A Bit about Me

This literally has nothing to do with finance, but a lot to do with why I write about finance.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

What Is This?

This has nothing to do with finances, or career stuff, or really anything that I normally write about. It’s just about me. So I guess this is the most narcissistic article that I’ve ever written.

Why write about “me”? Well I started this Substack back in the summer with a couple of hundred friends/family/acquaintances following along. But now I have almost 2,000 subscribers, which means the majority of people reading what I write have no idea who I am.

If you have a better understanding of who I am and where I come from, you will probably have a better understanding of what my writing is and where it comes from as well. Enjoy the world’s most abbreviated biography.

School, Career, All That Good Stuff

I graduated from Mercer University in December 2019. I fit just about every stereotype imaginable for a white dude in college: finance (and Spanish) major, football player, fraternity president. Textbook description of a college kid named “Jack” from the state of Georgia.

As a finance major with good grades and decent work ethic, I applied to every finance job in Atlanta, GA. And I got a great job with UPS in Atlanta. I started working in March 2020, right around the time a certain pandemic shut the world down. After a year and a half of working remote, I received an email that we would be returning to the office in September 2021.

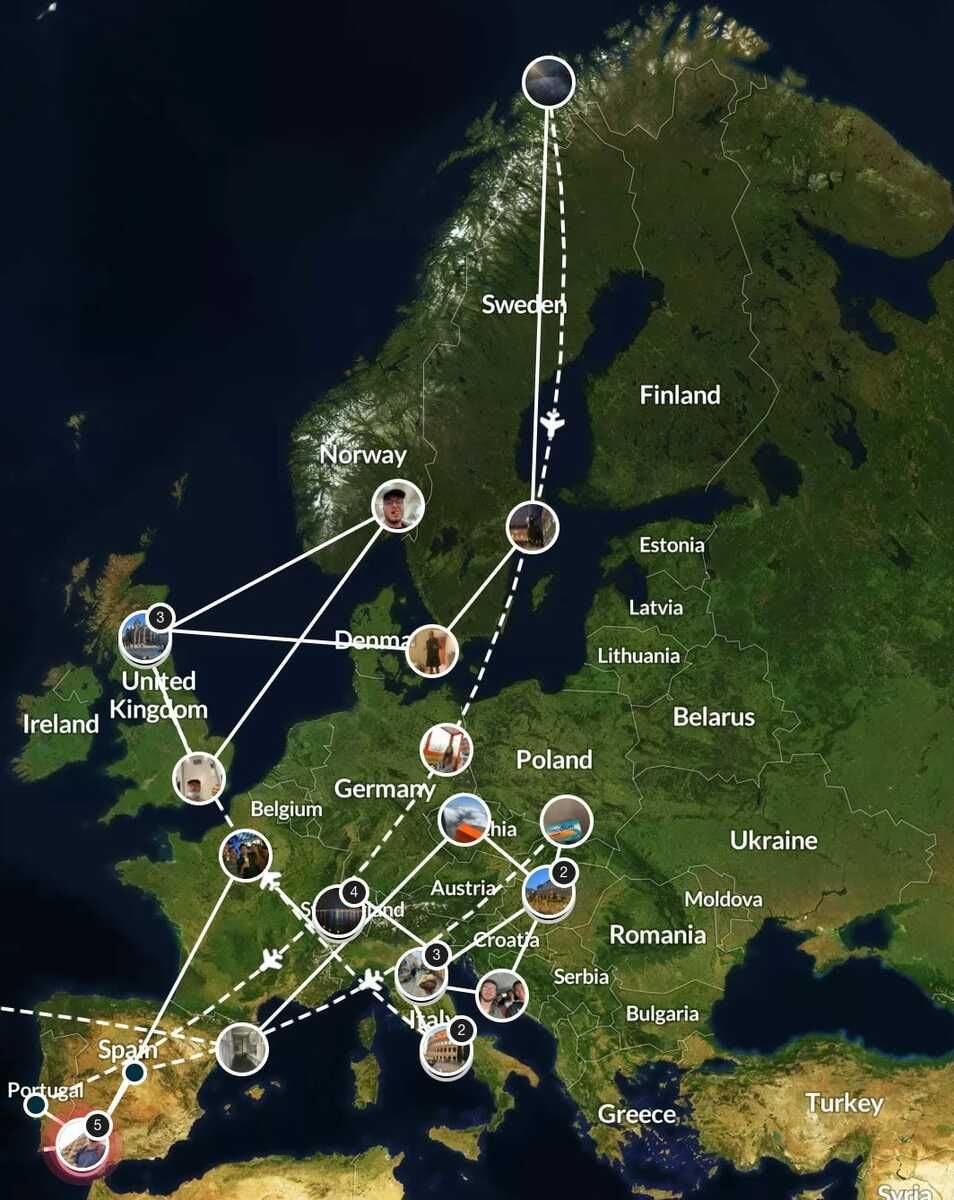

But at this point, I didn’t really want to go back to an office environment. The world was opening back up, and I wanted to go do and see a lot of cool stuff. I’m planning on moving to New York for business school in August, and I would rather spend year 24 doing a bunch of wild stuff than working in an office. So I quit my job, bought a one way ticket to Barcelona, and backpacked through 19 countries in Europe. In fact, I’m writing this from Sevilla, Spain right now.

Investing Stuff

You can read a detailed account of my trading journey in this interview with Alpha Investors, but in summary, I turned $6,000 into $400,000 in my Roth IRA by aggressively trading SPAC warrants in 2020 and early 2021. That really feels like a lifetime ago.

My first “play” in the market was buying $10,000 in SPY puts as the market started crashing in March 2020. That turned into $33,000 in about a week. Like any 22 year old who just made $23,000 in a week, I thought I was the next Burry. Or Buffett. Or something. So I bought $33,000 in SPY puts the day the market bottomed, because I thought we had more room to fall. Bill Ackman cried on TV, of course it couldn’t be the bottom!

It was the bottom.

$33,000 right back to $10,000. Market giveth. Market taketh away.

