When "Community" Is Shaped Like a Pyramid

A market full of solutions looking for problems. Grift or be grifted.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Over the last decade, cellular technology has evolved from 3g, to 4g, to 5g. The iPhone has upgraded from the 5, to 8, and now 13. Well the internet is undergoing a numerical shift of its own. First came web1. Then web2. And now?

Web3.

This is a shift away from centralized, corporation-owned platforms such as Twitter, Facebook, and YouTube, to a decentralized, community-owned… well, everything.

Guess what? Web3 is bullshit. A rebranding of crypto that emphasizes decentralization while remaining quite centralized. A system that incentivizes selling stories, not creating utility. A solution to problems that don’t exist. A dystopian future for finance, unless you prefer a world where everything becomes a speculative asset.

I woke up and chose violence today. Let’s dive in.

WTF is “Web3”?

I guess I should answer this question before going any further. This quote from a Wired interview with Ethereum cofounder Gavin Wood sums it up well:

“To believers, Web3 represents the next phase of the internet and, perhaps, of organizing society. Web 1.0, the story goes, was the era of decentralized, open protocols, in which most online activity involved navigating to individual static webpages. Web 2.0, which we’re living through now, is the era of centralization, in which a huge share of communication and commerce takes place on closed platforms owned by a handful of super-powerful corporations—think Google, Facebook, Amazon—subject to the nominal control of centralized government regulators. Web3 is supposed to break the world free of that monopolistic control.

At the most basic level, Web3 refers to a decentralized online ecosystem based on the blockchain. Platforms and apps built on Web3 won’t be owned by a central gatekeeper, but rather by users, who will earn their ownership stake by helping to develop and maintain those services.”

Tl;dr: in Web2, big companies (Google, Facebook, Amazon) control the methods of communication and commerce. In Web3, the users control the methods of communication and commerce.

The people are taking back control of the products. An admirable goal. And one that no one asked for.

