Inflation Up, Your Savings Down

Inflation increased 6.2% year over year in October. Invest or go broke.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Inflation is up 6.2% year over year, and everyone is talking about it. That might not sound like a big number, but it’s actually a really, really big number. The highest month over month change in 30 years, in fact. Big inflation is a bad thing. Before I get into the weeds on this, let’s break down what you need to know about inflation.

What Is Inflation?

Inflation refers to the increase in price of certain goods and services. When the Department of Labor states that inflation is up 6.2% year over year, it’s saying that the average cost of a several items (energy, food, commodities, etc.) in the United States has increased by 6.2% since October 2020. You can see inflation in the price of used cars, shown below:

I sold my 2016 4Runner with 90,000 miles for $27,500. The used vehicle market is definitely hot.

Simply put, inflation is the reason that $5 foot-longs now cost $6.25. The same amount of money now buys less stuff. Low inflation (~2%) is normal and expected. 6.2%? Not so much.

Why Does Inflation Matter?

Inflation is a stealth tax. It doesn’t show up on your pay stub, but you’ll notice it when you’re buying groceries. The government isn’t taking more of your money, but the money that you do have is worth less. It now takes you $106.20 to buy something that cost $100 last year.

$50 in gas is now $53.

$120 in electricity is now $127.

That $30,000 car is now $31,860.

All of these little 6% increases that seem irrelevant by themselves quickly add up. When it takes more money to buy the same amount of stuff, and you’re not making more money, you’re screwed.

Who Does Inflation Hit Hardest?

The lower and middle classes. Every year, politicians boast that anyone making less than $ ____ won’t be impacted by tax increases.

That may technically be true, but inflation is a shadow tax that does more damage to the lower and middle classes than anything else.

Rich people own stocks, real estate, and all sorts of assets that increase in value. Inflation often benefits asset holders, because the value of their assets increases along with the cost of goods and services.

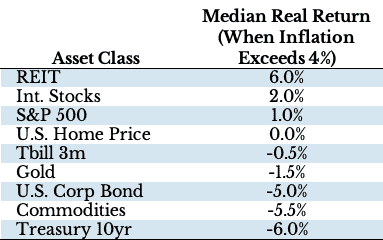

Nick Maggiulli wrote a great piece on investing in an inflationary environment, and he highlighted the returns of different asset classes during inflationary periods.

The top three performers?

Real estate, international stocks, and the S&P 500. It makes sense: companies and real estate both provide tangible value. Money is just a method for denominating that value and exchanging those assets. If the value of this money drops exponentially, the nominal value of those assets will increase.

To think about this another way: goods that you purchase everyday become more expensive. You pay more those goods. The companies that produce those goods now make more money. The company is more valuable. Same with real estate, where increased rent makes the land more valuable.

This is an incredibly simplistic view of why assets tend to move up in line with inflation. Just trying to illustrate a point here.

Lack of investments in these assets is what kills the lower class. If you have $20 million invested in REITs and stocks, and they return 12% and 8% respectively, who cares if inflation is up 6%? You are still outperformed inflation, and your purchasing power increased.

If you are living paycheck to paycheck with no extra money to invest, the value of your money keeps decreasing. Meanwhile, that of asset holders is increasing.

