The Golden Age of Grift

A throwback that was a bit too accurate.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

The Three Types of Investors

There are three investors in the market today:

Winners: Those who made a ridiculous amount of money in a short time

Losers: Those who lost a ridiculous amount of money in a short time

Outsiders: Those who neither made nor lost a significant sum of money, but they took notice of group 1

All three groups have incentives to trade aggressively:

Winners made a lot of money quickly, and they believe they will continue to make a lot of money. Losers lost a lot of money quickly, and they believe (or want to believe) they can make it back. Outsiders are jealous of Winners, and they want to make a lot of money too.

Winners made it look effortless. They bought a JPEG for $500 and sold it for $200k. They loaded Tesla call options when the market tanked. They bought a dog coin named after a dog coin, and it flew to the moon.

The Winners themselves are split into two groups: the gamers who know they are playing a speculative game, and the true believers in these assets. The gamers will likely retain their gains. The true believers are Losers who haven’t lost yet.

Outsiders don’t even acknowledge Losers, even though the Losers outnumber the Winners 10:1. Outsiders think that the Winners made money effortlessly (because some did), so they want to do the same.

Losers tried to do what winners did, but they bought the wrong stuff. Every Loser was previously an Outsider. They think they’ll buy the right stuff next time.

So now the Losers and the Outsiders are jealous that the Winners made money so easily. Jealously + the promise of instant wealth are a dangerous combination. An open flame next to a gas canister of FOMO (more on this later).

A few of the Winners made fortunes in almost no time. And those 1% of success stories convince the 99% of Losers and Outsiders that they can be an overnight success story too.

The best thing about 2021? All three groups can trade whenever they want, from wherever they want.

Instant Access

You can trade stocks all day on your phone. Then the markets close, and you can trade crypto. Then you log on Twitter dot com, and your timeline is full of NFTs, predictions that the market will crash, and thoughts on the latest EV manufacturer IPO.

Speculation has always been part of human nature, but financial speculation has never been so accessible. In today’s markets, trillions of dollars in liquidity can move around at any point of any day.

Markets used to be open 9:30 AM to 4:00 PM, Monday to Friday. Now you can trade 24/7. And even if you do step away from the markets themselves, you can’t avoid the commentary. Thanks to Twitter, Reddit, and Discord, the divide between entertainment and investment no longer exists. Buying certain stocks puts you in the same circle as a group of investors on Twitter. A massive loss gives you 20,000 karma on Wallstreetbets. 10,000 member chatrooms discuss the latest SPAC merger. Owning different NFTs lets you join exclusive online communities.

Investing is now a social game, and you can’t escape it.

The FOMO Catalyst

So you log on Twitter Dot Com, and you see that someone make $250k because they bought Dogecoin. Then you check Reddit, and the top post is some guy wearing a headband that turned $50k into $30 million with a massive bet on GameStop. You start thinking, “Shit, I could have done that. Why didn’t I buy GameStop when it was $5 a share? Why didn’t I load up on Tesla/Penn/any other company when the market tanked last year? Why didn’t I do XYZ? I’m not missing the next one.”

Because if some random clown on the internet made life-changing money, why can’t you?

Just like that, FOMO is in the driver’s seat.

Investing —> Cheerleading

You’re not interested in buying stocks to hold for 10 years. Who cares about 10 years? 10 weeks is an eternity in today’s market. You want to make your money, parlay those winnings into another investment, and keep compounding until you’re an “overnight” millionaire. So you read about this EV charging station manufacturer, ChargePoint, going public through a SPAC. And the price has barely moved. It was $10.20 before any news came out. It’s still only $11.40 now. You can’t believe it isn’t higher in today’s market, so you buy $50,000 worth of shares at $11.40.

You check $SBE (the SPAC that took ChargePoint public) on Twitter, and see other investors are already tweeting about it. So you do the same. After all, everyone needs to know about this industry-leading charging company. The pick & shovel to the EV gold rush.