Solutions Looking for Problems

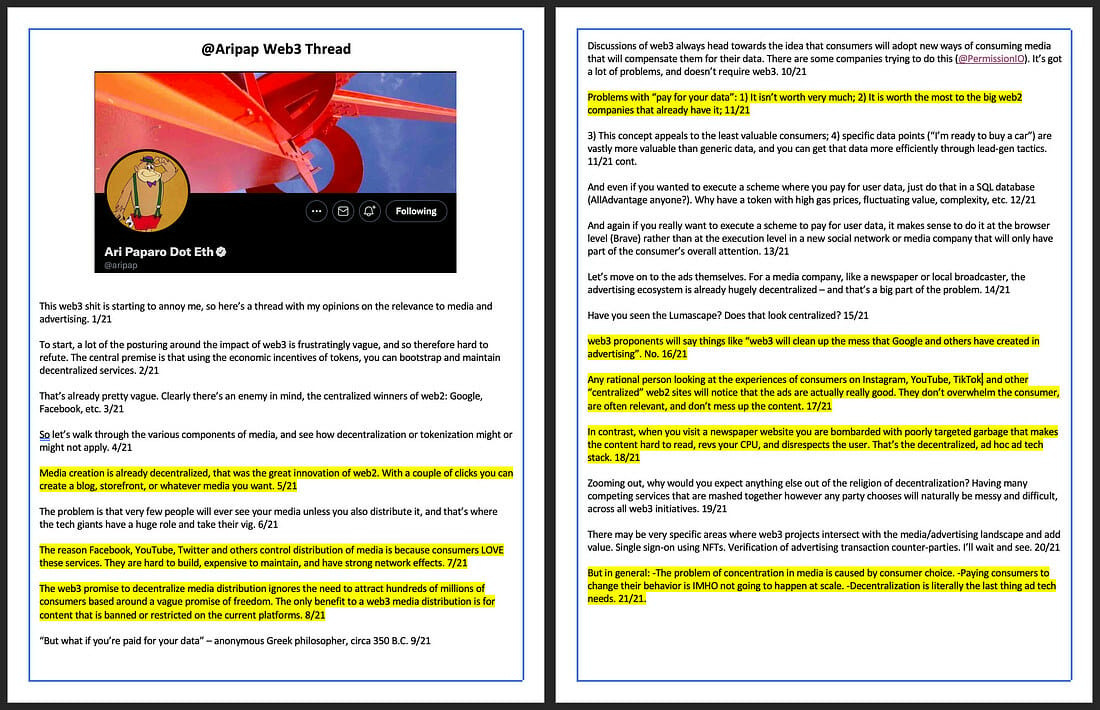

The biggest two issues with Web3 are 1) no one asked for any of these “solutions”, and 2) half of the problems that are “solved” don’t actually exist. Last week, I found a Twitter thread by @Aripap that covers this issue far better than I could.

A few key quotes:

“Media creation is already decentralized, that was the great innovation of web2. With a couple of clicks you can create a blog, storefront, or whatever media you want.”

“Any rational person looking at the experiences of consumers on Instagram, YouTube, TikTok, and other ‘centralized’ web2 sites will notice that the ads are actually really good… In contrast, when you visit a newspaper website you are bombarded with poorly targeted garbage… That’s decentralized, ad hoc ad tech stock.”

The key to any movement is a good story. And good stories need great villains. And the big tech overlords of web2 make great villains. But how many people have built their own businesses on Shopify? Started their own newsletters on Substack? Self-published on Amazon? Built audiences on social media platforms?

What’s the downside? You don’t “own” your business?

Okay. What’s the alternative?

Sure, you can go full decentralization. You can build your business and produce your content on-chain as they say. But will you have an audience? Are millions (billions?) of consumers going to download crypto wallets, deal with buggy user interfaces, and choose you over the limitless options that exist on platforms that they already use?

Thanks to 15 second Youtube ads and small 1200 x 900 banners on articles, we can watch and read literally anything for free. And creators get paid for including those ads. And companies make money from people buying products in the ads.

A win-win-win.

Consumers prefer platforms with great UX design and large network effects, and creators prefer platforms that have large audiences.

We all live in our own echo chambers, and this is amplified by our curated social media experiences. But I can assure you that most people couldn’t care less about decentralization.

“Play-to-Earn”