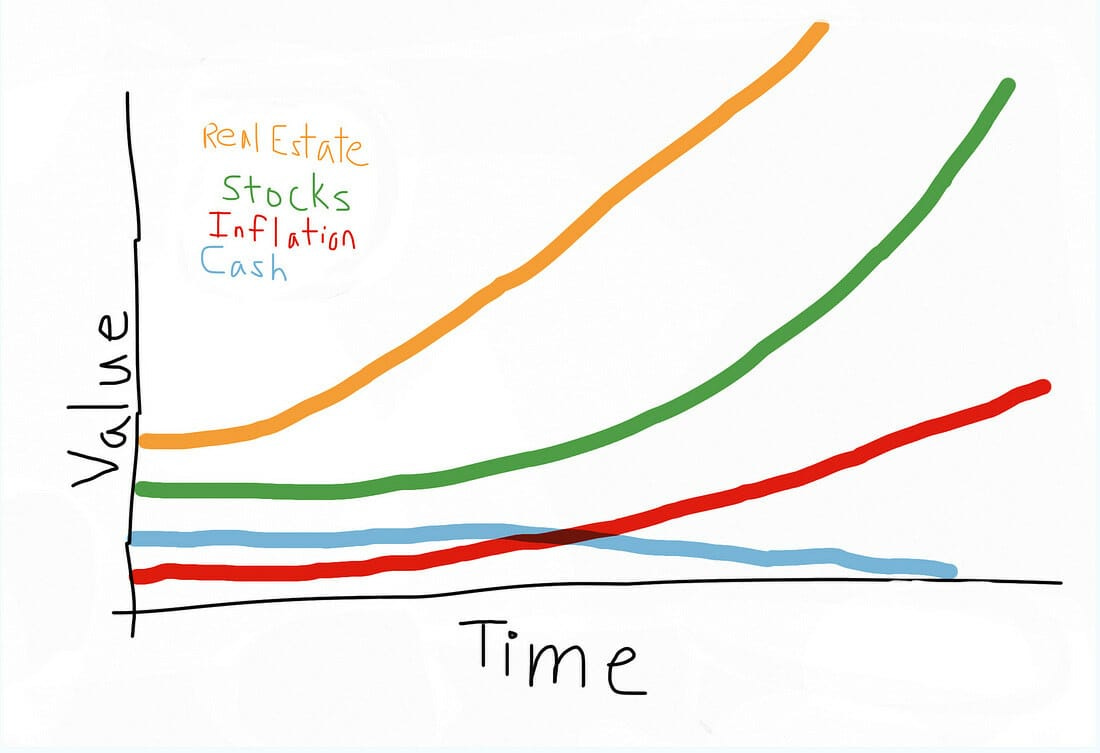

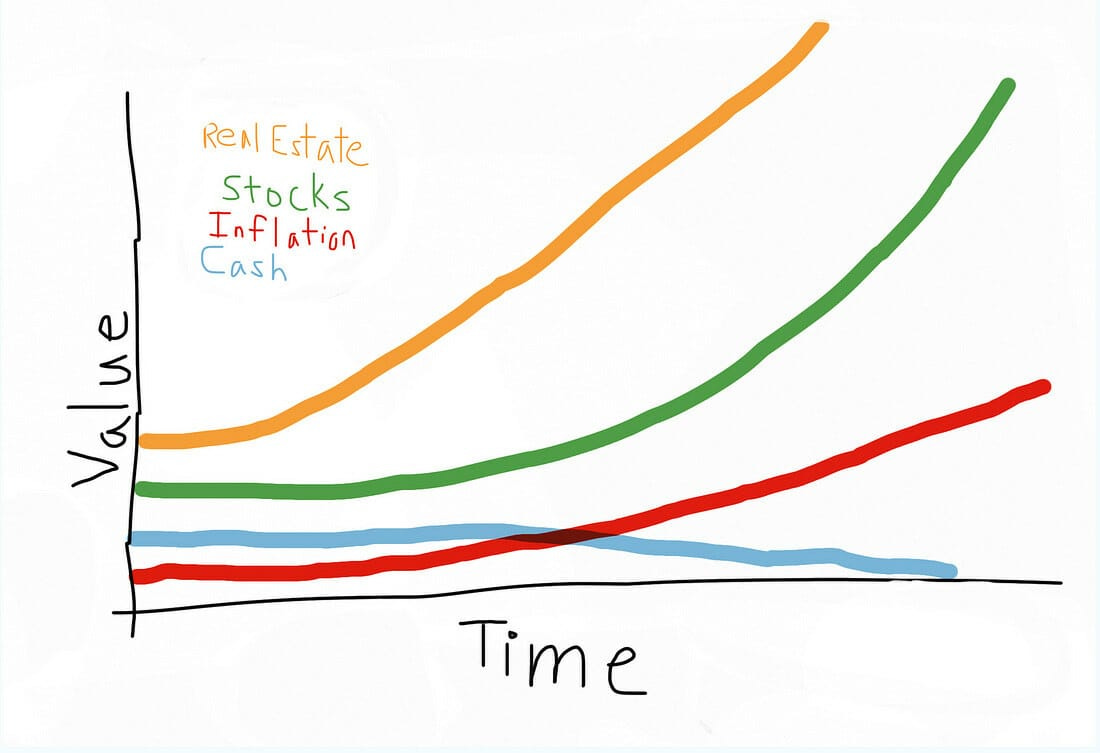

You aren’t just making less money, the value of the money that you do have is decreasing. Check out my crayon drawing of asset performance during inflationary periods:

That blue line is the “inflation tax”. If you can’t afford to invest, you’re fighting an uphill battle.