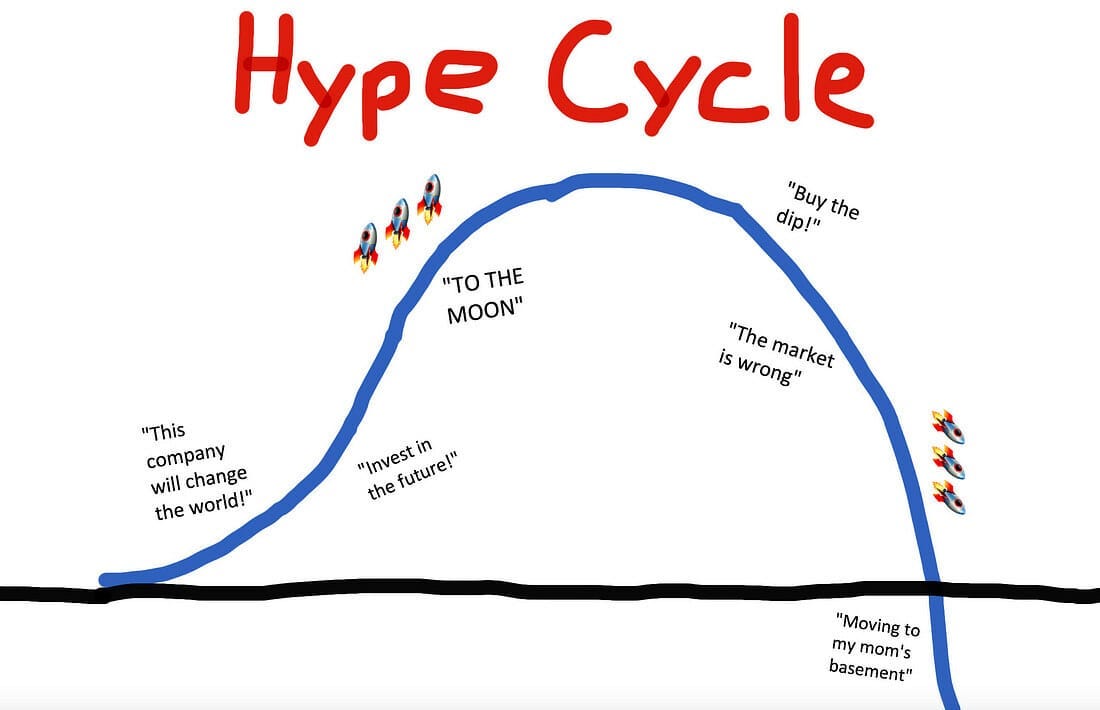

It takes a month, but ChargePoint starts climbing. It hits $20. $25. $30. All of a sudden you see posts about ChargePoint exploding on Twitter and Reddit.

“🚀🚀🚀 ChargePoint to the MOONNN!” Sums up what everyone is feeling.

Investors are going nuts that their stock is up. Price going up proves that they were right! They made money because they made a great investment!

Except they didn’t. They didn’t see the company scale to several billion in revenue as EV expansion took over. They didn’t see the company’s profit margins expand as economies of scale grew. So why did the price jump? Did the present value of future cash flows increase by 200% in a month?

They saw the price jump by 200% because other short-term speculators, likely the Losers and Outsiders mentioned earlier, finally discovered this EV play, and they wanted to ride the EV train. But you were in early, and you made a ton of money. Obviously your profits had nothing to do with the company executing. It’s only been a month.

You were right for the wrong reasons. Hype sent your stock to the moon. But none of that matters, as long as you sell for a profit. So you sell. But don’t you dare advertise that you sold.

Everyone Is Just Pumping Their Bags

“Have fun staying poor,” says everyone still holding the thing that you just sold. This phrase has become the rally cry of crypto investors, the classic response when someone says that they are selling their stake. My question is why would anyone else care what you do with your money? It’s your money. Sure, if you have a friend making reckless financial decisions, it would be kind of you to offer helpful advice. But dumping your position in any asset does not impact anyone else’s life in any way. Unless it does.

Some assets prices are driven by earnings, revenue growth, location (real estate), etc. Many assets in today’s market are driven by two variables:

Hype

Promise

Hype

What’s the difference between a $1.2 million JPEG (CryptoPunks) and a worthless JPEG (a screenshot of this newsletter)? People think the CryptoPunk is worth something. What happens when interest dies out? Price crashes. Remember NBA TopShot? The first big NFT wave of the year?

What happened when that interest dropped?

Rug pull.

A lot of pricy assets in today’s market either have no intrinsic value, or experienced price increases that severely outpaced their value increases (an EV truck company with $0 in revenue was worth less than $7 billion two years ago. That same EV truck company with $0 in revenue is worth $150 billion now).

Crypto is an obvious culprit. Throw in 27 buzzwords about how your new project will change the world, pay a C-list celebrity to pump it online, then dump on retail. Put together a massive Twitter thread about how some niche of Web3 will decentralize everything, then tie it back to an NFT.

Does anyone know what anything is this screenshot means?

No.

Does it matter?

Also, no.

If you are balls deep in this “new paradigm”, you probably think some of these companies or technologies will change everything.

I think many of these assets are of solutions looking for problems.