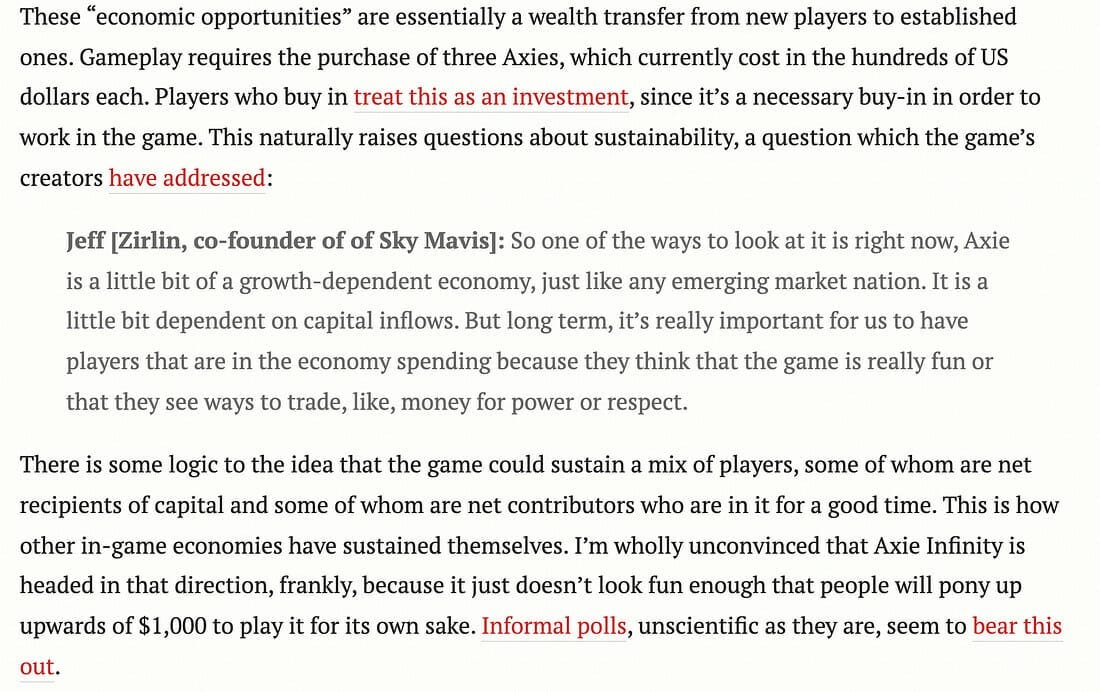

One of the alleged benefits of this web3 transition is the rise of “Play-to-Earn” video games, i.e. you can make money from your virtual efforts. And one game stands out above all else: Axie Infinity.

Axie Infinity is a Pokémon-like game where players can battle and breed different monsters, or axies. When players win battles, they receive an in-game currency called “Special Love Potion” (SLP). This currency is needed to breed axies, and both SLP and axies can be sold for real money on secondary markets.

Why is Axie cited as a success for web3? Because many users earn good money by playing this game. It looks good on the surface, but everything is not what it seems.

Paul Butler wrote a fantastic article on the realities of Axie Infinity. Here is an excerpt:

Players earn money by selling axies or SLP.

But if you want to play to earn, you first have to pay to play.

Newcomers must buy three axies, which cost $200 a piece. $600 is a hefty price tag to enter the game. But what if you can’t afford the upfront costs? It’s your lucky day! You can earn a scholarship. Users (known as managers) with a ton of axies and minimal free time can loan you their axies for free. The catch? The managers take a huge cut of any revenue that you generate.

This “game” quickly becomes a redundant grind of repetitive tasks as “players” try to generate income. Would anyone even play if financial incentives weren’t there? Doubtful.

And about those financial incentives. The sellers of these axies are making money. And maybe the new entrants will make money too, assuming they themselves become net sellers down the road. But for them to be sellers, they need new buyers.

The only “new money” created in Axie Infinity comes from new entrants. Its business model is reliant on user growth. Everything else is just exchanging hands back and forth with no new value created. As you zoom out, “Play-to-Earn” certainly resembles Ponzi-nomics, doesn’t it?

"But I own my axies. They are NFTs.”

Sure, you own them. But how valuable will they be if the creators change rules and skills? How valuable will your axie be if its blocked from Axie Infinity? Sure, you own it. But that doesn’t mean they will retain value.

Speculating on Anything

Speculation is human nature. Zero-commission trading and social media has turned investing into a trillion dollar game of blackjack for many. Sweeping legislative changes have turned sports gambling into a multibillion dollar industry in the US. Hell, rock paper scissors is a game of chance, and we’ve been playing it since we were children.

But just because we can speculate on something doesn’t mean that we should. Yet the end game of web3 is the speculation of everything.

Why?

Because decentralization —> community-owned. How does the community own anything? By either tokenizing that thing.

And when that thing becomes a liquid tradable asset from day one, the holders of that thing will want the price to go up. Because that’s how they make money. Maybe the creator of that thing doesn’t care about pumping the price from day 1, because the creator wants to build a brand. To create value.

But the other buyers? The “investors” who purchased tokens in that thing? They want to get paid.

You might think I’m being cynical. I would say I’m taking reality as I see it. What is the common theme of all NFT news on Twitter?

Price. "Bored Ape sells for $430,000!” “Cryptopunk goes for $1.2 million!” “$GAS / $SOS / any other crypto is up 400% in the last week!”

Speculation.

And anything can become a vector for speculation. Take ConstitutionDAO. The organization raised over $40 million to buy the US Constitution at an auction, but it was outbid by Ken Griffin.

To raise that money, ConstitutionDAO issued $PEOPLE token. After the auction, investors were able to redeem their $PEOPLE for cash. And most did.