The Good: Your Debt Got Cheaper

Inflation does benefit one group: debtors.

High inflation makes the dollar worth less. That’s usually bad. However, high inflation also makes your debt worth less. That’s good. High inflation and low interest rates? You are paying next to nothing to borrow money, and the money you borrowed keeps declining in real value.

Imagine that you took out $100k in student loans, but inflation is 10% annually. Those loans decrease in value by 10% each year. Even with 3% interest, your debt gets cheaper and cheaper. More crayons for visualization:

If inflation held constant at 10% a year, a $100k loan today would be worth $47k in purchasing power in 2028. The “value” of your debt was effectively cut in half, though the total dollars owed didn’t change.

Now inflation is nowhere near 10%, and we have no idea how long this period of heightened inflation will last. That being said, hyperinflation is a boon for debtors.

The Bad: The Cost of Literally Everything

Gas is expensive. Electricity is expensive. Food is expensive. Every single thing that you normally purchase is more expensive than it was last year. If you’re not making enough additional money to offset these increased costs, you’ll see your cost of living quickly increase.

The Ugly: Your Savings Account

Here are the year over year increases of a view different items:

Inflation is up 6%.

US home prices are up 15%.

Commercial real estate is up 21%.

The S&P 500 is up 32%.

The NASDAQ is up 38%.

Cash is up 0%.

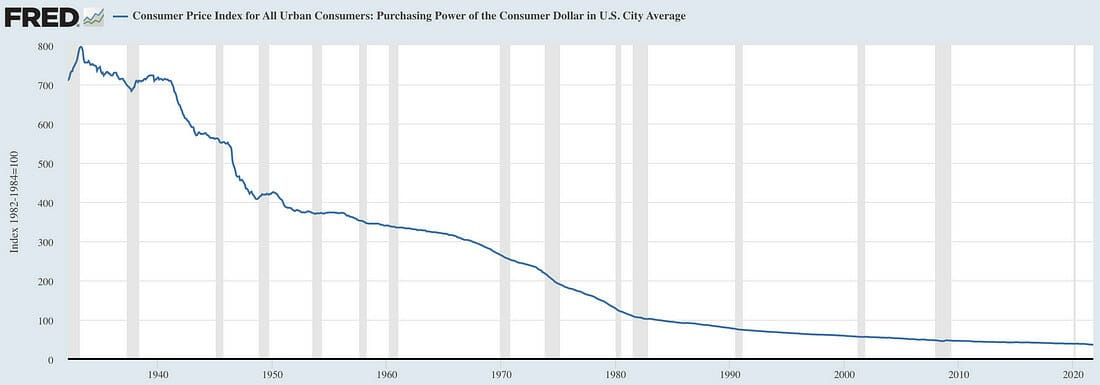

Every dollar left in your savings or checking account is losing value over time. This isn’t a new trend, the purchasing power of the US Dollar has trended down for years:

That being said, this trend is accelerating right now. At 6% year over year inflation, your cash is being devalued by 1% every 30 days. You are fighting a losing battle if you keep depositing your money in the bank and leaving it there.

So your cash and bank deposits are getting wrecked. What do you do?

What to Do About Inflation

Ask for a Raise

I’m dead serious.

If your salary was $60,000 last year, you need to make $63,600 this year for your income to match inflation. If you’re making the same salary as the year before, you’re effectively making $3600 less. That is three to four months’ rent, gone.

If your rent, electricity, food, and gas expenses increase by 6%, but the money that you take home stays the same, your real salary certainly didn’t stay the same.

If your company won’t bump your pay to match inflation, they are giving you a salary reduction. Sounds pretty messed up when you put it that way, but it’s true.

In an inflationary environment, you don’t become poorer by making less money. You become poorer because the money that you make does less.