What happens when these solutions don’t find problems to be solved? Investors lose interest, they sell, price drops, other investors panic, they sell, rug pull.

SPACs, crypto, penny stocks, NFTs, overpriced growth stocks, they’re all the same thing. Someone bought something early. Word spreads about that thing on the internet. Despite no change in the underlying asset, its price skyrockets as interest increases. Price is now fully dependent on this interest. People with a massive stake in these assets know that their net worth is tied to the hype behind their investment. No wonder “seller bullying” has become so popular online. Parabolic price increases are followed by parabolic decreases, and the parabola is fueled by hype. If interest dissipates, that parabola inverts.

Have fun staying poor indeed.

Promise

Here are some promises about the future.

Rivian is worth $150B, more than Volkswagen, despite having $0 revenue. But EVs are the future.

Bitcoin is a trillion-dollar decentralized currency and inflation hedge. The dollar is dead, Bitcoin is salvation.

NFTs will create exclusive internet communities.

What happens when the “what could be” gets slapped in the face by reality?

What happens when Ford and Volkswagen produce 20x the number of EVs as Rivian, while sporting smaller market caps?

What happens if the broader market realizes that the nature of healthy currencies means they can’t also be inflation hedges? (If you disagree here, think about it. If the currency itself kept going up, why would you buy anything? You would only hold that currency. Which means it wouldn’t be a currency, because people wouldn’t be exchanging it. You use currencies to 1) buy products that provide utility or 2) invest in assets that do go up. The currency can’t be the asset that goes up. So far Bitcoin has been more asset, less currency).

What happens when no one cares about your Twitter profile picture of an ape? or more importantly, who wants to join a community where the only common ground is the purchase of a JPEG?

Well, let’s see what happened to some other promise stories:

Peloton. Maybe connected fitness didn’t actually have a huge MOAT is a reopening world.

Zillow. Maybe it’s really hard to compete with the pricing power of local markets in residential real estate.

Nikola. Maybe you can’t just have a founder with a history of fraud copy Tesla’s namesake, outright lie about technological progress, and roll a truck down a hill.(though this dumpster fire is still worth like $5 billion, so idk.)

Good stories make prices go up. Great stories create generational wealth. Broken stories destroy fortunes.

Investments fueled by hype and promise are a real-time case study of Greater Fool Theory. The problem is, everyone thinks that everyone else is the fool.

What Regulation?

The SEC had an easy job 20+ years ago. Someone from Goldman Sachs traded on insider deal information? Busted. Someone funneled capital from a pension fund? prison.

Now?

Anonymous Twitter accounts front-run 100,000+ member chat rooms before calling out specific low-float stocks with some arbitrary price target.

Crypto boys can name a currency after a popular Netflix series, then rug pull buyers and disappear with millions.

NFT creators can pump their newest “project” as the beginnings of a valuable community, and flip their JPEGs for six figures a piece.

The cool thing about decentralization is that there’s no one to protect you from getting wrecked. How are regulators supposed to keep track of this Pandora’s Box of alternative investments? They can’t.