But some didn’t. And the remaining $PEOPLE were tradable on the secondary market. And what happens when you have a low float asset with a lot of hype?

Moon.

So this token that was created to crowdfund the purchase of a historic US document was pumped to a several hundred million dollar market cap after losing the auction.

Speculation.

When you tokenize everything, you are inviting widespread speculation on everything. Is that really a world that we want?

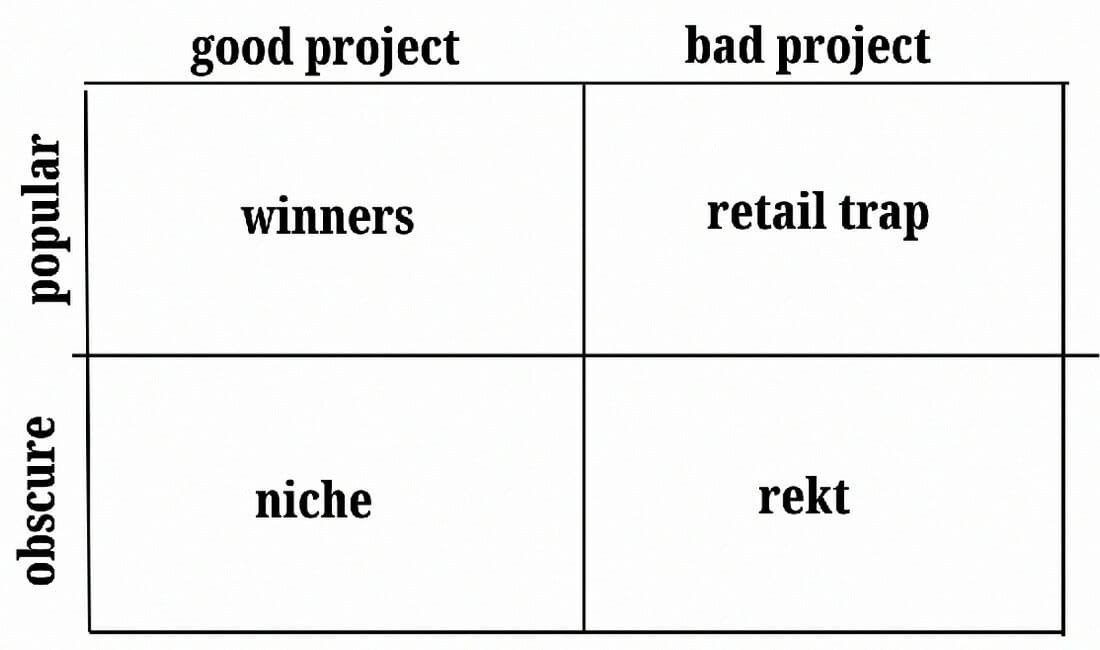

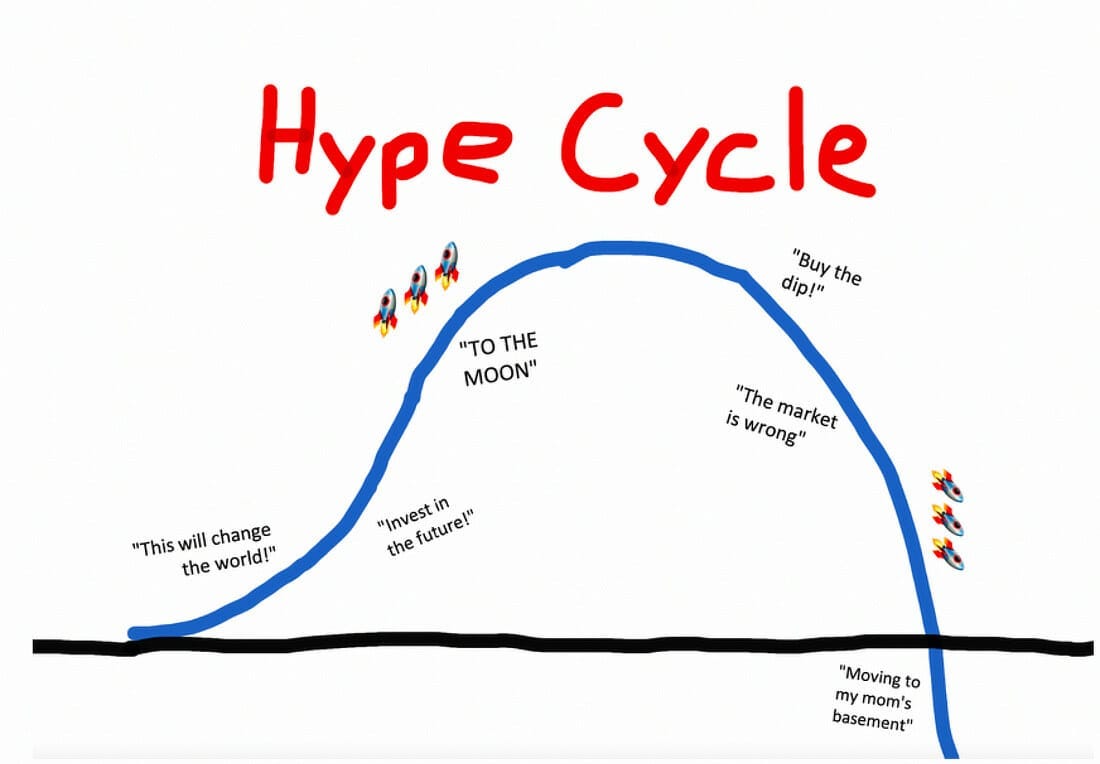

Hype Is King

“The only thing truly scarce is attention.” - Cobie

Cobie is a crypto-OG with a knack for thinking in probabilities and game theory. His content is awesome because he both understands what is going on, and what is going on behind the things that are going on. He wrote a banger of a piece last week about the attention economy.

I wanted to highlight some quotes from his article:

In web3, the fight for attention is so large that 9-figure incentive programs are the new normal, and 5-figure airdrops to users are not uncommon. Crypto YouTube influencers are commanding 5 to 6 figure advertising costs per video. Attention is scarce and it is in high demand.

In the last post, I wrote about bull-run crypto markets being more similar to a video game than to investing. If crypto is a massive multiplayer game where the score is kept in dollars, then attention dictates a lot of that shorter-term metagame…

Attention is the only factor impacting the supply & demand variables that change on the same cadence as the players, because it is directed and controlled by the players.

During thrill stages of a bull market, good players are not trying to buy the “best” assets. Instead, they are trying to buy the assets that are about to cross an attention chasm, or realize their valuation potential.

