You Can't Cure Cancer with a Bandaid: The Student Debt Problem

My thoughts on this whole student debt thing.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Today, I'm writing about our student debt problem.

A bit of context before diving into this:

I am a 25 year-old business school student at Columbia University, and I have some student loans.

Many of my classmates have student loans.

Many of my former classmates from Mercer University have student loans.

So given that many of my peers and I have student loans, I believe this makes me qualified to write about student loans, right?

Cool. Okay, let's get into it.

A Ticking Time Bomb

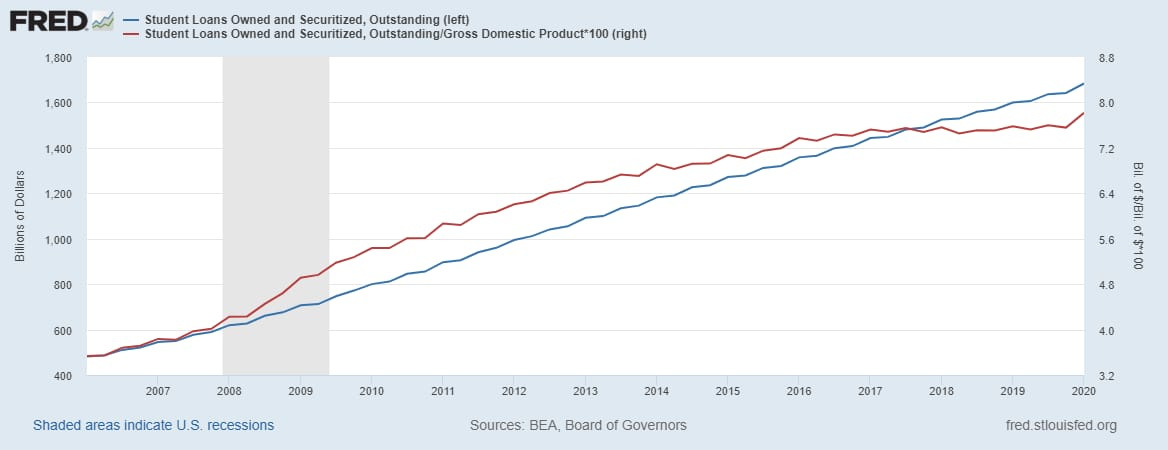

I have thought for a while now that student loans are the most likely asset (liability?) class to cause a 2008-like meltdown. I mean look at this chart:

We now have more than $1.75T in outstanding student loans as of August 2022. The entire value of US subprime mortgages was just $1.3T in March 2007. And the subprime mortgage collapse almost broke our entire financial system.

But instead of greedy bankers bundling shit-mortgages as securities and 22-year-old strippers buying 10 houses (2007 was pretty wild), we have decided to let millions of 18-year-old kids take out nearly $2T in debt to pay for school.

This certainly seems sustainable, right?

lol. lmao.

So how did we get here in the first place?

Perverse Incentives

Incentives drive everything.

What happens when you are given free money, and you suffer zero consequences if that money is never paid back? You abuse that free money, and you want more free money.

Now I bet you think I'm talking about the "entitled" students who had $10,000 of their loans forgiven.

Well guess what! You're wrong!

I'm talking about the colleges and universities around the United States. Nassim Taleb had a great tweet yesterday highlighting my point:

Allow me to demonstrate what Taleb is talking about:

Uncle Sam gives a loan to Jimmy, a college student. Jimmy then uses that loan to pay his tuition bill at Ball-So-Hard University. Jimmy has a great time at Ball-So-Hard U, and he graduates with a 3.4 GPA in finance. Jimmy then lands a job, and he spends the next few years paying off the loans to Uncle Sam. Notice who isn't involved in this payback cycle?

Ball-So-Hard University.

Government gives student loans. Student uses loans to pay for school. School gets paid upfront. After graduation, student owes government money. School is chillin'.

If you are a university, and the government is offering student loans to anyone, and the student will pay you that loan money upfront, and then it's on the government to collect those debts, your potential revenue just grew exponentially at no cost to you.

Sure, $10,000 in tuition is nice. But what if you charged $20,000? Or $40,000? Or $60,000? After all, the kids can take out bigger loans, and they will pay you upfront, and then they simply owe the government money for these loans for the rest of their lives.