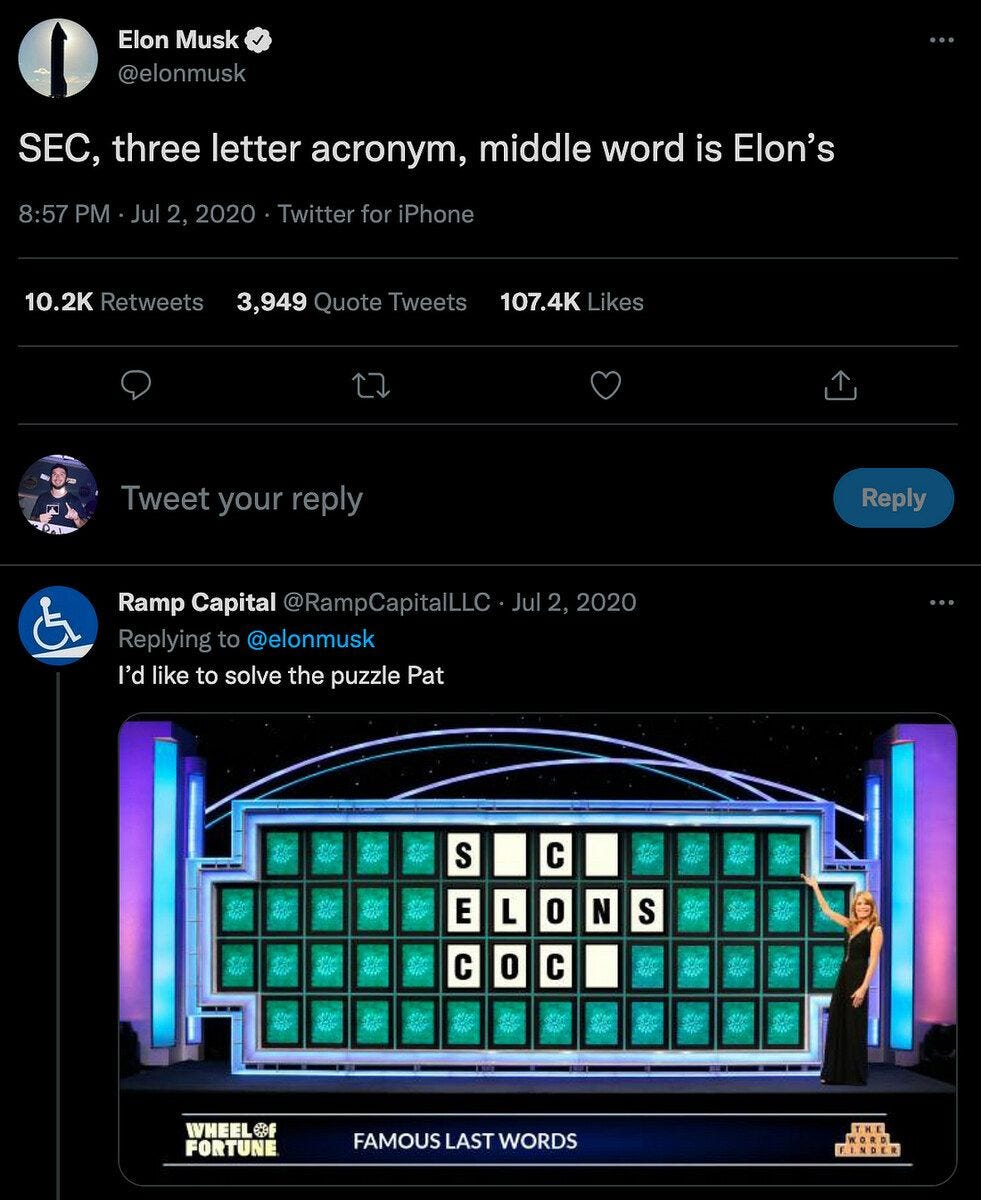

Boiler rooms became Discord servers. Ponzi schemes became decentralized projects. The CEO of the world’s biggest automaker taunts the SEC with a promiscuous acronym and faces no repercussions (though I love Musk’s Twitter so I hope nothing changes on that front).

Today’s markets are the wild, wild west, except the Sheriff is passed out drunk and the grifters robbed the armory.

Grift Gods

Now let’s tie this together.

Everyone has access to markets and market commentary 24/7. Investors and speculators flaunt their overnight wealth online, which sparks FOMO in everyone else. “If that guy made millions, why couldn’t I?” you think. The winners, losers, and outsiders of today’s markets all think they’re going to be the next success story, and they’re all looking for the next get rich quick flip.

The boundary between investment and entertainment has disappeared as markets spilled over to Twitter and Reddit. Losses generate online karma. Owning certain assets puts you in good standing with others on the internet. Everyone is pumping their bags online, and admonishing those who sell.

And then one asset catches the attention of the masses. And then they tell their friends. And then you see it on CNBC. And it’s trending on Twitter. And the story sounds so good, who cares if it’s true. Because if enough people just believe, they’ll buy it. And if enough people buy it, the price will go up. And if you buy early enough and sell at the right time, you can make millions.

Those who can spin compelling narratives. Those who can incite FOMO. Those who can buy the influence of influencers. They are going to make a ton of money. Sure, someone else has to lose a ton of money for them to profit, but who cares? It’s not like they’re going to get caught.

We are in the middle of a trillion dollar game of musical chairs. Except some people think their chair can’t disappear, other people sit in a chair before the music actually stops, and a few players just pick up a chair and leave the room altogether. The only losers are the people actually following the rules.

When all of the players think that that everyone else is the sucker, half of them will be wrong. But you don’t read about the suckers. You read about the winners. And you think you’re going to be the next one.

Welcome to the Golden Age of Grift. Let’s go pump some dog coins.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

In the wake of FTX collapsing, some of Sequoia's notes (such as FTX's CEO playing League of Legends while pitching them for 100s of millions) before they last invested in the crypto exchange are pretty wild. Check 'em out here.

Matt Levine's column on the FTX death spiral is fantastic, check it out here.