As projects increase in popularity and awareness, they become favored amongst traders. This period of “becoming favored” is where valuations experience the most change.

Once an asset has entered the consciousness of many players, it is easier to get all players to think about this asset again, but achieving sustained attention without a product and without users is much harder.

I really liked the quote, “In the last post, I wrote about bull-run crypto markets being more similar to a video game than to investing.”

Most of these market participants are gamers, and the game is scored in $$$. Crypto is volatile, it moves quickly, and trillions of dollars are floating around in this ecosystem.

Imagine walking in the Bellagio, but the chandeliers are replaced with strobe lights, gamblers receive complementary 4Lokos, new games appear every hour, and every television has a scoreboard tracking who is making the most money on what games.

That’s the crypto market.

Because most of these “assets” have little to no utility (at least for now), attention is king. And what happens when your zero-utility asset hits hype saturation?

Morgan Housel uses the phrase “Best Story Wins” to explain the power of storytelling.

My take? If “best story wins” is a universal truth, then the fastest readers will get rich in crypto. Because the story is changing every single day.

Incentives Matter

Charlie Munger once said, “Show me the incentives, and I’ll show you the outcome.”

Let me show you some incentives.

Building companies takes a long freaking time. And the end goal for all founders is one of two things: Acquisition or IPO. That’s where the money is made.