I then invested $6,000 in some ETFs in my Roth to be responsible. Three days later, my friend told me about DraftKings going public through a merger with a SPAC, Desert Eagle Acquisition Company (DEAC). I didn’t buy it, because I didn’t understand how the transaction would work.

But I did notice that DEACw, or DEAC warrants, outperformed DEAC stock both before and after the merger. After researching these securities, I realized that warrants offered a ridiculous amount of upside as a five year call option with an $11.50 strike price.

And SPAC shares offered capped downside risk as investors could redeem their shares for $10 cash premerger. I smelled asymmetric risk/reward, and just like that, I was all in. The next SPAC that hit the headlines? VTIQ and Nikola. Did Nikola seem “scammy”? Yes. But did it have hype? Also yes. So I bought $6,000 of NKLA warrants, and I made around $11,000 profit.

And I parlayed those gains into all sorts of warrants. Fisker, ChargePoint, Genius Sports, ASTS, Canoo, Tattooed Chef, Sofi, Proterra. And that $6,000 turned into $400,000 in a year or so.

Screenshot below is February 2021.

That’s nuts.

But here’s the craziest part. I wasn’t satisfied. I kept betting big. Because I had made a lot of money by betting big. This Twitter thread was written about crypto, but it describes my trading journey with SPACs quite well too.

Market conditions shifted on me, and I started taking more aggressive bets in pursuit of higher returns. And I lost $200,000 in the process. RIP the road to a million.

The Psychology of Gambling

Making a lot of money by trading is euphoric. And no one can teach you how to deal with that experience. Have you ever made your salary is a week by clicking buttons on your phone? It’s the greatest game ever made.

Losing a lot of money by trading is gut-wrenching, and no one can teach you how to deal with that experience. Have you ever lost 2x your salary in a day by clicking buttons on your phone? It’s the worst game ever made.

And when you have this much money tied up in stocks, with concentrated positions in very risky stocks, it is always on your head. You wake up in the middle of the night and check the futures markets. You constantly refresh the Twitter search bar with your favorite ticker to look for any news. You check TD Ameritrade every six minutes to watch every tick of price movement.

And your conversations all revolve around the market. Your friend wants to go to the gym? You somehow turn that into a discussion about Peloton. You have a date with your girlfriend? She is going to hear a ton about the EV market this week. Your parents are invested in boomer ETFs? How lame. And everyone texts you about stocks, because you’re the stock guy. Which accelerates the cycle.