From a financial standpoint, it would be heinous for universities to not charge as much as possible. It's a free check from the government by way of the student body, who cares what the students owe Uncle Sam after graduation? You got paid, fam.

And yes, as you could probably guess, universities and colleges have taken full advantage of the government's lax student loan policy.

The US's first major government loan program was the Student Loan Marketing Association, or Sallie Mae, formed in 1973.

Since 1977, when the first class eligible for Sallie Mae would have graduated, college tuition has experienced average inflation of 6.28% per year. The US's overall average inflation rate during that time? 3.54%.

The average tuition in 1977 was $2275. After increasing by ~6.28% per year for 45 years, the average tuition is more than $35,000. Of course, if tuition had matched broader US inflation trends, it would be closer to $10,000 per year.

It's almost as if, for some reason, schools artificially inflated their costs in response to more money coming in from student loans?

Crazy, I know.

And don't worry, I'm not the only person thinking this. In 2015, the Federal Reserve Bank of New York (which has a lot of people much smarter than me!) published a report that found that institutions more exposed to student loan program maximums tended to respond with disproportionate tuition increases.

The government will write a blank check to schools (via student tuition), and the schools face zero consequences if the kids struggle to pay back their loans?

Consider me shocked, and I mean shocked, that schools have increased tuition so much.

So What about this Loan Forgiveness?

To ease this student loan burden, we have just ctrl+alt+deleted between $10k and $20k in student debt for millions of students, to the grand tune of a $330B hit to the federal government (or $2,000 per taxpayer).

Is this fair? I don't know. Who am I to say what is and isn't fair? I mean sure, if I had just paid off my student loans I would probably be annoyed. If I never went to school and my tax money was (in theory) going to pay off someone else's loans, I would probably be annoyed (though honestly, this is probably a better use of taxpayer money than most of the cash incinerating programs that come out of DC).

And yes, while the image of the college graduate suffocating in predatory student loan debt tugs at all of our heartstrings, the reality is that *most* college graduates are still better off over the course of their lives, even with the debt. The reason is simple: college graduates tend to make a lot more money.

There is a quote widely misattributed to Joseph Stalin that says, "One death is a tragedy. One million deaths is a statistic."

One student struggling to pay off debt is a tragedy, but one million who have net positive outcomes despite their loans are simply a statistic. The reality is that this relief helps a group (college graduates, and especially grad school graduates) who, as a whole, need the help the least.

However, neither of these examples is why I think this student loan forgiveness is bad. In fact, despite the reservations that I just mentioned, I am all for lowering the debt burden of students, because student debt is a predatory industry that shackles way too many young people each year.

This "solution" is bad because it exasperates the problem. We just tried to cure cancer with a bandaid.

This debt forgiveness will have two outsized side effects:

Universities will once again bump up their prices to pass through some additional costs in response to the "loan forgiveness"

Students will take out more loans either A) in response to even higher tuition costs or B) because they feel the likelihood of future loan forgiveness is high

So the short-term impact of loan forgiveness helps those currently in debt: they now owe $10,000 less.

But the long-term impact? In all likelihood, colleges will raise tuition prices even more (why not? They've done it for 40 years), and future students will take on even more debt to attend these even more expensive schools. But this time, both students and universities will quietly assume, at least to some degree, if the situation grows dire enough, the government will simply forgive some more student debt.

The end result of one-off student loan forgiveness is simply more debt and even higher tuition costs for future students.

We put a bandaid on a tumor and acted like we cured cancer.

So what's the solution?

I don't know. That's why I'm not the President, I'm not in Congress, and I don't have plans to run for Secretary of Education.

I do think we have to align incentives to bring costs down. Schools need to bear some of the responsibility for debts unpaid by their graduates. I can assure you, if Harvard ran the risk of owing billions if its graduates failed to repay their debts, tuition would drop quickly. The same can be said for any school.

If kids weren't guaranteed such large amounts of money from the government, tuition would drop to make school affordable. If schools were partially liable for unpaid student loans, tuition would drop to lower the potential risk to the universities. If schools continue to receive blank checks from the government in the form of student loans, those checks will just grow larger and larger.

Maybe one day, our elective officials will realize that this process isn't sustainable, but it's not happening anytime soon. In the meantime, who has the best idea for how I should blow this hypothetical $10k?

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!