Shares in private companies remain illiquid for years. If you want to reach the end goal of acquisition or IPO, you have to deliver value to customers for years. A good story might help you raise a Series A, but execution is paramount to cross the finish line (though SPACs are trying their best to help “stories” go public with no execution).

Thankfully, web3 changed everything. By tokenizing your project, you have liquidity from day one.

Building a sustainable business is difficult and time consuming. It’s also no longer necessary if you want to make money. Let me show you a better alternative:

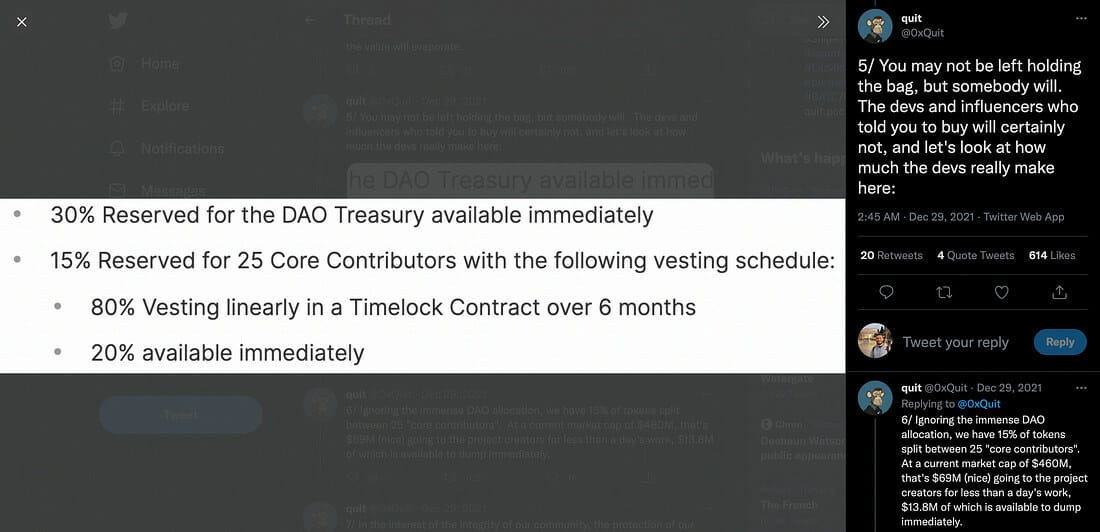

First, build a website that looks like it was pulled out of 1992. Add some buzzwords like web3, NFT, and Defi. Then make sure founders control a large percentage of the token supply, and have no lock up clause on part of their stash. Finally, have a few influencers promote this as the next big thing, and cash out on the liquidity pump

And when your project stalls out a week later? Who cares. You got paid, fam. Web3 doesn’t incentivize building. It incentivizes the exploitation of hype and FOMO.

