House Money

Why our appetite for risk grows with our money.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

A Casino Story

I play poker. A lot. At a poker table, skill, luck, probability, adrenaline, and money collide to form the greatest game in the world.

Last Tuesday, I was in London with my friend Jake. Being the poker aficionados that we are, we decided to visit the Hippodrome Casino in Soho. And three hours later, my £120 buy-in had nearly tripled to £350.

The responsible (and right) decision would have been to cash out and leave the casino £230 richer. And I planned on doing that.

But on the way to the cashier, I walked past a few roulette tables. I thought to myself, “£350 is cool, but £700 would be really cool.”

So I threw £350 on red, because it felt good. As you can probably guess, the ball landed on black. Adios, £350. In hindsight (and in real time), this was a boneheaded decision. I spent three hours making £230 on the poker table, and I gave it all back to the house with one fatal spin.

What gives?

Enter: The House Money Effect

Per Investopedia: The house money effect is a theory used to explain the tendency of investors to take on greater risk when reinvesting profit earned through investing than they would when investing their savings or wages.

Poker isn’t exactly “investing”, but you get the point.

Had I “earned” the £350 by conventional means, I would have been far less likely to risk it all on the spin of a wheel. But I didn’t “earn” most of it. In my head, it felt like I was only risking my initial £120. The other £230 was house money.

The house money effect isn’t just a casino phenomenon. You see it everywhere from equity markets to sports betting. But the house money effect is running rampant in one sector more than most: crypto.

Young Money

There has been an unfathomable amount of money made in crypto over the last decade. But it's not the amount of money made that is most shocking. It is the velocity at which it occurred, and the age group that benefited most.

We are bombarded by new information 24/7, meaning that our attention spans and memories are shorter than ever. It’s hard to believe now, but Ethereum was trading at $116 as recently as March 2020. It has nearly 40x’d since then. 40x in a year and a half isn’t normal.

The people most likely to buy crypto during the 2020 crash? Young investors.

Maybe it was because they felt excluded from traditional markets. Or maybe it was because they felt the system had failed them. Or maybe they just wanted to make a quick buck. But young investors flocked to crypto in droves, and there are now thousands and thousands of 20-something year old crypto millionaires. That’s a hell of a dopamine rush.

Why do I bring up crypto specifically? Because of this fascinating Twitter thread that put me on to “The House Money Effect” in the first place.

This whole thread was a wild, enlightening read. But no one wants to click through a 12-tweet thread that was linked in an email newsletter. So I have turned this thread into a PDF, and brought it directly to you:

Never before have so many people so young made so much money so quickly. And it is addicting.

I’ve never traded crypto. Probably never will. I know, I know. “HAVE FUN STAYING POOR!” It just isn’t my game. But I am a 20-something. And I did (at one point) make a lot of money from a little money in a short amount of time. And I know exactly how that feels.

In-tox-i-cat-ing.

Communicating in online chatrooms where you and 100 internet strangers are exchanging 🚀 emojis as you all get rich. Watching the broader market wake up to an investment that you loaded weeks ago, and the masses bidding your position up 500%. Discovering the next play, and parlaying gain after gain.

You start to feel like a genius, because you must be if you are making so much money.

Poker. Crypto. SPACs. Three different games that are all played the same way. A high risk appetite and fortunate timing will get you paid.

But money made overnight doesn’t feel earned. It feels like a number on a screen. And you start chasing that rush, or as Fintechjunkie says, “chasing the dragon.”

Young people (myself included) are notoriously dumb. And right now, a lot of young people are incredibly rich. Being notoriously dumb (or at least, having notoriously high risk tolerance) is an important ingredient to getting rich quickly.

Being notoriously dumb (or at least, having notoriously high risk tolerance) is also the trait that makes it impossible to stay rich.

Getting Rich vs. Staying Rich

Four years ago, Morgan Housel wrote a fantastic piece on the the difference between getting rich and staying rich.

This entire essay is a gem, but my favorite quote is the following:

“I’ve noticed a pattern: Getting rich can be the biggest impediment to staying rich.

It goes like this. The more successful you are at something, the more convinced you become that you’re doing it right. The more convinced you are that you’re doing it right, the less open you are to change. The less open you are to change, the more likely you are to tripping in a world that changes all the time.

There are a million ways to get rich. But there’s only one way to stay rich: Humility, often to the point of paranoia. The irony is that few things squash humility like getting rich in the first place.”

You see it all the time on Twitter. The crypto gurus who were early to Bitcoin and Ethereum. The growth investors who made a killing on high beta stocks in 2020. Your buddy who built a six figure Robinhood account in a few months.

They all think they’re geniuses.

How do I know? Because I was the biggest gEnIuS of all. I turned $6k into $400k trading SPACs. Why the hell would I listen to my dad and take some chips off the table? I was up more than 5000%. Another mere 150% gain and I would be a millionaire.

If I sound ignorant, arrogant, or foolish, it’s because I was.

And every other 20 something who made a lot of money in a short time is likely ignorant, arrogant, and foolish as well. Because you can’t make that kind of money that quickly without some arrogance.

The problem is that the arrogant fools think they are genius investors. And when you think you are a genius investor. When you think you are invincible. When you think you have the market at your fingertips.

Well, the market has a funny way of humbling you. And that humbling often looks like a guaranteed win.