Invest Your Money

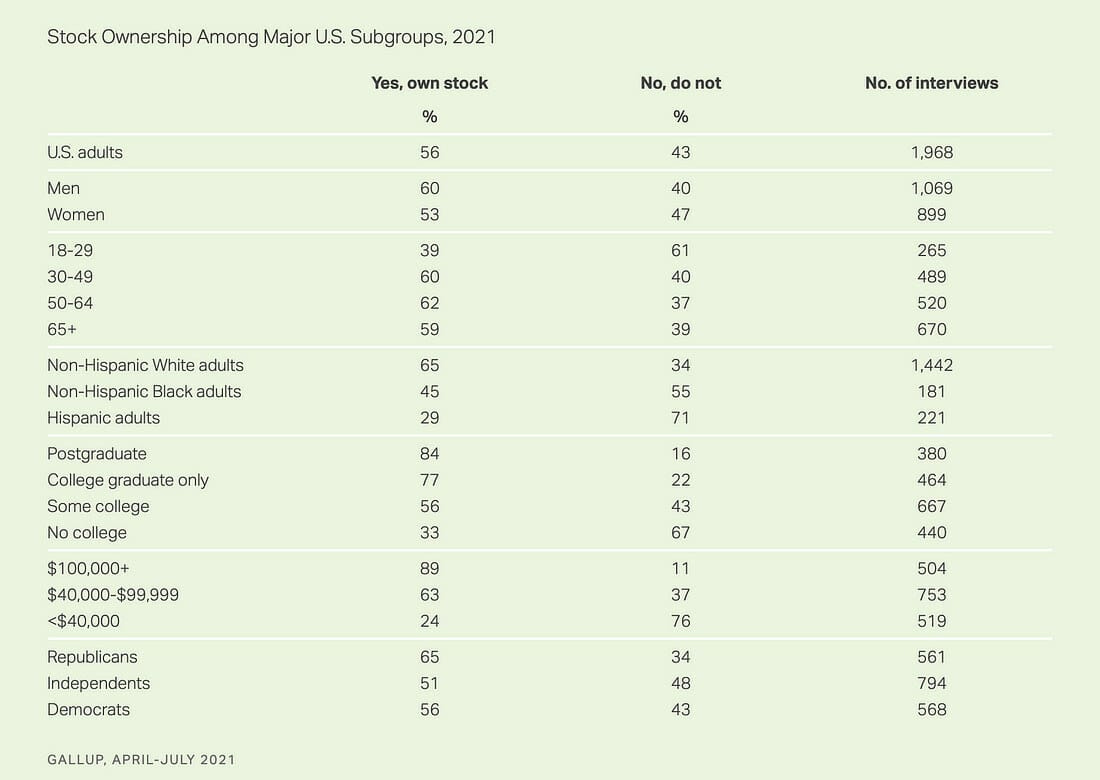

Most young people don’t own stocks or any other tangible assets.

Only 39% of 18 - 29 year olds and 24% of all workers earning less than $40k own stock. This makes sense, as these people have less disposal income to invest. However, inflation makes it harder and harder for the uninvested to get ahead, as their money keeps losing value.

Imagine that you make $50,000, and save 20%. You’re putting $10,000 in the bank.

Say we average ~4% inflation a year for the next 20 years, and interest rates remain near 0%. Your $10,000 will only have $4420 of current purchasing power in 2041. After 20 years, the value of your money has been cut in half.

You will never get ahead financially by storing your money in bank accounts, especially with interest rates this low. Recall that graph in the last section about the purchasing power of the dollar. Pretty dismal, right?

Now check the graph of the S&P 500 over that time:

Purchasing power might go down, but stocks only go up. Investing your money in assets that increase in value over time is the best hedge against inflation. Intuitively, it makes sense.

It doesn’t matter if your currency is dollars, crypto, painted rocks, or anything else. Companies that produce things have value. By investing in these companies, your money is tied to their value. No matter the currency, these stocks will retain value due to the underlying companies. Refer back to my original crayon creation:

When inflation is high, you want to be the yellow or green line. You definitely don’t want to be the blue line.

Is It Permanent?

No one knows, and be skeptical of anyone who claims otherwise. Inflation may have peaked yesterday. Or inflation may persist at 6% (or higher) for the foreseeable future. Maybe money printing caused inflation. Or maybe it was supply constraints.

I can’t tell you what is going to happen in the future, but I can tell you what will do well if inflation persists: real estate and stocks.

Wrapping Up

Inflation is bad for your cash, but good for your student loans. During inflationary periods like this, the biggest losers are the uninvested. I have no idea how long inflation will persist, but I do know that you need to invest your money somewhere, especially when the value of the dollar is dropping.

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!