You can’t do more than two sets at the gym without checking your portfolio. You really can’t do a whole lot of anything without looking at the market. Because when you are 23 and make $400,000 by hitting buttons on your phone, buttons on your phone dominate your life. But sometimes you are wrong, and if you aren’t constantly monitoring your positions, 30 minutes could be the difference between a $10,000 and $100,000 loss.

That was the reality of my life for a year or so. Don’t get me wrong, I made fairly life-changing money. Even after the massive loss, I still have a six figure Roth IRA. Life could be worse.

But my trading obsession made me miserable, because I couldn’t escape. The day I lost $100,000+ was the best day of my life. Because it snapped me out of the vicious cycle.

I think my trading journey gives me a lot of perspective on this stuff.

I have been a wide-eyed novice just trying to figure out financial markets.

I have been a cocky, self-proclaimed expert who thought he was well on his way to $1 million.

I have day traded six figure positions like they were monopoly money.

I have been humbled by financial markets, losing double my salary in a day.

Right now, I’m fully invested in ETFs, and I rarely check stock prices.

I’m certainly more introspective now, and I see parallels from my own trading journey in every corner of the market today.

Hotshots who hit it big doubling down on their bets. Novices getting lost in the sea of information just trying to keep their heads afloat. Grifters shilling their positions so someone else will buy them for a higher price.

But the most dangerous one? Investors (especially in crypto and growth stocks) assuming that positive price movement means their theses were correct. There is nothing more dangerous than being right for the wrong reasons, because you will be emboldened to take bigger risks the next time around.

So I write from the perspective of someone who has made a lot, lost a lot, and managed to cash out at a pretty solid net positive.

Additionally, we always talk about portfolio returns, but rarely discuss how much time and effort it takes to generate alpha. Is the extra 5% return worth it if it consumes your thoughts? How much of your time are you willing to sacrifice for your investments?

Once I began thinking about money in terms of time instead of simply portfolio CAGR, my values shifted dramatically.

Life Stuff

As a kid, I wanted to be the President of the United States. As a college student, I wanted to be the CEO of a large company. Now? I just want control of my time, and to make enough money to do whatever I want. That’s a pretty wild shift for the 4.0 graduate with Ivy League ambitions.

But when you make $400,000 in 10 months and find yourself stressed out instead of content, you realize that money probably isn’t the best “end goal”.

That being said, I think money is important. I want to make a lot of money, because I like doing a lot of things that cost money. But I don’t want to chase money for money’s sake. I certainly don’t want to chase the vain concepts such as prestige for prestige’s sake.

I guess that’s why I’m writing to you from a hostel in southern Spain, when I’m supposed to be working in an office in Atlanta, Georgia.

I think that we spend a lot of time worrying about we should be doing, and not enough time worrying about what we want to do.

At the end of the day, there are a million ways to make a living now. And it’s going to take hard work to be successful in really any field. But we do get to pick where we want to apply that hard work. So I started writing. And writing. And writing some more. And I decided to go do a bunch of cool stuff.

I used to optimize for financial gains at all costs. Now I optimize for experiences. My life motto now? Rich in experiences, sufficient in finances.

Why Do I Write Stuff?

At a basic level, writing helps me organize my thoughts. We think that we understand a topic when it is in our head. Try to turn your thoughts into concise writing. You’ll quickly see just how jumbled your mind actually is.

Writing is my venue for untangling those thoughts.

I write about money, careers, and life. I’m a 24 year old just trying to figure stuff out, and I think those topics apply to a lot of other people trying to figure stuff out. Writing has helped me make sense of chaotic markets and career decisions. It has helped me figure out what to optimize my life for.

And I like sharing my thoughts and insights with the great abyss known as the internet. Because it is really, really cool when people message me stuff like this:

ing online also allows me to build a portfolio of work for the world to see. Instead of telling others what I can do, there is evidence of what I have done. And this evidence opens doors. Expands networks. Creates potential employment opportunities. As long as I keep writing.

Writing is a skill that scales and sells well, as it is always in high demand and low supply. The goal is, at some point, to make enough money writing to fully support myself. We’ll see if that comes to fruition.

I write because I love writing, but I am well aware of the potential financial upside to this skillset.

That’s about it. And hopefully it’s the last time I write about me, because I know you guys are probably far more curious about which meme stock is going to moon next week than my life story. So we’ll get back to your regularly scheduled content on Monday. Happy weekend amigos 🤝

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!