The Most Dangerous Hand in Poker

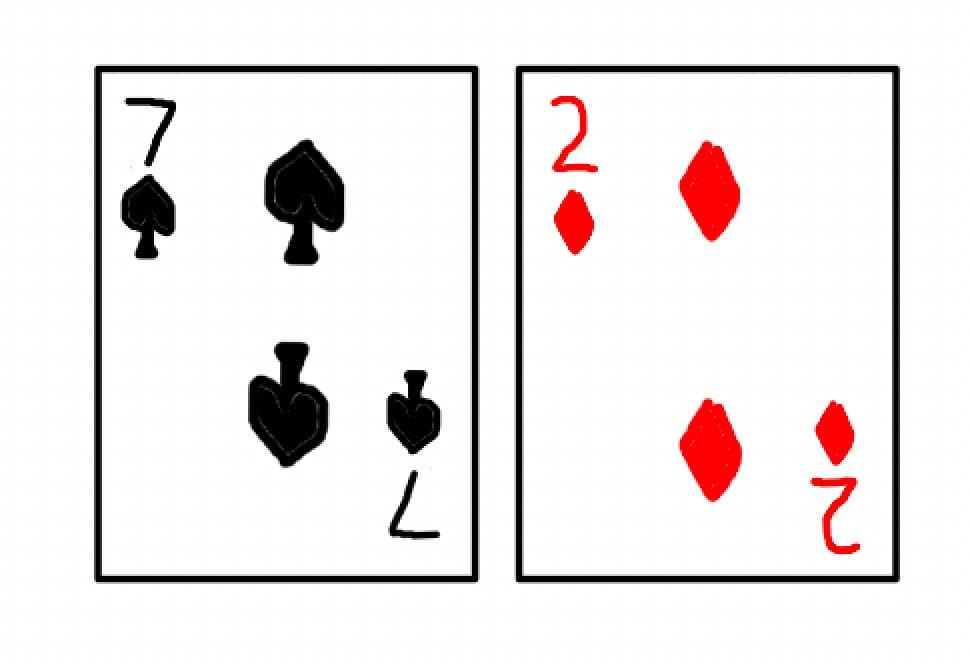

What is the worst hand in poker? 2 - 7 off suit.

These are the lowest two cards that cannot make a straight (there are five cards between 2 and 7). Even if they are suited, they will make a very low flush, and if either makes pairs, it is still a low hand.

But the worst hand isn’t the most dangerous hand. Even novice players know their odds suck with a 2-7, and they can play accordingly. The most dangerous hand has to be a really good hand.

Imagine that instead of a 2-7, you start off with a Jack and Ace of spades. Unknown to you, your opponent starts with a pair of twos.

Pre-flop, with no other information, the odds are basically 50-50.

The flop goes King of spades, 10 of spades, 10 of clubs. One away from a flush, one away from a straight, and you have an Ace high. You now have a 65% chance of winning. Your opponent raises, and you call.

Then the Queen of diamonds comes out on the turn.

Straight ✅

You raise, your opponent calls. You have 90.91% chance of winning the hand going into the river.

And the 2 of spades comes out on the river.

Flush ✅

At this point you know you have a lock. The straight put you in a good position, but the 2 of spades gave you a flush. Ace high flush, specifically.

So you go all in.

But the 2 of spades that gave you the flush? The one that “secured” your victory?

It gave your opponent a full house. So he calls your all-in. Because a full house beats a flush.

Out of 1326 possible hole card combinations, there are only four that could have beaten you: pair of Kings, pair of 10s, pair of Queens, or pair of 2s. But your opponent had a pair of 2s.

The most dangerous hand in poker isn’t the 2-7 off suit. It’s the hand that wins 99% of the time, and you bet like it wins 100% of the time, on an instant that happens to be the 1% of the time.

It’s the Ace-high flush that got wrecked by pocket 2s.

The most dangerous hand in poker isn’t just a poker thing. It’s an everything thing.

It’s the crypto speculator who has never made a bad trade, but gets locked out of his wallet. The SPAC trader who get rug-pulled by unusual warrant terms that he missed in the prospectus. The investor whose “sure thing” position commits accounting fraud. It’s a lot of things.

The only way to avoid the most dangerous hand in poker is to stay wary of the pocket 2s. But the only way to get rich quickly is playing like the pocket 2s will never happen.

As Morgan said, “The more successful you are at something, the more convinced you become that you’re doing it right. The more convinced you are that you’re doing it right, the less open you are to change.”

So when you get rich by ignoring the 1% risk of financial ruin, you become more convinced that it will never happen. Which leads to that 1% eventually hitting. Often at the most inopportune times.

What We Do vs. What We Should Do

The ideal behavior for those who did get rich quick is to stop. You make a million trading some dog coins? Invest in real estate. Buy ETFs. Put that money somewhere. Anywhere. Where you won’t risk it going to zero. But we don’t do that, because we like doubling down on the strategy that made us rich in the first place.

It’s why we have people like “Slumdoge Millionaire” who made millions on a meme bet…

… and they never sell.

Because when you’re playing with house money, it doesn’t feel real. But it doesn’t matter how it feels. It is real. And once you blow your house money, the house rarely gives you a chance to make it back.

Happy Tuesday, let’s go trade some dog coins.

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!