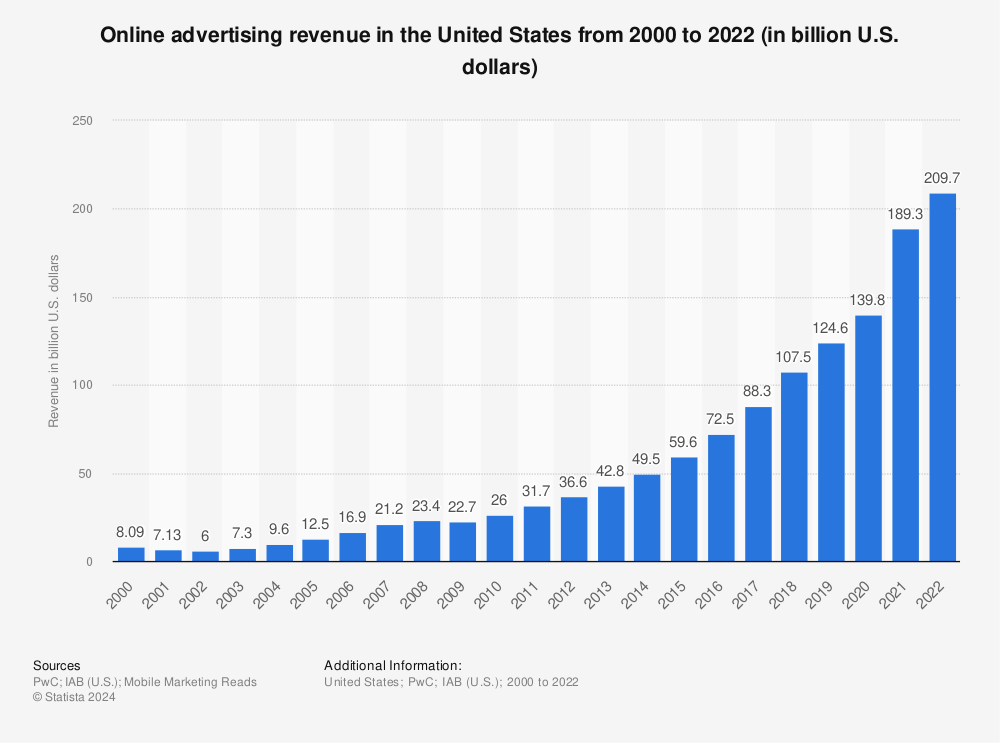

Advertising money flowed to those platforms accordingly, and they prospered. Then the internet hit the scene, changing everything. This change didn’t happen overnight, of course. The first banner ad hit the web in 1994, and these primitive digital ads were terrible. The user experience was erratic, attribution was nonexistent, and targeting was impossible. As search engines and social media platforms evolved, however, targeting and placement improved, and once advertisers realized how powerful these platforms were, revenues exploded.

The power dynamic shifted as a search and social oligopoly replaced the print and television oligopoly.

But media isn’t dead, it has simply struggled to adapt to a new industry landscape. The media businesses that dominated the 1900s misunderstood the source of their competitive advantage. They thought their competitive advantage was their quality of content, and they believed that advertisers would always pay a premium to advertise on that content. But their competitive advantage wasn’t content, it was attention. When search and social stole some of that attention, ad dollars left as well.

Traditional media companies’ entire business models were predicated on the idea that they could charge premium advertising rates forever, and that isn’t the case anymore. Folks say, “Media is dead,” but that isn’t true. Media isn’t dead. The previous ad-heavy business model that supported traditional media is dead. But there aren’t any rules to how media companies have to be run. You don’t have to have ____ reporters, editors, and anchors covering _____ topics monetized by ______ advertisements.

You just have to 1) make “media” (which can mean a lot of different things) and 2) make money. How you do both of those things is up to you. Dollars in, dollars out. You have to make the math work.

Did you know that The New York Times added 300,000 paid digital subscribers, and 880,000 total digital subscribers, in the 4th quarter of 2023 alone? Oh, and their digital revenue per user is growing? The Times expanded into new verticals and figured out its paid subscription business.

Bloomberg, arguably the most important name in financial media, is doing just fine. Yes, the majority of their revenue comes from their terminals and other professional services, but there aren’t any rules stating that media companies have to be standalone media companies. They provide superb coverage of all things financial and business news.

Morning Brew, a company whose initial product was an email-delivered business newsletter, sold for $75M a few years ago. The Hustle sold for $27M. Industry Dive, a B2B news organization, sold for a whopping $525M to Informa in 2022.

Two weeks ago, I signed up for a $225 annual subscription to The Information. Why? Because their coverage is excellent. The Information has 65 full-time employees. They’re lean, focused, and cover their markets, primarily finance and tech, exceptionally well. The don’t run ads. They don’t have to.

“But what about local journalism? It’s been destroyed.” Has it? Yes, many traditional local newsrooms have struggled, but it’s never been easier to launch a local news site. The Ottowa Lookout, a one-person newsletter covering all things Ottowa, has 32,000 total subs with 1,700 paid subscribers paying $125+ per year, plus local advertisers likely paying a premium to advertise to a specific geography. That’s likely $250,000+ for a one-person newsletter, before advertising revenue. Total costs are probably than $150 a month for web hosting and an email platform.

The world rewards those who can best adapt to change. Legacy companies struggle to adapt because their businesses are organized to dominate a market that no longer exists. The game has changed, but media is far from dead.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

One of my favorite newsletters lately been Lykeion, an independent financial media outlet founded by a team of portfolio managers and geopolitical strategists. They have fantastic investment grade research, insightful commentary on macro trends, and thematic analysis that focuses on the intersection of financial markets and geopolitics. You can sign up for their free weekly newsletter and reports here.

Josh Brown’s latest blog post on the value of “showing up” is excellent.

Drew Dickson published an excellent blog on how passive investing may be impacting markets.