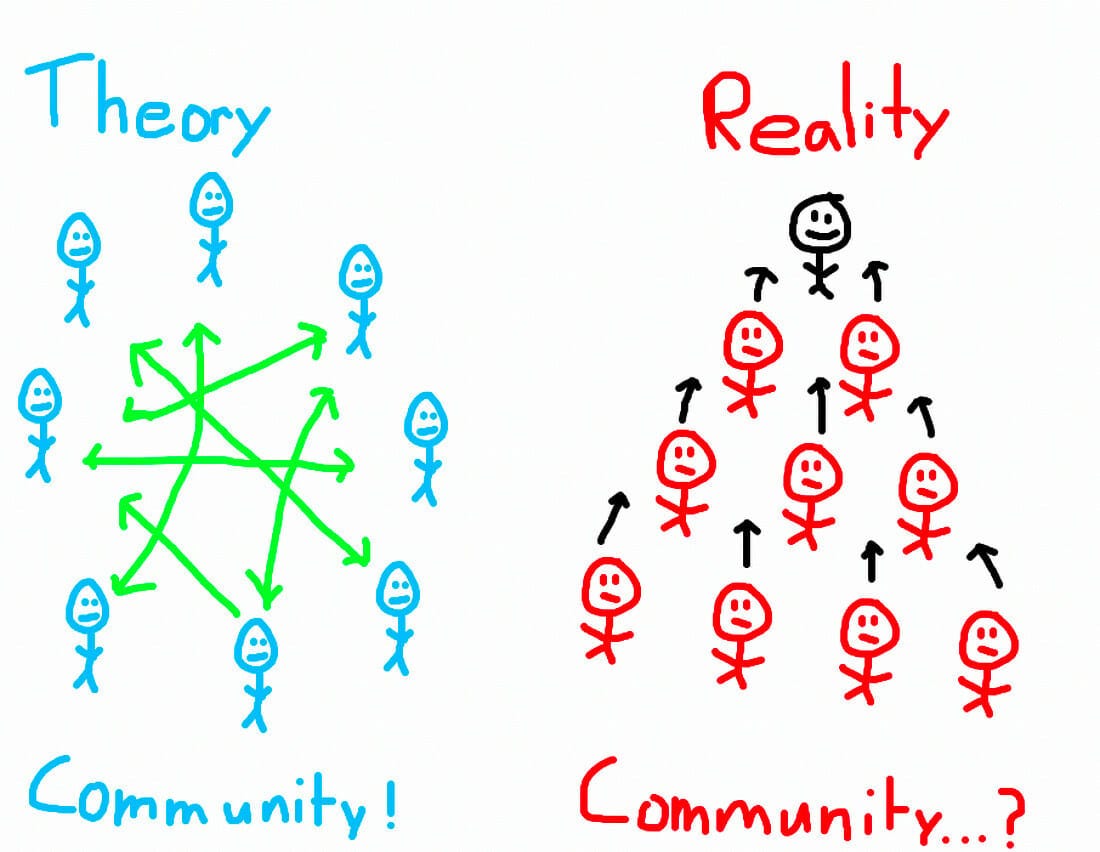

The Real Winners of Decentralization

There is this idea that decentralization will unlock value for creators and consumers of all shapes and sizes. But even web3 isn’t immune to power laws.

Winners and losers will always be subject to power laws. The top 1% of artists will capture 95% of profits. The top 1% of companies will create 95% of value. “Owning your work” doesn’t matter if you can’t build an audience. “Owning your data” doesn’t mean anyone will pay you for it. Web1, Web2, Web3, Web100. It doesn’t matter. Those who make the best stuff will capture the lion’s share of the rewards.

Decentralization won’t change that.

But decentralization does benefit certain promotors and investors.

If you have 50,000 Twitter followers and a crooked moral compass, then you can thrive in Web3. After all, no centralization and no regulation are synonymous. Take a payment to promote an alt-coin. Mention that a cryptocurrency (that you just so happen to be holding) is primed to moon soon. Then you just happen to sell when a wave of buyers push the price up.

When you show your followers just how much money they could have made by following your call, they will all rush to load the next one. Pretty lucrative cycle.

It’s no wonder venture capitalists have poured into this space as well. In traditional private markets, a VC may not realize returns for a decade.

But web3 offers a new solution: tokens.

VC firms can pre-mine tokens at discounted prices. They can help generate hype around these tokens. And they can sell their stakes whenever they want. No wonder every VC firm wants a web3 arm! Where else can you generate 10 year returns in 10 days? If the project doesn’t pan out? Who cares. You got paid, fam.

Decentralization might mean that “anyone can participate”, but I can promise you the gains will be quite centralized. The top percent of builders, the top percent of promotors, and the top percent of investors will make bank. The difference is their gain is your loss. And they don’t have to build anything useful to do it.

Last Remarks

But maybe I’m wrong.

Maybe some of these solutions will find problems.

Maybe Play-to-Earn will become a viable model.

Maybe speculation will eventually create value.

But I don’t think I’m wrong. You know why?

Ja Rule tweeted about it. How does Fyre F3stival sound? Check mate, nerds.

Let’s have a great 2022. - Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!